电信公司希望对有流失倾向的客户进行挽留。数据分析人员从公司提前了客户基本信息(出生年月等)、社区信息(社区平均收入等)和6个之内的业务信息(通话时间长等),附件为数据及字段说明。

导入数据和数据清洗

> setwd('C:\\Users\\Xu\\Desktop\\data')

> telecom_churn<-read.csv("telecom_churn.csv")

> telecom_churn<-na.omit(telecom_churn)

> attach(telecom_churn)随机抽样,建立训练集与测试集

> set.seed(100)

> select<-sample(1:nrow(telecom_churn),nrow(telecom_churn)*0.7)

> train=telecom_churn[select,] #训练集

> test=telecom_churn[-select,] #样本集拟合模型,并且根据逐步回归选择更优的模型,AIC越小模型越优

> lg<-glm(churn~AGE+edu_class+incomeCode+duration+feton+peakMinAv+peakMinDiff,family=binomial(link='logit'))

> summary(lg)

Call:

glm(formula = churn ~ AGE + edu_class + incomeCode + duration +

feton + peakMinAv + peakMinDiff, family = binomial(link = "logit"))

Deviance Residuals:

Min 1Q Median 3Q Max

-3.07235 -0.58919 -0.03107 0.62704 2.73329

Coefficients:

Estimate Std. Error z value Pr(>|z|)

(Intercept) 3.3456176 0.2522880 13.261 < 2e-16 ***

AGE -0.0229400 0.0042145 -5.443 5.24e-08 ***

edu_class 0.4476978 0.0719659 6.221 4.94e-10 ***

incomeCode 0.0071214 0.0033891 2.101 0.0356 *

duration -0.2641532 0.0126729 -20.844 < 2e-16 ***

feton -1.0583303 0.1153652 -9.174 < 2e-16 ***

peakMinAv 0.0001973 0.0004272 0.462 0.6441 #并不显著

peakMinDiff -0.0028613 0.0003654 -7.830 4.87e-15 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

(Dispersion parameter for binomial family taken to be 1)

Null deviance: 3336.6 on 2423 degrees of freedom

Residual deviance: 1898.2 on 2416 degrees of freedom

AIC: 1914.2

Number of Fisher Scoring iterations: 6

> lg_ms<-step(lg,direction = "both") #寻找最好的回归模型,both向前,向后回归

Start: AIC=1914.21

churn ~ AGE + edu_class + incomeCode + duration + feton + peakMinAv +

peakMinDiff

Df Deviance AIC

- peakMinAv 1 1898.4 1912.4

<none> 1898.2 1914.2

- incomeCode 1 1902.6 1916.6

- AGE 1 1928.4 1942.4

- edu_class 1 1938.5 1952.5

- peakMinDiff 1 1967.8 1981.8

- feton 1 1985.8 1999.8

- duration 1 2954.6 2968.6

Step: AIC=1912.43

churn ~ AGE + edu_class + incomeCode + duration + feton + peakMinDiff

Df Deviance AIC

<none> 1898.4 1912.4

+ peakMinAv 1 1898.2 1914.2

- incomeCode 1 1902.8 1914.8

- AGE 1 1930.8 1942.8

- edu_class 1 1938.7 1950.7

- peakMinDiff 1 1968.0 1980.0

- feton 1 1986.1 1998.1

- duration 1 2954.8 2966.8

> summary(lg_ms)

Call:

glm(formula = churn ~ AGE + edu_class + incomeCode + duration +

feton + peakMinDiff, family = binomial(link = "logit"))

Deviance Residuals:

Min 1Q Median 3Q Max

-3.01069 -0.58881 -0.03095 0.62815 2.72788

Coefficients:

Estimate Std. Error z value Pr(>|z|)

(Intercept) 3.3989882 0.2247215 15.125 < 2e-16 ***

AGE -0.0233168 0.0041359 -5.638 1.72e-08 ***

edu_class 0.4478730 0.0719857 6.222 4.92e-10 ***

incomeCode 0.0070731 0.0033873 2.088 0.0368 *

duration -0.2641731 0.0126728 -20.846 < 2e-16 ***

feton -1.0589440 0.1153516 -9.180 < 2e-16 ***

peakMinDiff -0.0028390 0.0003616 -7.851 4.13e-15 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

(Dispersion parameter for binomial family taken to be 1)

Null deviance: 3336.6 on 2423 degrees of freedom

Residual deviance: 1898.4 on 2417 degrees of freedom

AIC: 1912.4 #这个AIC更小,所以这个模型更合适

Number of Fisher Scoring iterations: 6选择模型后对训练集进行预测

> train$lg_p<-predict(lg_ms, train) #训练集中进行预测

> summary(train$lg_p)

Min. 1st Qu. Median Mean 3rd Qu. Max.

-15.8300 -2.6670 -0.1845 -0.9950 1.3380 5.3550 逻辑回归算出来的是将事件发生的概率logit,所以我们把他转化回来,这样更易于我们理解它

> train$p<-1/(1+exp(-1*train$lg_p)) #exp():自然对数e为底指数函数

> summary(train$p) #概率值的概述

Min. 1st Qu. Median Mean 3rd Qu. Max.

0.0000001 0.0649300 0.4540000 0.4505000 0.7922000 0.9953000 对预测的模型进行评估

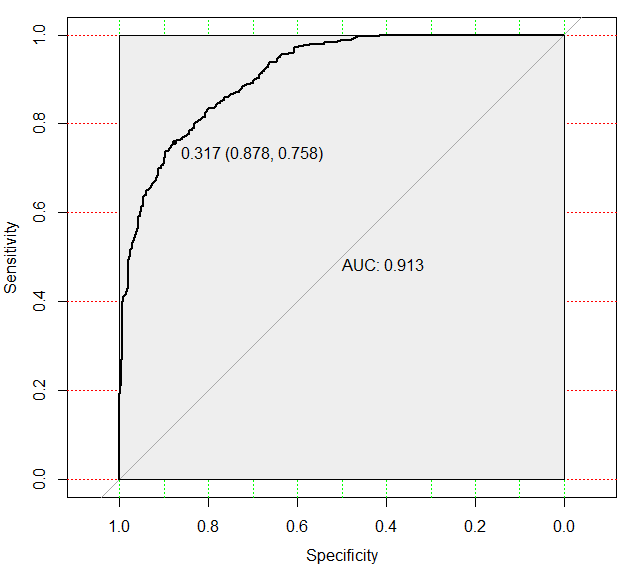

> test$lg_p<-predict(lg_ms, test)我们可以直接利用pROC包,直接绘制ROC曲线和AUC值

> library(pROC)

> modelroc <- roc(test$churn,test$lg_p) #test$churn为预测的变量1为流失,0为未流失, test%lg_p则为拟合的模型

> plot(modelroc,print.auc=T,auc.ploygon=T,grid=c(0.1,0.2),

+ grid.col=c('green','red'),max.auc.polygon=T,

+ auc.ploygon.col='skyblue',

+ print.thres=T)

Call:

roc.default(response = test$churn, predictor = test$lg_p)

Data: test$lg_p in 597 controls (test$churn 0) < 442 cases (test$churn 1).

Area under the curve: 0.9131

AUC值为0.913,说明模型还是相关可以的

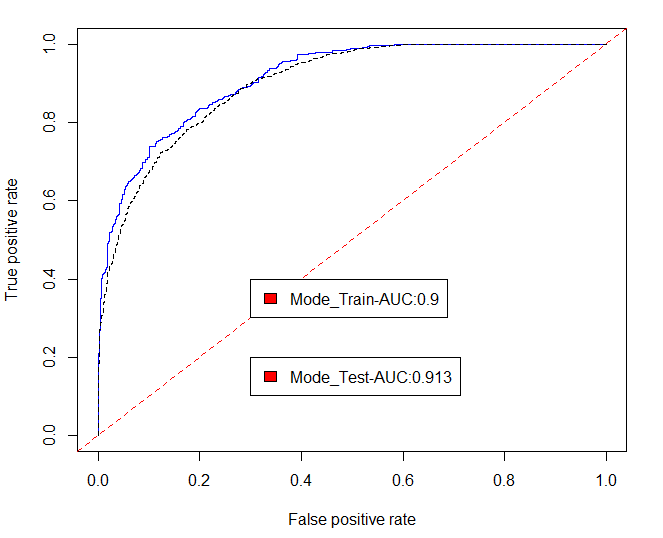

绘制ROC曲线,也可以这样,

> library(ROCR)

There were 50 or more warnings (use warnings() to see the first 50)

> pred_Te <- prediction(test$p, test$churn)

> perf_Te <- performance(pred_Te,"tpr","fpr")

> pred_Tr <- prediction(train$p, train$churn)

> perf_Tr <- performance(pred_Tr,"tpr","fpr")

> plot(perf_Te, col='blue',lty=1);

> plot(perf_Tr, col='black',lty=2,add=TRUE);

> abline(0,1,lty=2,col='red')

> lr_m_auc<-round(as.numeric(performance(pred_Tr,'auc')@y.values),3)

> lr_m_str<-paste("Mode_Train-AUC:",lr_m_auc,sep="")

> legend(0.3,0.4,c(lr_m_str),2:8)

> lr_m_auc<-round(as.numeric(performance(pred_Te,'auc')@y.values),3)

> lr_m_ste<-paste("Mode_Test-AUC:",lr_m_auc,sep="")

> legend(0.3,0.2,c(lr_m_ste),2:8)

当然这种绘制方法比较麻烦,推荐用第一种那种,这样如果想要进行电信客户流失的预警,就可以用这个模型试试了,算出客户流失的可能性有多大,针对可能流失的客户针对性采取挽留方法。

2976

2976

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?