Alternative Data行业调查

1. 另类数据的定义:

“Alternative data in finance refers to any data that is not traditionally considered financial data but nonetheless offers investors market insights. It is often quite "raw", meaning that the investor has to do data mining or data science to extract insight. Examples include:

Social media sentiment data: data reflecting investor sentiment derived from social media

AgTech data: primary data about crop yields via satellites or aggregation of farm sensor data

Consumer trends: original data about consumer habits derived from observation mechanisms such as satellites, drones, surveillance cameras”

—wikipedia.

2. 为什么需要另类数据?

As quants, we’re all aware that every model has a shelf-life. Sooner or later, the ideas and techniques behind every “proprietary” analytical technique diffuse into the broader world, at which point that technique is no longer the source of a competitive edge or alpha. What’s less well appreciated is that a similar pattern applies to the world of data. Rare, unique and proprietary data eventually diffuses and becomes commonplace, easily available, edgeless data. The best analysts constantly reinvent their models, to avoid their inevitable obsolescence. Today, they’re venturing into the world of alternative data as a new source of alpha.

3. 另类数据的历史和现状?

“Edge-worthy” Data

Information is power. This has always been the case in the market: a trader with unique and important data has an advantage over one without. “Informational edge” is one of the cleanest, simplest, most obvious ways to make money, and it always has been.

Two hundred years ago, geo-political events fell into the category of “edge-worthy” data. In an era before telegrams and news services, knowing the results of battles, elections and campaigns before anybody else was a huge plus. Today, of course, there is no piece of news that is not disseminated world-wide almost instantly.

One hundred years ago, stock price data fell into this category. This was the era of ticker-readers and bucket shops; Jesse Livermore and J. P. Morgan. Many of the classic price-dependent trading strategies, including all the technical patterns beloved of modern chartists, were developed during this time. Today, of course, every analyst has free or cheap access to high-quality stock price data.

Fifty years ago, corporate financials fell into this category. Until Reuters corporation first digitized company statements in the 1970s, this data was hard to find and hard to use; the best analysts used them anyway. It’s no coincidence that Benjamin Graham and Warren Buffett cut their teeth in this era; it was the era of fundamentals-based investing. Today, of course, every analyst has free or cheap access to high-quality stock fundamentals data.

Five years ago, social sentiment data fell in this category. Thanks to the internet, for the first time ever investors could tap into the true wisdom of crowds, and gauge first-hand the degree of fear and greed, hope and despair, permeating the market. In the early 2010s, only the biggest banks and hedge funds could afford to access the Twitter firehose and similar sources of sentiment data. Today, of course, every analyst has free or cheap access to high-quality sentiment data.

The truth is, the landscape of data is constantly changing, and analysts have to evolve to keep up with it. Data that was unique and rare even five years ago is now commonplace. If anything, the pace of change is accelerating.

Witnessing A Data Revolution

We’re in the middle of a data revolution.

Business processes everywhere are becoming digitized. Firms like Walmart and Target know exactly what you search for, and what you end up buying. Other firms like ADP, Mastercard and Fedex are intimately involved in payrolls, transactions, delivery and every other stage of the commercial pipeline. And every single action that these firms take is recorded and stored for analysis.

Human interactions are also becoming digitized. Social networks, instant messaging and web search paint a dramatic, real-time picture of what people are interested in and who they’re talking to. Again, every single action is recorded and stored for posterity.

Smart phones are ubiquitous. This means an accurate location sensor, audio recorder, still/video camera, radio transponder and internet connection in every pocket. Almost no part of the world is outside the limits of cellular coverage.

Cars and trucks now have embedded sensors, tracking position, velocity, traffic and much more. Satellites and GPS have gone from the preserve of the few (military) to the plaything of the many; imagery and position data is today a public good.

As a result of these technological innovations, we are drowning in a sea of data. Yet this data would be meaningless if it weren’t for another, parallel advancement in the area of computation. Thanks to the relentless progress of Moore’s Law, we have the bandwidth to capture all this data, the memory to store it, and the cycles to analyze it and extract commercial value from it.

This capacity has transformed industries everywhere. Today, every company is a data company. Firms produce huge quantities of data, and they consume huge quantities of data, in the pursuit of profit. One way or another, companies and analysts are seeing – in real time! – the same data that will one day become the content of 10K filings or economic releases or financial news. The finance industry is calling this phenomenon “Alternative Data.”

As a quant, this is both an opportunity and a threat. The opportunity is to unlock new alpha from all these new data sources. The potential here is enormous: every single industry is going to be transformed by data, and early access to that data means an inside view on all those industries and companies.

The threat is that others may beat you to the punch. If you don’t use these new data sources, you will be trading against people who do use them, and have more information than you. That’s a sucker’s game.

4. 另类数据的三个阶段?

Every Company is a Data Company

The Baltic Dry Index, the ADP Payrolls Survey, the ISM Manufacturing Index, and the NAHB Housing Survey are all examples of datasets that are not “traditionally” financial in nature (coming as they do from a shipping insurer, a payroll provider, a supply chain group, and a constructors association respectively); yet they move markets. In recent years, many more such alternative datasets have come to the fore, created by companies in every sector of the economy.

INRIX provides location-tracking services to a wide range of auto manufacturers and trucking firms. The data they capture allows them to paint a detailed picture of commercial road traffic in the USA; information that is of value to economic forecasters. Transmatch does something similar in the railroad space.

Credit card companies have comprehensive information on consumer spending patterns, broken down by retailer, product, area, demography and more, although there are regulatory challenges involved with accessing the data. Email inboxes contain scores of electronic receipts that say something about real-time company performance of juggernauts including Amazon, e-bay, and Groupon.

Premise aggregates an army of smartphone users to capture real-time inflation signals; a dataset that is especially potent for Wall Street. Borrell tracks ad spending data, while Buildfax has information about building construction permits in the U.S.

UrsaSpace and Orbital Insight take advantage of the plummeting costs of satellite imagery to create novel, predictive datasets around crop yields, shipping and manufacturing.

DataMinr was one the pioneers in the alternative data space. By parsing the Twitter firehose in real-time, they generated one of the first “crowd sentiment” datasets, which they sold to investment banks and hedge funds.

Accern aims to capture a similar set of sentiment data, but based on a much broader sample space encompassing millions of websites, blogs and media pages.

Many of these data vendors are already on Quandl; many more are in the pipeline. This group is only going to grow larger.

Alternative Data Sources

We’ve barely scratched the surface of potential alternative data sources. The data sources that will become available in the next decade dwarf what we have access to right now.

The Internet of Things (IoT) will incorporate sensors that are orders of magnitude more granular, and orders of magnitude more broadly dispersed, than our current smart phone network. Drones and micro-satellites will provide real-time physical and logistical data far more detailed than our current coverage. Beacons and embedded chips inside products will allow instantaneous knowledge of transactions, usage, obsolescence and more.

And companies will evolve to make use of all this data. Today, for every Amazon or Target that runs a rigorous program of data collection, analysis and action, there are dozens of companies that still operate by old-school rules. As time goes by, these firms will either adapt, or die. Either way, the future belongs to businesses that embrace the data revolution. Which means that the amount of business data available to analysts will only continue to grow.

But as new data becomes available, “old” data will become commonplace. This is inevitable; and analysts must prepare for this eventuality.

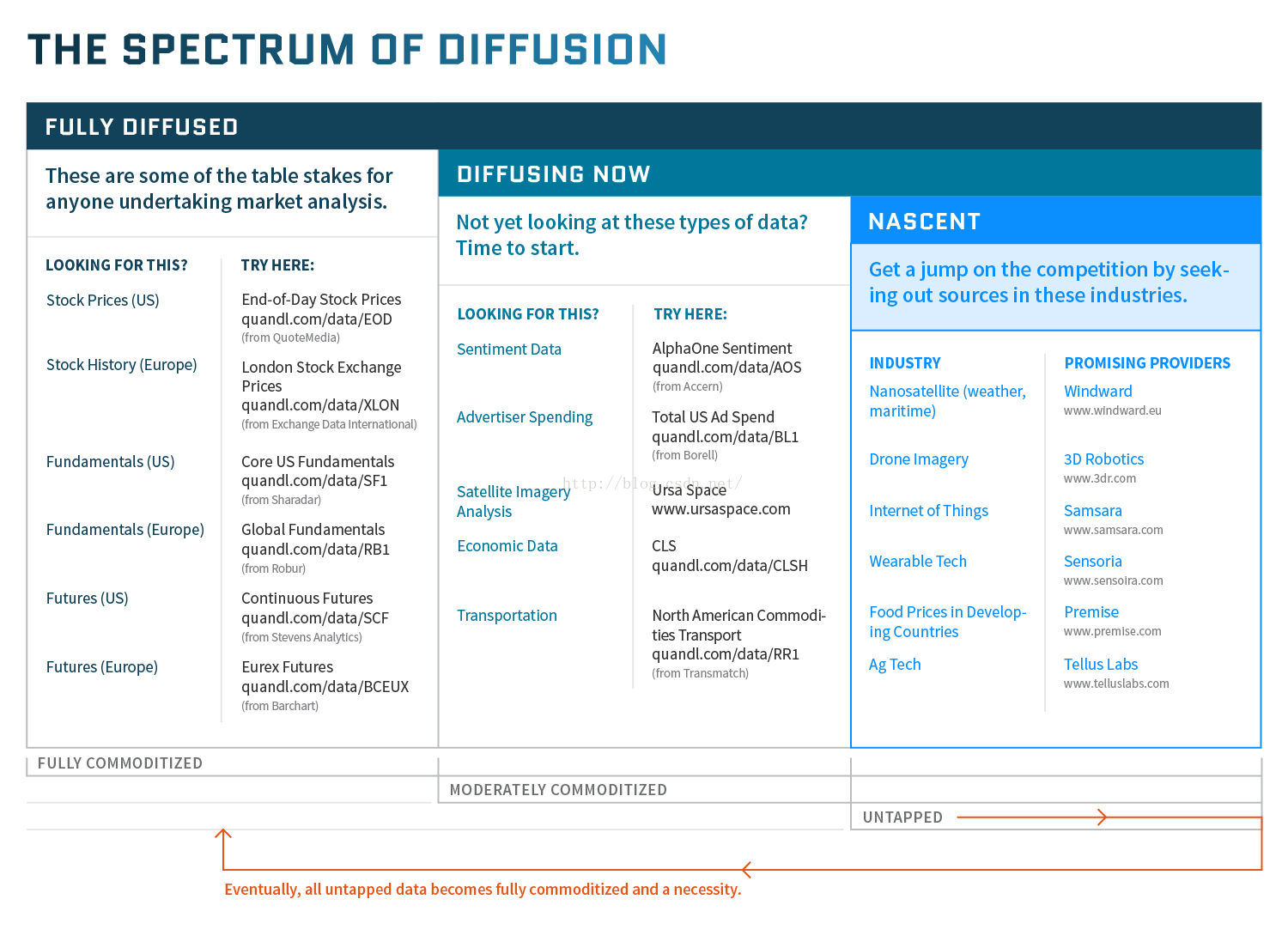

The Spectrum of Diffusion for Alternative Data

Data has a natural lifecycle. Newly discovered datasets are rare, jealously guarded, and valuable because they contain alpha. As time goes by, this data diffuses to a wider audience, and its alpha content diminishes; nonetheless analysts continue to use the data because not doing so would leave them at an information disadvantage. Finally, the data becomes old and obsolete: fully priced in by a market that has moved on to the next source of edge.

Smart analysts are aware of this dynamic, and are always ready to adapt. They’ve internalized where we are on the spectrum of diffusion.

The Spectrum of Data Diffusion

In evaluating whether to invest in rare data, some questions to ask are: Do the people who are trading against me have this information? Am I willing to risk the possibility that they are? You don’t want people with better information trading against you. In 2015, investors were surprised at JC Penney’s Q2 results. The hedge funds that paid RS Metrics, however, were not. RS Metrics uses satellite images to measure the amount of traffic into the stores. It reported, in near real time, that volume was rising in April and May. The company’s clients then traded on this information. In mid-August, JCPenney’s shares jumped more than 10%.

It’s a cautionary tale, or an opportunity, depending on how you look at it. Eventually, everybody will have access to satellite data, just like everybody has access to fundamentals data today, and it will no longer be edge-worthy.

But for now, unorthodox alternative data sources like Satellite and Consumer data are moving the markets. Those who can access the information the fastest will stay ahead of the market.

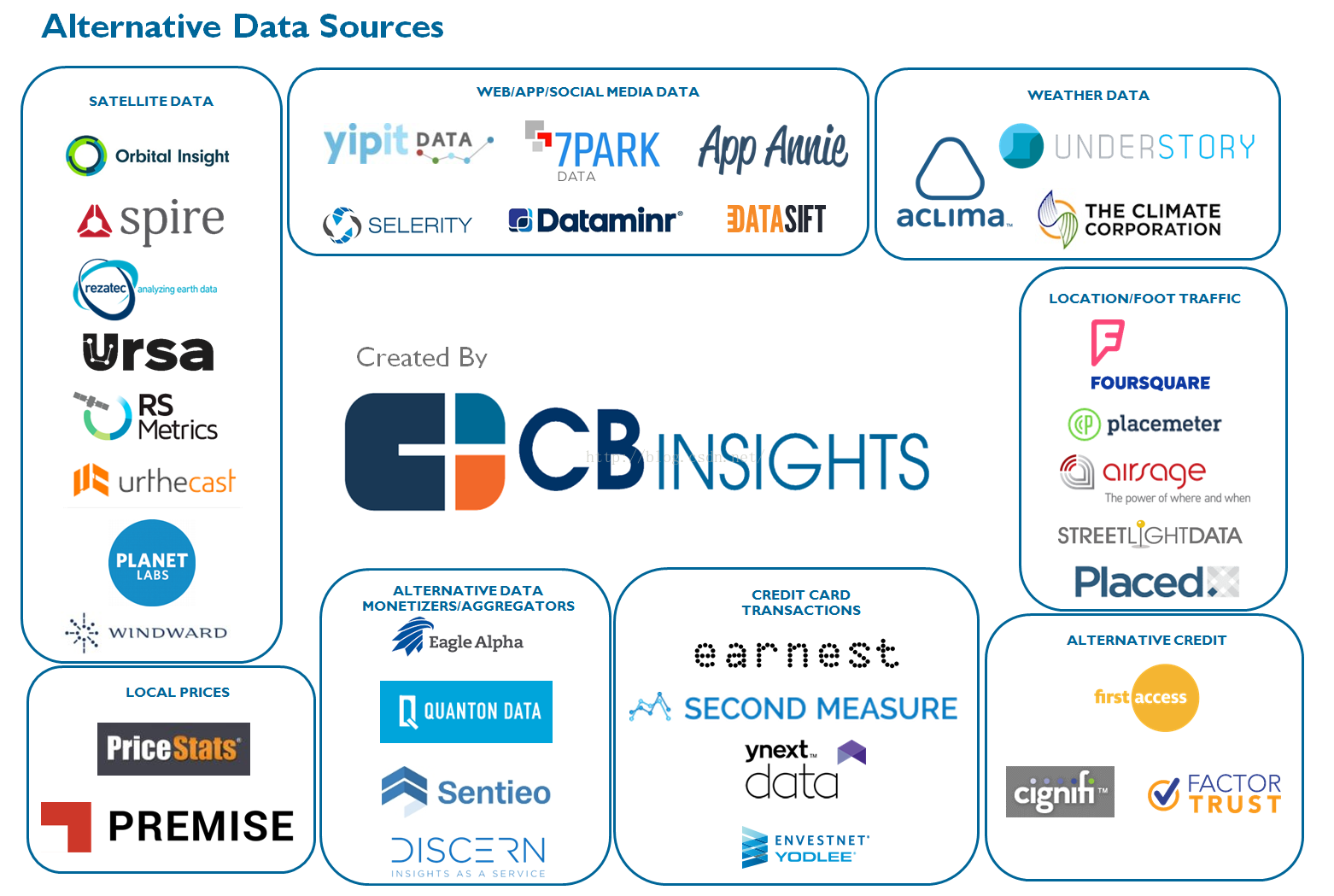

5. 另类数据行业的国外行业调查

Satellite Data - These are companies that utilize image data from orbiting satellites to do things like measure the number of cars in Walmart parking lots or farm health based on the color of crops.

Select Companies: Orbital Insight, Rezatec, Windward

Web/App/Social Media Data – These are companies which mine social media or use data firehoses from the web/mobile to understand what’s happening in the world or how people are interacting with their devices.

Select Companies: Dataminr, App Annie, 7ParkData

Weather Data – These are companies which are developing weather models and utilizing more sensors to get better localized data or improve weather forecasting.

Select Companies: Aclima, Understory

Location/Foot Traffic Data – Companies that use different means to understand where consumers are going by measuring foot traffic via check-ins, video analysis, etc.

Select Companies: Foursquare, Placemeter, Placed

Alternative Credit - Companies developing new credit models that utilize sources of alternative data (like mobile usage).

Select Companies: Cignifi, First Access, FactorTrust

Credit Card Transactions – These are companies that use anonymous aggregate transaction data to understand trends in consumer purchasing habits.

Select Companies: Earnest, Second Measure

Alternative Data Monetizers/Aggregators – These are companies who pay for access to individual data streams which become more valuable in a bundle, and then sell those packages to investors.

Select Companies: Eagle Alpha, Quanton Data, Discern

Local Prices – These companies can see what’s happening to prices and inflation by aggregating data from ground-level sources.

Select Companies: Premise

- https://blog.quandl.com/alternative-data Alternative Data – The Newest Trend in Financial Data

- https://www.cbinsights.com/blog/alternative-data-startups-market-map-company-list/# The New Alpha: 30+ Startups Providing Alternative Data For Sophisticated Investors

- https://cbi-blog.s3.amazonaws.com/blog/wp-content/uploads/2016/05/Alternative-Data-Map1.png

- http://www.capco.com/insights/capco-blog/alternative-data-the-ascent-to-better-risk-management-financial-inclusion

693

693

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?