真实波动幅度均值-主要演示maximum函数

# In[1]:

import numpy as np

# In[2]:

h,l,c = np.loadtxt('data/data.csv',delimiter=',',usecols=(4,5,6),unpack=True)

# In[3]:

#ATR 基于N个交易日的最高价和最低价进行计算,通常取近20个交易日

N = 20

h = h[-N:]

l = l[-N:]

# In[4]:

#前一个交易日的收盘价

previousclose = c[-N-1:-1]

# In[5]:

#h-l 当日股价范围

#h-previousclose 当日最高价与前一日收盘价之差

#previousclose - l 前一日收盘价与当日最低价之差

# In[6]:

truerange = np.maximum(h-l,h-previousclose,previousclose-l)

# In[7]:

print truerange

# Out[7]:

[ 4.26 2.77 2.42 5. 3.75 9.98 7.68 6.03 6.78 5.55

6.89 8.04 5.95 7.67 2.54 10.36 5.15 4.16 4.87 7.32]

# In[8]:

atr = np.zeros(N)

# In[9]:

atr[0] = np.mean(truerange)

# In[10]:

for i in range(1,N):

atr[i] = (N-1)*atr[i-1] + truerange[i]

atr[i] /= N

# In[11]:

atr

# Out[11]:

array([ 5.8585 , 5.704075 , 5.53987125, 5.51287769, 5.4247338 ,

5.65249711, 5.75387226, 5.76767864, 5.81829471, 5.80487998,

5.85913598, 5.96817918, 5.96727022, 6.05240671, 5.87678637,

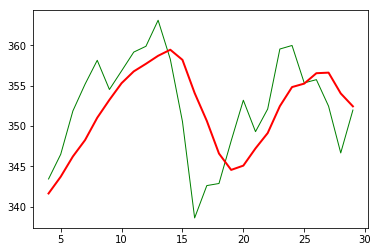

6.10094705, 6.0533997 , 5.95872972, 5.90429323, 5.97507857])简单的移动平均线

# In[12]:

N = 5

weights = np.ones(N)/N

print weights

# In[13]:

c = np.loadtxt('data/data.csv',delimiter=',',usecols=(6,),unpack=True)

# In[14]:

sma = np.convolve(weights,c)[N-1:-N+1]

# In[15]:

import matplotlib.pyplot as plt

t = np.arange(N-1,len(c))

plt.plot(t,c[N-1:],color='g',linewidth=1.0)

plt.plot(t,sma,color='r',linewidth=2.0)

plt.show()

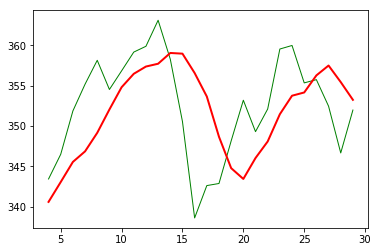

指数移动平均线

# In[16]:

x = np.arange(5)

print "Exp ",np.exp(x)

# Out[16]:

Exp [ 1. 2.71828183 7.3890561 20.08553692 54.59815003]

# In[17]:

print "Linspace ",np.linspace(-1,0,5)

# Out[17]:

Linspace [-1. -0.75 -0.5 -0.25 0. ]

# In[18]:

N = 5

weights = np.exp(np.linspace(-1,0,N))

weights /= weights.sum()

print "Weights ",weights

# Out[18]:

Weights [ 0.11405072 0.14644403 0.18803785 0.24144538 0.31002201]

# In[19]:

c = np.loadtxt('data/data.csv',delimiter=',',usecols=(6,),unpack=True)

ema = np.convolve(weights,c)[N-1:-N+1]

t = np.arange(N-1,len(c))

plt.plot(t,c[N-1:],color='g',linewidth=1.0)

plt.plot(t,ema,color='r',linewidth=2.0)

plt.show()

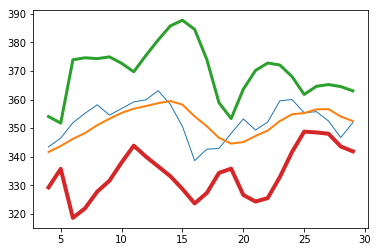

绘制布林带

# In[20]:

deviation = []

C = len(c)

for i in range(N-1,C):

if i + N <C:

dev = c[i:i+N]

else:

dev = c[-N:]

averages = np.zeros(N)

averages.fill(sma[i - N - 1])

dev = dev - averages

dev = dev ** 2

dev = np.sqrt(np.mean(dev))

deviation.append(dev)

deviation = 2 * np.array(deviation)

print len(deviation),len(sma)

upperBB = sma + deviation

lowerBB = sma - deviation

c_slice = c[N-1:]

between_bands = np.where((c_slice < upperBB) & (c_slice > lowerBB))

print lowerBB[between_bands]

print c[between_bands]

print upperBB[between_bands]

between_bands = len(np.ravel(between_bands))

print "Ratio between bands", float(between_bands)/len(c_slice)

t = np.arange(N - 1, C)

plt.plot(t, c_slice, lw=1.0)

plt.plot(t, sma, lw=2.0)

plt.plot(t, upperBB, lw=3.0)

plt.plot(t, lowerBB, lw=4.0)

plt.show()

用线性模型预测价格

# In[21]:

b = c[-N:]

b = b[::-1]

print "b ",b

# Out[21]:

b [ 351.99 346.67 352.47 355.76 355.36]

# In[22]:

A = np.zeros((N,N),float)

print A

# Out[22]:

[[ 0. 0. 0. 0. 0.]

[ 0. 0. 0. 0. 0.]

[ 0. 0. 0. 0. 0.]

[ 0. 0. 0. 0. 0.]

[ 0. 0. 0. 0. 0.]]

# In[23]:

#用b向量中的N个股价值填充数组A

for i in range(N):

A[i,] = c[-N-1-i:-1-i]

print A

# Out[23]:

[[ 360. 355.36 355.76 352.47 346.67]

[ 359.56 360. 355.36 355.76 352.47]

[ 352.12 359.56 360. 355.36 355.76]

[ 349.31 352.12 359.56 360. 355.36]

[ 353.21 349.31 352.12 359.56 360. ]]

# In[24]:

#求线性回归函数的系数,残差平方和数组,矩阵A的秩,A的奇异值

(x,residuals,rank,s) = np.linalg.lstsq(A,b)

print x,residuals,rank,s

# Out[24]:

[ 0.78111069 -1.44411737 1.63563225 -0.89905126 0.92009049] [] 5 [ 1.77736601e+03 1.49622969e+01 8.75528492e+00 5.15099261e+00

1.75199608e+00]

# In[25]:

#numpy.dot()计算向量的点积,即对下一个收盘价进行预测

print np.dot(b,x)

# Out[25]:

357.939161015绘制趋势线

# In[26]:

#趋势线,是根据股价走势图上很多所谓的枢轴点绘成的曲线,

#描绘的是价格变化的趋势

# In[27]:

#假设枢轴点等于最高价、最低价、收盘价的算数平均值

h,l,c = np.loadtxt('data/data.csv',delimiter=',',usecols=(4,5,6),unpack=True)

pivots = (h+l+c)/3

print pivots

# Out[27]:

[ 338.01 337.88666667 343.88666667 344.37333333 342.07666667

345.57 350.92333333 354.29 357.34333333 354.18

356.06333333 358.45666667 359.14 362.84333333 358.36333333

353.19333333 340.57666667 341.95666667 342.13333333 347.13

353.12666667 350.90333333 351.62333333 358.42333333 359.34666667

356.11333333 355.13666667 352.61 347.11333333 349.77 ]

# In[28]:

#支撑位是指在股价下跌时可能遇到支撑,从而止跌回稳前的最低价位.

#阻力位则是指在股价上升时可能遇到压力,从而反转下跌前的最高价位

# In[29]:

#定义一个函数用直线y=ax + b 来拟合数据

def fit_line(t,y):

A = np.vstack([t,np.ones_like(t)]).T

return np.linalg.lstsq(A,y)[0]

# In[30]:

#假设支撑位在枢轴点下方一个当日股价区间的位置

#阻力位在枢轴点上方一个当日股价区间的位置

#据此拟合支撑位与阻力位的趋势线

t = np.arange(len(c))

sa,sb = fit_line(t,pivots-(h-l))

ra,rb = fit_line(t,pivots+(h-l))

support = sa*t +sb

resistance = ra*t + rb

# In[31]:

#判断数据点是否位于两条趋势线之间

condition = (c>support) & (c<resistance)

print "Condition ",condition

between_bands = np.where(condition)

# Out[31]:

Condition [False False True True True True True False False True False False

False False False True False False False True True True True False

False True True True False True]

# In[32]:

#复查具体取值

print support[between_bands]

print c[between_bands]

print resistance[between_bands]

# Out[32]:

[ 341.92421382 342.19081893 342.45742405 342.72402917 342.99063429

343.79044964 345.39008034 346.4565008 346.72310592 346.98971104

347.25631615 348.0561315 348.32273662 348.58934174 349.12255197]

[ 345.03 344.32 343.44 346.5 351.88 354.54 350.56 348.16 353.21

349.31 352.12 355.36 355.76 352.47 351.99]

[ 352.61688271 352.90732765 353.19777259 353.48821753 353.77866246

354.64999728 356.39266691 357.55444667 357.84489161 358.13533655

358.42578149 359.2971163 359.58756124 359.87800618 360.45889606]

# In[33]:

#where函数返回的是秩为2的数组,需要用ravel展平

between_bands = len(np.ravel(between_bands))

print "Number points between bands ",between_bands

print "Ratio betwwen bands ",float(between_bands)/len(c)

# Out[33]:

Number points between bands 15

Ratio betwwen bands 0.5

# In[34]:

#此时得到一个新的预测模型,可用于预测下一个交易日的阻力位与支撑位

print "Tomorrows support ",sa*(t[-1]+1)+sb

print "Tomorrows resistance ",ra*(t[-1]+1) + rb

# Out[34]:

Tomorrows support 349.389157088

Tomorrows resistance 360.749340996

# In[35]:

#计算支撑位与阻力位之间数据点个数

#intersect1d 函数返回一个由两个数组的所有共同元素构成的数组

a1 = c[c>support]

a2 = c[c<resistance]

print "支撑位与阻力位之间数据点个数:",len(np.intersect1d(a1,a2))

# Out[35]:

支撑位与阻力位之间数据点个数: 15

# In[36]:

#绘制结果图

import matplotlib.pyplot as plt

plt.plot(t,c)

plt.plot(t,support)

plt.plot(t,resistance)

plt.show()

数组的修剪和压缩

# In[37]:

#clip方法返回一个修剪过的数组,即把所有比给定最大值还大的元素设定为给定的最大值

#而所有比给定最小值还小的元素设为给定的最小值

a = np.arange(8)

print "a= ",a

print "Clipped ",a.clip(2,6)

# Out[37]:

a= [0 1 2 3 4 5 6 7]

Clipped [2 2 2 3 4 5 6 6]

# In[38]:

#compress 方法返回一个根据给定条件筛选后的数组

a = np.arange(8)

print "a=",a

print "Compressed",a.compress(a>4)

# Out[38]:

a= [0 1 2 3 4 5 6 7]

Compressed [5 6 7]

# ### 计算阶乘

# In[39]:

#prod 可以计算数组中所有数据的乘积,以此来计算阶乘

b = np.arange(1,9)

print "b = ",b

print "8的阶乘:",b.prod()

# Out[39]:

b = [1 2 3 4 5 6 7 8]

8的阶乘: 40320

# In[40]:

#cumprod 可以计算数组的累积乘积

print "累积乘积:",b.cumprod()

# Out[40]:

累积乘积: [ 1 2 6 24 120 720 5040 40320]

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?