The blockchain space has built digital asset economic systems including DeFi, NFT, Meta-universe which are independent and interconnected. Combined with the advantages of blockchain technology in terms of confirmation, transaction, circulation and decentralized governance, they form a huge open financial system that has become a new engine driving global economic development and trade growth.

Crypto Market Analysis

If we pay attention to the performance of the crypto market, we can find that the overall market is still continuing to rise. DeFi has attracted more investors, and as of now, the highest lock-up volume of DeFi 2022 has reached $219.47 billion in the network, with MakerDAO, Lido and Aave occupying the top three, accounting for 10.32%, 8.69% and 8.06% respectively.

NFT’s GameFi, digital artwork, digital collectibles, domains and other applications have added a lot of interest to the crypto world. Currently, the total trading volume of NFT has exceeded $61 billion, with Axie Infinity’s single project trading a total of $4.087 billion and nearly 2.2 million total holders. Next are CryptoPunks and Bored Ape Yacht Club, with the average NFT price of $110,300 and $72,000 respectively.

Metaverse is an emerging product of 5G, AR/VR/MR, digital twin, sensors, cloud computing, AI, blockchain and other technologies, which is essentially the process of virtualization and digitization of the real world. As an important infrastructure for Web3, the metaverse is expected to pioneer the right way about digital assets to the world and increase people’s engagement between the real and the virtual.

Growing Demand for Digital Currency Custody

The popularity of digital currencies has led to an increasing number of users, and the variety and amount of digital currencies in their hands is rising exponentially. As the demand for personalized new investments grows, the number of places to store them — wallets, DEX, centralized exchanges, various protocols, Dapps, etc. — is fragmented, potentially leaving users’ digital assets in separate places for long periods and unable to quickly find, overview, manage or navigate them, which has not kept pace with the times.

Given that one of the most obvious opportunities in terms of asset allocation is probably digital assets. Therefore, in the crypto space, users need a platform to view and manage the data. And the XMETA Capital Management Platform is the solution that can take digital asset management to a whole new level. Here we are talking about a global asset management platform that can manage all kinds of digital assets, rights and permissions and quickly provide influential social investment networks.

XMETA, a global digital asset management platform

XMETA digital asset management platform is revolutionary, which pioneers a decentralized social finance management ecosystem that integrates digital banking, collateralized lending, DEX, synthetic assets, wealth management business, and smart investment advisors. XMETA provides popular transaction types in traditional and crypto financial markets such as funds, stocks, bonds, commodities, digital currencies, etc. XMETA has revolutionized the way of participating in financial transactions. In XMETA, anyone can enjoy professional one-stop financial services with low threshold, simplicity and fluency.

The platform is governed by a set of smart contracts that are responsible for performing specific functions: investment/redemption, asset custody, trading, fee allocation, etc., and are bundled together through the XMETA contract. The smart contracts can implement decentralized governance operations as well as automatically enforce corresponding rules. At the same time, XMETA contracts are set up with mechanisms such as maximum retraction and risk control, completely avoiding the investment trust crisis under the traditional model. XMETA can continuously release liquidity while achieve safety.

Four “firsts” in XMETA capital management platform

1, the first introduction of on-chain fund Tokenization: In XMETA capital management platform, not only all on-chain assets are Tokenized, but also theon-chain funds and products. Users are allowed to establish, manage and invest in decentralized funds. In this way, there are two roles: fund manager and investor. The fund manager has the power to make decisions about the fund, including setting the rules of the fund, such as investment strategy, periodicity, maximum retracement and other corresponding conditions and indicators.

The platform combines the two approaches of active and passive asset management, allowing fund managers to use active strategies and algorithmic strategies even passive strategies to invest in the fund products on XMETA. Information about the fund’s trading strategy and performance is publicly displayed on the platform, and investors can independently choose the fund they want to invest in through the fund’s performance and the the transaction.

2. The first realized portfolio management tool: First, the platform provides automated DeFi asset management products with a series of liquidity mining strategies that match full gradient risk and return preferences, while aggregating high-quality DeFi assets in the market and generating personalized, structured DeFi product matrices and accurate investment strategies for users based on an intelligent balance of risk and return. Selected portfolios can then be pledged to generate income by receiving LP tokens, which can also be used for liquidity mining to generate $XMETA, allowing users to achieve additional zero-risk income generation when investing in their ideal assets. In addition, the XMETA Capital Management Platform automatically reinvests earnings automatically, making this feature even more attractive throughout the crypto world.

The XMETA Capital Management Platform is a critical integration of trading and revenues, various DeFi services such as DEX can be used to manage portfolios, connect developers, fund managers and investors to help them achieve a higher combined return on their crypto assets. The platform is the first platform to implement asset management on BSC, and will later provide services for mainstream public chain assets such as ethereum, polygon, TRON, Solana, etc.

3. The first developed strategy-following system: The platform sets up an on-chain following system with AI arbitrage bots to allow “one-click following”, aiming to copy the strategies of the best traders. It adopts the strategy method of copying the wallet address of successful traders, allowing users to follow the professionals for optimal management of digital assets. Currently, XMETA capital management platform has achieved its key objectives: creating an easy-to-use product and decentralized on-chain trading strategies that follow the best traders/wallets.

4. First introduced social trading model: The XMETA Capital Management Platform connects traders around the world, providing them with shared strategies and insights. It is an unprecedented and intelligent way that allows investors to communicate, learn and discuss with each other. On the platform, like-minded partners can be found through a simple search and the best way to gain profit can be explored from the thousands of results displayed on the home page. Just freely discuss your ideas with other trading participants and absorb excellent trading ideas to improve the current trading experience and provide the industry with a new way of investment.

XMETA Capital Management Platform provides all of these functions to enable the users to effectively manage large amounts of assets and ensures peak performance by continuous innovation.

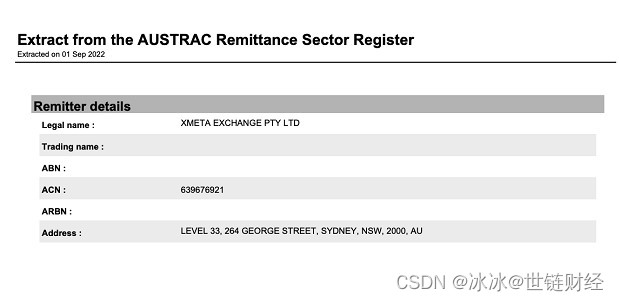

Backed by the XMETA Foundation, the XMETA Capital Management Platform is fully legal and currently holds financial licenses for blockchain, digital banking, virtual currency exchanges, and market-making liquidity providers in multiple countries, such as: NFA (National Futures Association registered regulatory (non-commissioned)), AUSTRAC (Australian digital currency exchange license), ASIC (Australian Securities and Investment Commission digital banking and LP license), etc.

(Figure is NFA (National Futures Association registered regulatory (non-commission) license)

(AUSTRAC Australian Digital Currency Exchange License)

(Picture above is the ASIC (Australian Securities and Investment Commission) Digital Banking and Liquidity Provider License)

$XMETA is XMETA Capital Management Platform’s native token designed to safeguard the interests of users, token holders and protocol maintainers. The total number of $XMETA is 300 million, and a proportional portion of the market capitalization allocation is considered to used for fund protocol development to better scale its ecology. Investors are required to hold $XMETA tokens to participate in the capital management business for governance, payment and other functions. $XMETA still has huge room for appreciation for its destruction mechanism .

Openness and Collaboration

Managing digital assets has undoubtedly become an important way of personal asset allocation in the current era, and digital asset management may be the most basic wealth management need for everyone in the future. XMETA capital management platform takes advantage of Tokenized design of on-chain funds, automated DeFi asset management products, leading portfolio management tools, advanced strategy following system, and powerful social trading network to establish a full range of multi-directional capital management services, and it is believed that the platform will soon usher in an increase in cumulative linkage with the value of XMETA. The goal of XMETA capital management platform is to extend these capabilities and promote this vision globally in a decentralized manner.

XMETA是一款全球数字资产管理平台,提供创新的去中心化社会金融管理生态系统,整合数字银行、抵押借贷、DEX等服务。平台引入链上基金通证化、实现投资策略跟随等功能,为用户提供一站式金融服务。

XMETA是一款全球数字资产管理平台,提供创新的去中心化社会金融管理生态系统,整合数字银行、抵押借贷、DEX等服务。平台引入链上基金通证化、实现投资策略跟随等功能,为用户提供一站式金融服务。

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?