git 重新追踪索引

Note from Towards Data Science’s editors: While we allow independent authors to publish articles in accordance with our rules and guidelines, we do not endorse each author’s contribution. You should not rely on an author’s works without seeking professional advice. See our Reader Terms for details.

Towards Data Science编辑的注意事项:尽管我们允许独立作者按照我们的规则和指南发表文章,但我们不认可每位作者的贡献。 您不应在未征求专业意见的情况下依赖作者的作品。 有关详细信息,请参见我们的阅读器条款。

为什么进行索引追踪 (Why Index Tracking)

A common challenge faced by many institutional and retail investors is to effectively control risk exposure to various market factors. There is a great variety of indices designed to provide different types of exposures across sectors and asset classes, including equities, fixed income, commodities, currencies, credit risk, and more.

许多机构和散户投资者面临的共同挑战是有效控制各种市场因素的风险敞口。 各种各样的指数旨在提供跨行业和资产类别的不同类型的敞口,包括股票,固定收益,商品,货币,信用风险等。

Some of these indices can be difficult or impossible to trade directly, but investors can trade the associated financial derivatives if they are available in the market. For example, the CBOE Volatility Index (VIX), often referred to as the fear index, is not directly tradable, but investors can gain exposure to the index and potentially hedge against market turmoil by trading futures and options written on VIX.

其中一些指数可能很难或无法直接交易,但投资者可以在市场上交易相关的金融衍生工具。 例如,经常被称为恐惧指数的CBOE波动率指数(VIX)不能直接交易,但投资者可以通过在VIX上买卖期货和期权来获得该指数的敞口,并有可能对冲市场动荡。

波动率指数(VIX) (Volatility Index (VIX))

To illustrate the benefits of having exposure to VIX, consider the 2011 U.S. credit rating downgrade by Standard and Poor’s. News of a negative outlook by S&P of the U.S. credit rating broke on April 18th, 2011. As displayed in Figure 1(a), a portfolio holding only the SPDR S&P 500 ETF (SPY) would go on to lose about 10% with a volatile trajectory for a few months past the official downgrade on August 5th, 2011.

为了说明使用VIX的好处,请考虑标准普尔(Standard and Poor's)将2011年美国信用评级下调。 标准普尔对美国信用评级前景的负面展望于2011年4月18日发布。如图1(a)所示,仅持有SPDR S&P 500 ETF(SPY)的投资组合将继续下跌约10%。在2011年8月5日正式降级后的几个月内,该市场波动不定。

In contrast, a hypothetical portfolio with a mix of SPY (90%) and VIX (10%) would be stable through the downgrade and end up with a positive return. Figure 1(b) shows the same pair of portfolios over the year 2014.

相反,假设组合包含SPY(90%)和VIX(10%),则在降级期间将保持稳定并最终获得正收益。 图1(b)显示了2014年的同一对投资组合。

Both earned roughly the same 15% return though SPY alone was visibly more volatile than the portfolio with SPY and VIX. The large drawdowns (for example on October 15th, 2014) were met by rises in VIX, creating a stabilizing effect on the portfolio’s value.

尽管仅SPY明显比SPY和VIX的投资组合波动更大,但两者的收益率大致相同,均为15%。 大幅缩水(例如,2014年10月15日)通过VIX的上升来弥补,对投资组合的价值产生了稳定作用。

This example motivates the investigation of trading strategies that directly track VIX and other indices, or achieve any pre-specified exposure with respect to an index or market factor.

该示例激发了对直接追踪VIX和其他指数,或实现有关指数或市场因素的任何预定敞口的交易策略的研究。

索引追踪的挑战 (Challenges of Index Tracking)

Many ETFs or ETNs are advertised to provide exposure to an index by maintaining a portfolio of securities related to the index, such as futures, options, and swaps. However, some of ETFs or ETNs often miss their stated targets, and some tend to significantly underperform over time relative to the targets.

许多ETF或ETN进行广告宣传,以通过维护与该指数相关的证券组合(例如期货,期权和掉期)来提供该指数的敞口。 但是,某些ETF或ETN经常会错过其既定目标,并且相对于目标,有些ETF可能会随着时间的推移而明显跑输大盘。

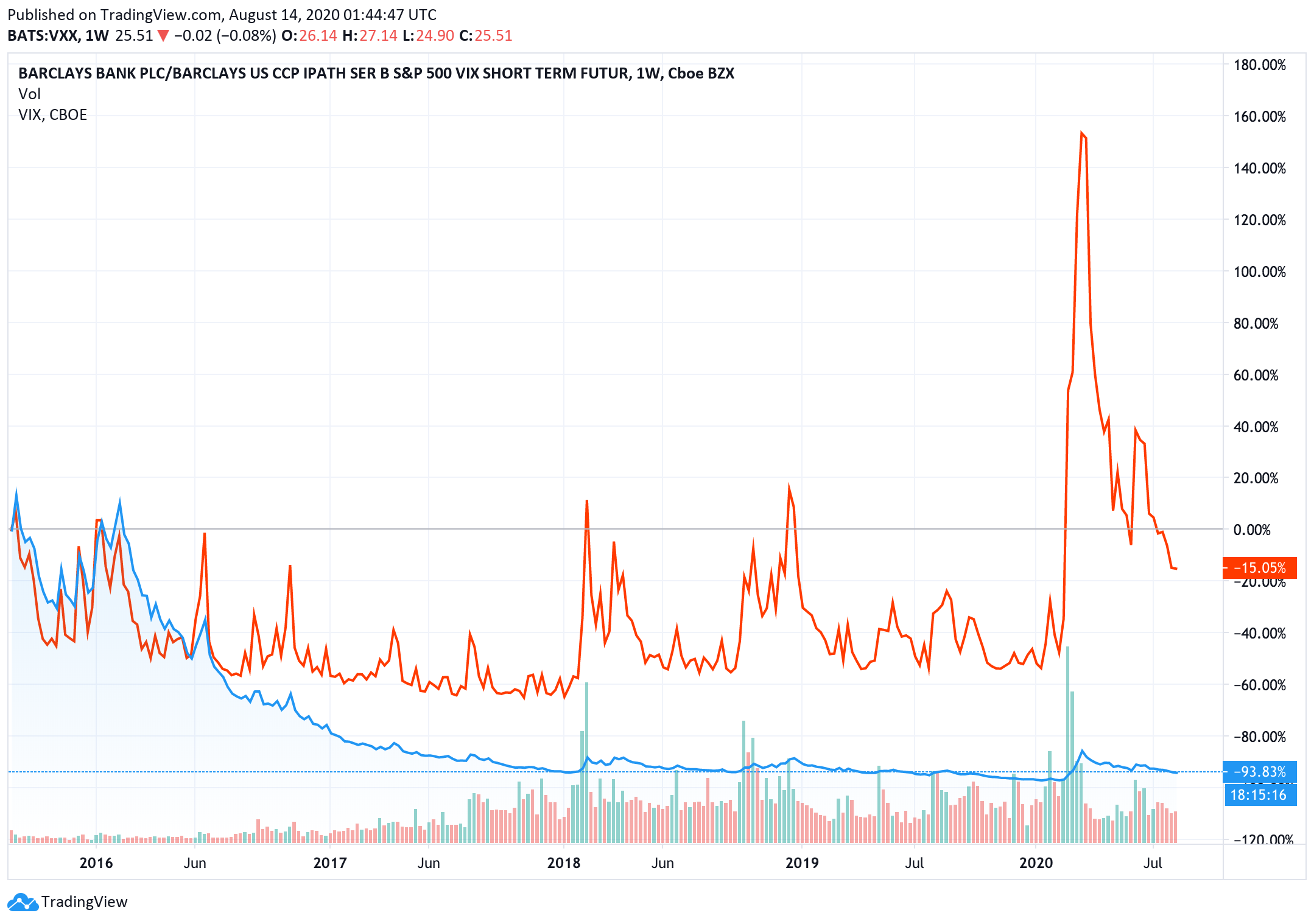

One example is the Barclay’s iPath S&P 500 VIX Short-Term Futures ETN (VXX), which is also the most popular VIX exchange-traded product.3 The failure of VXX to track VIX is well documented. In fact, most of these ETFs or ETNs follow a static strategy or time-deterministic allocation that does not adapt to the rapidly changing market.

一个例子是巴克莱的iPath S&P 500 VIX短期期货ETN(VXX),它也是最受欢迎的VIX交易所交易产品。3有据可查的是VXX未能追踪VIX。 实际上,大多数此类ETF或ETN都遵循静态策略或时间确定性分配,无法适应快速变化的市场。

The problem of tracking is relevant in all asset classes, and the use of derivatives is quite common. For example, many investors seek exposure to gold to hedge against market turmoil. However, direct investment in gold bullion is difficult due to storage cost. In order to gain exposure, an investor may select among a number of gold ETFs and derivatives.

跟踪问题与所有资产类别相关,并且衍生工具的使用非常普遍。 例如,许多投资者寻求向黄金敞口以对冲市场动荡。 但是,由于存储成本的原因,直接投资金条很困难。 为了获得风险敞口,投资者可以在许多黄金ETF和衍生品中进行选择。

一种新方法 (A New Methodology)

In our recent paper, we discuss a general methodology for index tracking and risk exposure control using derivatives. Under very general framework for the market and associated risk factors, we derive a formula that links the exposures (with respect to different risk factors) embedded in a derivatives portfolio.

在最近的论文中,我们讨论了使用衍生工具进行指数跟踪和风险敞口控制的一般方法。 在非常笼统的市场和相关风险因素框架下,我们得出了一个公式,该公式将嵌入在衍生产品组合中的风险敞口(相对于不同的风险因素)进行链接。

The portfolio’s log-return can be decomposed as follows:

投资组合的对数回报可以分解为以下形式:

The first two terms on the right-hand side indicate that the portfolio’s log-return (LHS) is proportional to the log-returns of the index S and its driving factors Yᵢ, with the proportionality coefficients (β,ηᵢ) being equal to the desired exposures. However, the portfolio’s log return is subject to the slippage process Z.

右边的前两项表示投资组合的对数回报(LHS)与指数S及其驱动因子Yᵢ的对数回报成正比,比例系数(β,ηᵢ)等于所需的曝光。 但是,投资组合的对数回报受滑点处理Z的约束。

The slippage process can be used to quantify the divergence of portfolio return from the target returns of the index and its factors. It is a function of not only the realized variance of the underlying factors, but also the realized covariance among the index and factors.

滑移过程可用于 量化投资组合收益与指数目标收益及其因素的差异。 它不仅取决于潜在因素的实现方差,而且还取决于指标和因素之间的实现方差。

Slippage reveals the potential value erosion arising from the interactions among risk factors.

滑移揭示了由风险因素之间的相互作用引起的潜在价值侵蚀。

Index tracking can be perceived as an inverse problem to dynamic hedging of derivatives. In the traditional hedging problem, the goal is to trade the underlying assets so as to replicate the price evolution of the derivative in question, and thus, the tradability of the underlying is of crucial importance.

索引跟踪可以看作是衍生工具动态套期的反问题。 在传统的套期保值问题中,目标是交易基础资产,以便复制相关衍生产品的价格演变,因此,基础资产的可交易性至关重要。

In our proposed paradigm, the index and stochastic factors may not be directly traded, but there exist traded derivatives written on them. We use derivatives to track or, more generally, control risk exposure with respect to the index return in a path-wise manner. Consequently, we can study the path properties resulting from various portfolios of derivatives, and quantify the portfolio’s divergence, if any, from a pre-specified benchmark. Our methodology also allows the investor to achieve leveraged or non-leveraged exposures with respect to the associated factors in the model.

在我们提出的范式中,指数和随机因素可能无法直接交易,但是上面写有交易衍生产品。 我们利用衍生工具来跟踪或者更一般地说,控制风险敞口相对于在路径明智的方式指数收益率。 因此,我们可以研究各种衍生产品投资组合所产生的路径特性,并根据预先设定的基准量化投资组合的差异(如果有)。 我们的方法还允许投资者针对模型中的相关因素实现杠杆或非杠杆风险敞口。

回到VIX (Back to VIX)

Motivated still further by VIX, we explore the applications and implications of our methodology under some models for VIX. In particular, our methodology and examples shed light on the connection between the mean-reverting behavior of VIX and the implications to the pricing of VIX derivatives and tracking this index and its associated factors. We consider the tracking and risk exposure control problems under the Cox-Ingersoll-Ross (CIR) model

受VIX的进一步激励,我们在某些VIX模型下探索了方法论的应用和含义。 尤其是,我们的方法和示例阐明了VIX的均值回复行为与VIX衍生产品的定价含义以及跟踪该指数及其相关因素之间的联系。 我们考虑Cox-Ingersoll-Ross(CIR)模型下的跟踪和风险暴露控制问题

and the two-factor Concatenated Square Root (CSQR) model

和两因素串联平方根(CSQR)模型

Among our findings, we derive the trading strategies using options or futures to track the VIX or achieve any exposure to the index and/or its factors. Our portfolio utilizes an explicit pathwise-adaptive strategy, as opposed to a time-deterministic one used by VXX and other ETNs.

在我们的发现中,我们使用期权或期货来追踪VIX或实现对指数和/或其指数的敞口,从而得出交易策略。 我们的产品组合采用了明确的路径自适应策略,而不是VXX和其他ETN使用的时间确定性策略。

Although we have chosen VIX as our main example, our analysis applies to other mean-reverting price processes or market factors.

尽管我们选择了VIX作为主要示例,但我们的分析也适用于其他均值恢复价格过程或市场因素。

For more, follow/connect on Linkedin: https://www.linkedin.com/in/timstleung/

有关更多信息,请在Linkedin上关注/连接: https : //www.linkedin.com/in/timstleung/

翻译自: https://towardsdatascience.com/index-tracking-mind-the-gap-3dc745bbc36f

git 重新追踪索引

1595

1595

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?