加密货币市场使用效果较好,适用于5min分钟级别。

原理上基于vegas tunnel 和 ut boot 实现,

拥有广泛的可调参数,

!!!!!!!建议充分回测后再使用!!!!!!

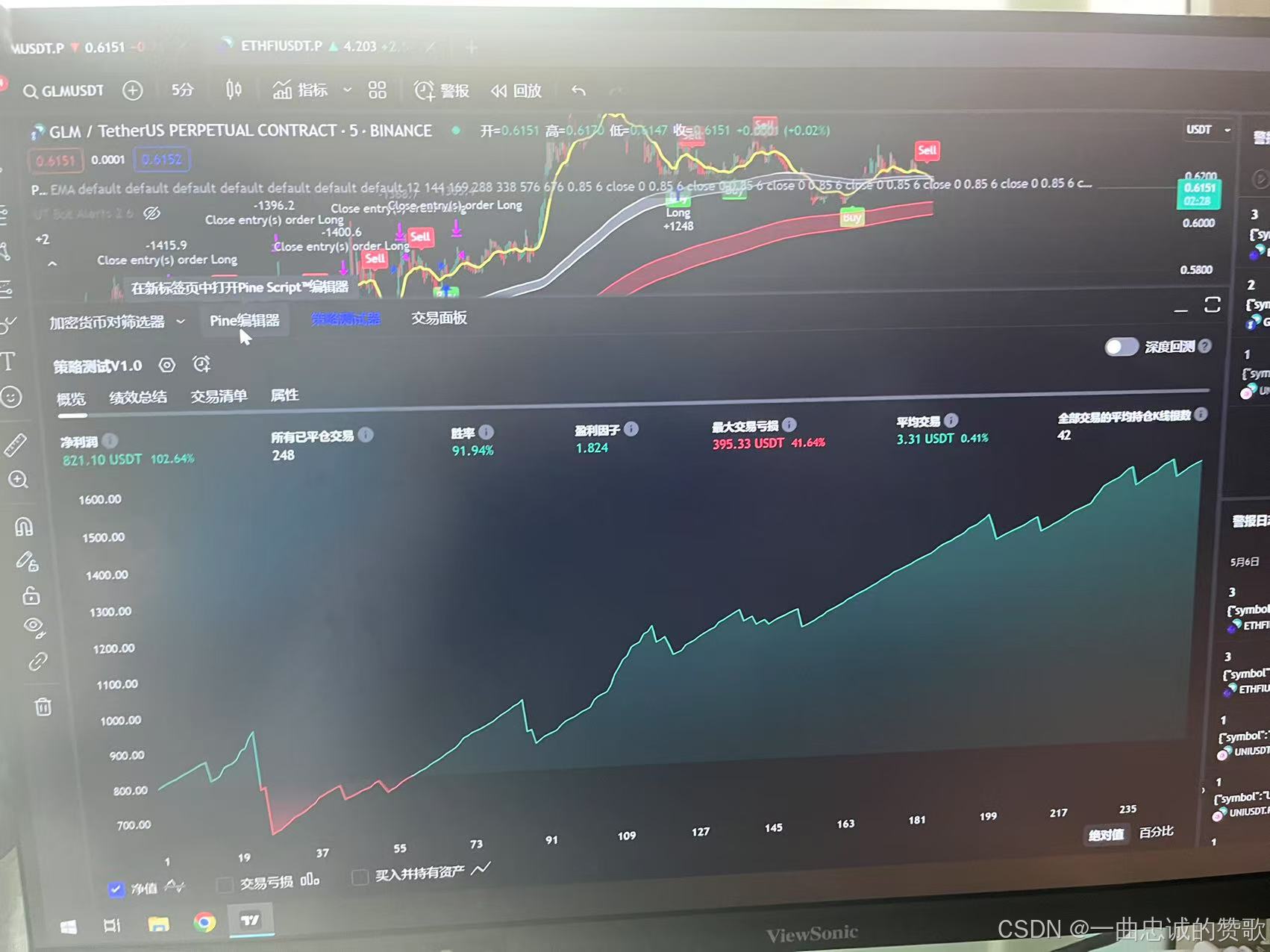

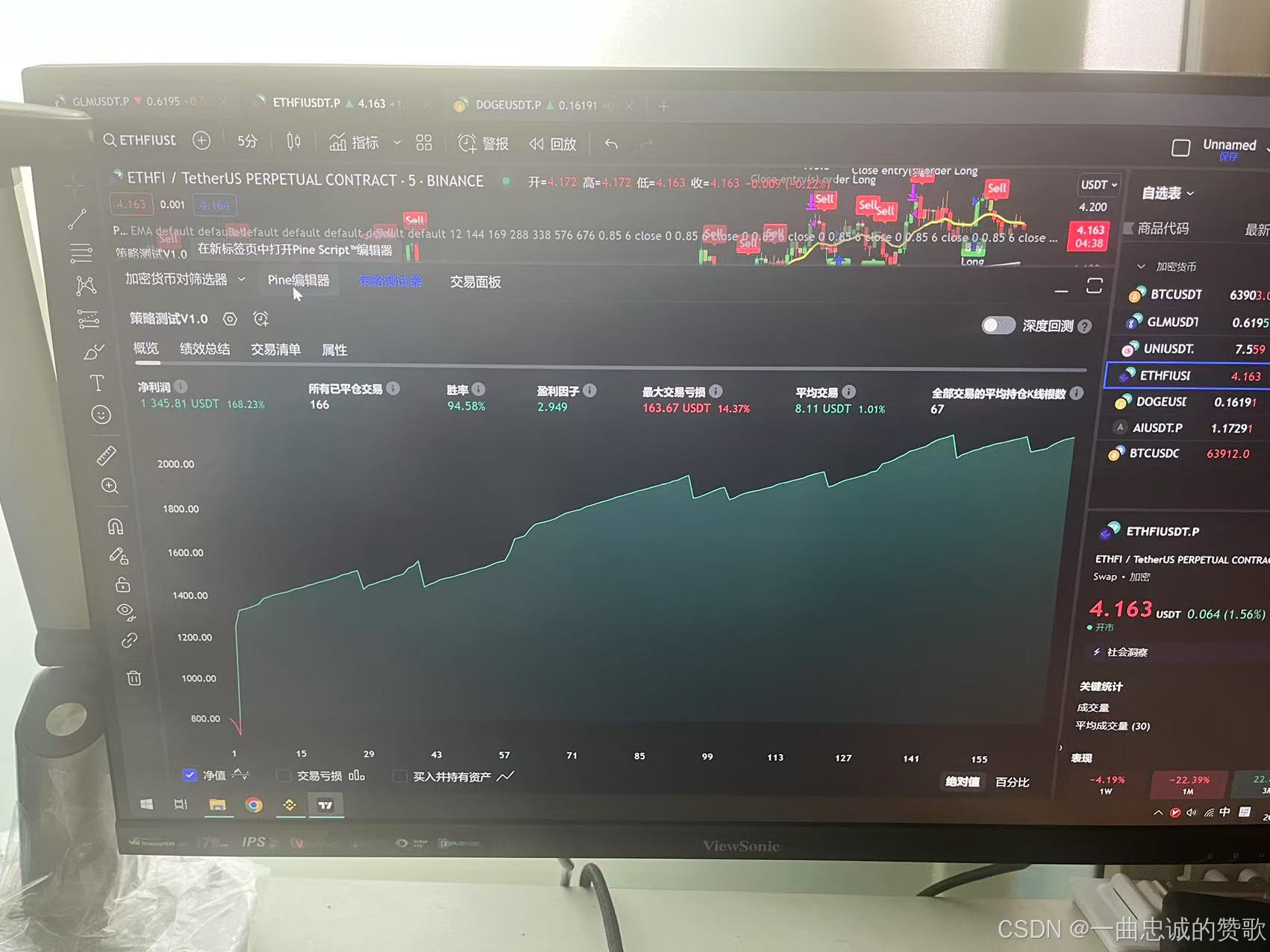

截图展示下部分回测数据:均为屏摄

代码如下:(pine脚本)

//@version=4

strategy("策略测试V1.0 ", overlay = true)

// UT BOOT 部分 LONG

a = input(1, title = "Long_Key Vaule. 'This changes the sensitivity'")

c = input(22, title = "Long_ATR Period")

h = input(false, title = "Long_Signals from Heikin Ashi Candles")

xATR = atr(c)

nLoss = a * xATR

src = h ? security(heikinashi(syminfo.tickerid), timeframe.period, close, lookahead = false) : close

xATRTrailingStop = 0.0

xATRTrailingStop := iff(src > nz(xATRTrailingStop[1], 0) and src[1] > nz(xATRTrailingStop[1], 0), max(nz(xATRTrailingStop[1]), src - nLoss),

iff(src < nz(xATRTrailingStop[1], 0) and src[1] < nz(xATRTrailingStop[1], 0), min(nz(xATRTrailingStop[1]), src + nLoss),

iff(src > nz(xATRTrailingStop[1], 0), src - nLoss, src + nLoss)))

pos = 0

pos := iff(src[1] < nz(xATRTrailingStop[1], 0) and src > nz(xATRTrailingStop[1], 0), 1,

iff(src[1] > nz(xATRTrailingStop[1], 0) and src < nz(xATRTrailingStop[1], 0), -1, nz(pos[1], 0)))

xcolor = pos == -1 ? color.red: pos == 1 ? color.green : color.blue

ema = ema(src,1)

above = crossover(ema, xATRTrailingStop)

below = crossover(xATRTrailingStop, ema)

buy = src > xATRTrailingStop and above

barbuy = src > xATRTrailingStop

plotshape(buy, title = "Buy", text = 'Buy', style = shape.labelup, location = location.belowbar, color= color.green, textcolor = color.white, transp = 0, size = size.tiny)

barcolor(barbuy ? color.green : na)

alertcondition(buy, "UT Long", "UT Long")

// UT BOOT 部分

// UT BOOT 部分 SHORT

a_1 = input(1, title = "Short_Key Vaule. 'This changes the sensitivity'")

c_1 = input(22, title = "Short_ATR Period")

h_1 = input(false, title = "Short_Signals from Heikin Ashi Candles")

xATR_1 = atr(c_1)

nLoss_1 = a_1 * xATR_1

src_1 = h_1 ? security(heikinashi(syminfo.tickerid), timeframe.period, close, lookahead = false) : close

xATRTrailingStop_1 = 0.0

xATRTrailingStop_1 := iff(src_1 > nz(xATRTrailingStop_1[1], 0) and src_1[1] > nz(xATRTrailingStop_1[1], 0), max(nz(xATRTrailingStop_1[1]), src_1 - nLoss_1),

iff(src_1 < nz(xATRTrailingStop_1[1], 0) and src_1[1] < nz(xATRTrailingStop_1[1], 0), min(nz(xATRTrailingStop_1[1]), src_1 + nLoss_1),

iff(src_1 > nz(xATRTrailingStop_1[1], 0), src_1 - nLoss_1, src_1 + nLoss_1)))

pos_1 = 0

pos_1 := iff(src_1[1] < nz(xATRTrailingStop_1[1], 0) and src_1 > nz(xATRTrailingStop_1[1], 0), 1,

iff(src_1[1] > nz(xATRTrailingStop_1[1], 0) and src_1 < nz(xATRTrailingStop_1[1], 0), -1, nz(pos_1[1], 0)))

xcolor_1 = pos_1 == -1 ? color.red: pos_1 == 1 ? color.green : color.blue

ema_1 = ema(src_1,1)

above_1 = crossover(ema_1, xATRTrailingStop_1)

below_1 = crossover(xATRTrailingStop_1, ema_1)

sell_1 = src_1 < xATRTrailingStop_1 and below_1

barsell_1 = src_1 < xATRTrailingStop_1

plotshape(sell_1, title = "Sell", text = 'Sell', style = shape.labeldown, location = location.abovebar, color= color.red, textcolor = color.white, transp = 0, size = size.tiny)

barcolor(barsell_1 ? color.red : na)

alertcondition(sell_1, "UT Short", "UT Short")

// UT BOOT 部分

//获取金额

money = strategy.initial_capital

//money = strategy.equity

//平仓条件

float long_profit_target_percent = input(0.7, title="做多——利润率%")

float short_profit_target_percent = input(0.7, title="做空——利润率%")

// 计算每次购买的合约数量

contracts = money / close

contract = round(contracts, 1)//交易所限制精确到1位小数

//5min级别vagas tunnel(主要使用) //用于判断趋势

ema12 = ema(close, 12)

ema144 = ema(close, 144)

ema169 = ema(close, 169)

ema576 = ema(close, 576)

ema676 = ema(close, 676)

//ema576 = ema(close, 288)

//ema676 = ema(close, 338)

//15min级别vagas tunnel(加强趋势判断)

//加强判断不至于逆势操作

ema144_15min = security(syminfo.tickerid, '15' , expression = ema(close,144))

ema169_15min = security(syminfo.tickerid, '15' , expression = ema(close,169))

ema576_15min = security(syminfo.tickerid, '15' , expression = ema(close,576))

ema676_15min = security(syminfo.tickerid, '15' , expression = ema(close,676))

//判断多空情况

result = ''

if ema576 > ema169

result := 'Short'

else if ema169 > ema576

result := 'Long'

else

result := 'No Signal'

var starttime = time

starttime := timestamp("Asia/Shanghai", 2024, 5, 17, 19, 10, 0 )

if(time >= starttime)

//开仓条件

if(result == 'Long')

// RSI处于超卖状态

if (buy)

//ema12过滤器

//if(ema12 > ema676 or ema12 > ema576)

if(strategy.position_size == 0)

// 576 676

// 1 100 0.7 flase 5min

strategy.entry("Long", strategy.long, qty = contract)

else if(result == 'Short')

// RSI处于超买状态

if (sell_1)

//ema12过滤器

//if(ema12 < ema676 or ema12 < ema576)

if(strategy.position_size == 0)

// 576 676

// 1 100 0.7 true 5min

strategy.entry("Short", strategy.short, qty = contract)

//止盈条件

// 如果当前持有long订单并且达到利润目标,则平仓

if (strategy.position_size > 0 and close >= strategy.position_avg_price * (1 + long_profit_target_percent/100 ))

strategy.close(id="Long")

// 如果当前持有Short订单并且达到利润目标,则平仓

if (strategy.position_size < 0 and close <= strategy.position_avg_price * (1 - short_profit_target_percent/100 ))

strategy.close(id="Short")

// 止损条件

if (strategy.position_size > 0)

if(((ema144 < ema676 and ema144 < ema576) and (ema169 < ema676 and ema169 < ema576)) )

//if(close < ema676 and ema12 < ema676)

strategy.close(id="Long")

if (strategy.position_size < 0)

if((ema144 > ema676 and ema144 > ema576) and (ema169 > ema676 and ema169 > ema576))

//if(close > ema144 and ema12 > ema144)

strategy.close(id="Short")

1607

1607

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?