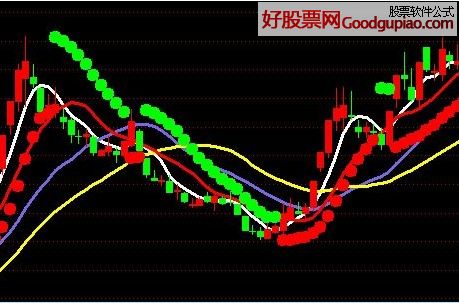

好股票软件下载网(www.goodgupiao.com)提示:您正在下载的是:自用多年的很牛的多空指标、无敌短线王

MA1:MA(CLOSE,5),COLORFFFFFF,LINETHICK3;

MA2:MA(CLOSE,10),COLORFFFFFF,LINETHICK3;

MA3:MA(CLOSE,20),COLORE66878,LINETHICK3;

MA4:MA(CLOSE,30),COLOR00FFFF,LINETHICK3;

MA5:MA(CLOSE,10),COLOR0000FF,LINETHICK3;

涨停:=IF(REF(C,1)*1.1-C<0.2 ,1,0);

STICKLINE(OPEN>=CLOSE ,O,C,3,0 ),COLOR00FF00;

STICKLINE(OPEN>=CLOSE ,O,C,1.75,0 ),COLOR00FF00;

STICKLINE(OPEN>=CLOSE ,O,C,0.5,0 ),COLOR00FF00;

STICKLINE(CLOSE>OPEN,O,C,3,0 ),COLORRED;

STICKLINE(CLOSE>OPEN,O,C,1.75 ,0 ),COLORRED;

STICKLINE(CLOSE>OPEN,O,C,0.5,0 ),COLORRED;

STICKLINE(CLOSE>OPEN,OPEN,LOW,0,0),COLORRED;

STICKLINE(CLOSE>OPEN,CLOSE,HIGH,0,0 ),COLORRED;

STICKLINE(OPEN>=CLOSE,CLOSE,LOW,0,0 ),COLOR00FF00;

STICKLINE(OPEN>=CLOSE,OPEN,HIGH,0,0),COLOR00FF00;

VAR1:=SAR(10,2,20);

IF(VAR1<=C,VAR1,DRAWNULL),COLORRED,CIRCLEDOT,LINETHICK8;

IF(VAR1>C,VAR1,DRAWNULL),COLORGREEN,CIRCLEDOT,LINETHICK8;

B1:=REF(C,1);B2:=REF(C,2);

SS:=IF(C>REF(C,1) AND REF(C,1)>=REF(C,2),1,IF(CREF(C,2) AND REF(C,2)>REF(C,1),2,IF(C

SM:=IF(REF(SS,1)>0 OR REF(SS,1)<0,REF(SS,1),IF(REF(SS,2)>0 OR REF(SS,2)<0,REF(SS,2),IF(REF(SS,3)>0 OR REF(SS,3)<0,REF(SS,3),IF(REF(SS,4)>0 OR REF(SS,4)<0,REF(SS,4),IF(REF(SS,5)>0 OR REF(SS,5)<0,REF(SS,5),IF(REF(SS,6)>0 OR REF(SS,6)<0,REF(SS,6),IF(REF(SS,7)>0 OR REF(SS,7)<0,REF(SS,7),0)))))));

好股票软件下载网(www.goodgupiao.com)提醒您:股市有风险,投资需谨慎。

2864

2864

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?