🍉CSDN小墨&晓末:https://blog.csdn.net/jd1813346972

个人介绍: 研一|统计学|干货分享

擅长Python、Matlab、R等主流编程软件

累计十余项国家级比赛奖项,参与研究经费10w、40w级横向

1 目的

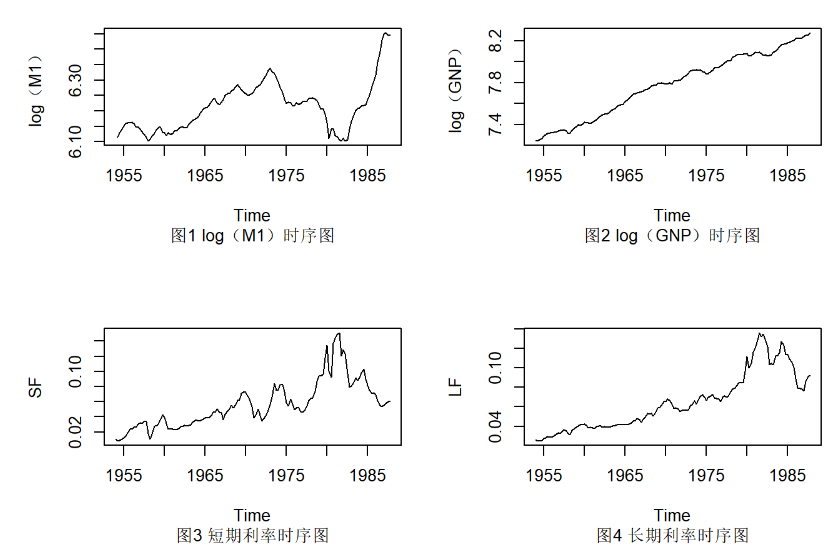

为研究国民生产总值与货币供应量及利率的关系。现收集到1954年1月至1987年10月M1货币量对数序列 l o g ( M 1 ) log(M1) log(M1),美国月度国民生产总值对数序列 l o g ( G N P ) log(GNP) log(GNP),以及短期利率和长期利率序列,部分数据见表1。该篇文章主要对四个序列分别研究其单整性及按照实际情况拟合 A R I M A ARIMA ARIMA模型,后续将研究研究这些变量的格兰杰因果关系及协整关系。

2 原序列可视化

运行程序:

rm(list=ls()) #清空变量

library("openxlsx") #加载包

library("knitr") #加载包

library("xlsx") #加载包

library("tseries")

#加载包

data<-read.xlsx("F:\\时间序列分析\\数据.xlsx",'Sheet1',

encoding ="UTF-8")#读取数据

M1<-ts(data$log.M1.,start = c(1954,1),frequency = 4) #log(M1)

GNP<-ts(data$log.GNP.,start = c(1954,1),frequency = 4) #log(GNP)

SF<-ts(data$短期利率,start = c(1954,1),frequency = 4) #短期利率

LF<-ts(data$长期利率,start =c(1954,1),frequency = 4) #长期利率

par(mfrow=c(2,2)) #创建2×2画布

plot(M1,sub='图1 log(M1)时序图',ylab="log(M1)")

plot(GNP,sub='图2 log(GNP)时序图',ylab="log(GNP)")

plot(SF,sub='图3 短期利率时序图')

plot(LF,sub='图4 长期利率时序图')

运行结果:

通过各变量的时序图(图1-图4)可以发现,各时序数据具有明显趋势效应。

3 各序列单整性检验

3.1 log(M1)单整性检验

1.平稳性检验

运行程序:

library(aTSA)

adf.test(M1) #log(M1)序列平稳性检验

运行结果:

## Augmented Dickey-Fuller Test

## alternative: stationary

##

## Type 1: no drift no trend

## lag ADF p.value

## [1,] 0 2.290 0.990

## [2,] 1 1.062 0.921

## [3,] 2 0.899 0.900

## [4,] 3 0.738 0.854

## [5,] 4 0.742 0.855

## Type 2: with drift no trend

## lag ADF p.value

## [1,] 0 1.084 0.990

## [2,] 1 -0.658 0.816

## [3,] 2 -0.971 0.707

## [4,] 3 -1.395 0.558

## [5,] 4 -1.425 0.547

## Type 3: with drift and trend

## lag ADF p.value

## [1,] 0 0.324 0.990

## [2,] 1 -1.291 0.871

## [3,] 2 -1.610 0.737

## [4,] 3 -2.057 0.548

## [5,] 4 -2.082 0.538

## ----

## Note: in fact, p.value = 0.01 means p.value <= 0.01

2.一阶差分后平稳性检验

运行程序:

adf.test(diff(M1)) #一阶差分log(M1)序列平稳性检验

运行结果:

## Augmented Dickey-Fuller Test

## alternative: stationary

##

## Type 1: no drift no trend

## lag ADF p.value

## [1,] 0 -5.96 0.01

## [2,] 1 -4.76 0.01

## [3,] 2 -3.88 0.01

## [4,] 3 -3.65 0.01

## [5,] 4 -3.44 0.01

## Type 2: with drift no trend

## lag ADF p.value

## [1,] 0 -6.05 0.01

## [2,] 1 -4.84 0.01

## [3,] 2 -3.94 0.01

## [4,] 3 -3.72 0.01

## [5,] 4 -3.52 0.01

## Type 3: with drift and trend

## lag ADF p.value

## [1,] 0 -6.14 0.0100

## [2,] 1 -4.94 0.0100

## [3,] 2 -4.05 0.0100

## [4,] 3 -3.84 0.0192

## [5,] 4 -3.63 0.0328

## ----

## Note: in fact, p.value = 0.01 means p.value <= 0.01

3. log(GNP)单整性检验

1.平稳性检验

运行程序:

adf.test(GNP) #log(GNP)序列平稳性检验

运行结果:

## Augmented Dickey-Fuller Test

## alternative: stationary

##

## Type 1: no drift no trend

## lag ADF p.value

## [1,] 0 8.62 0.99

## [2,] 1 5.13 0.99

## [3,] 2 4.11 0.99

## [4,] 3 4.21 0.99

## [5,] 4 4.05 0.99

## Type 2: with drift no trend

## lag ADF p.value

## [1,] 0 -0.695 0.803

## [2,] 1 -0.793 0.769

## [3,] 2 -0.656 0.817

## [4,] 3 -0.564 0.849

## [5,] 4 -0.423 0.899

## Type 3: with drift and trend

## lag ADF p.value

## [1,] 0 -1.53 0.772

## [2,] 1 -2.16 0.503

## [3,] 2 -2.40 0.405

## [4,] 3 -2.15 0.511

## [5,] 4 -2.05 0.552

## ----

## Note: in fact, p.value = 0.01 means p.value <= 0.01

2.一阶差分后平稳性检验

运行程序:

adf.test(diff(GNP)) #一阶差分log(GNP)序列平稳性检验

运行结果:

## Augmented Dickey-Fuller Test

## alternative: stationary

##

## Type 1: no drift no trend

## lag ADF p.value

## [1,] 0 -6.13 0.01

## [2,] 1 -4.12 0.01

## [3,] 2 -3.82 0.01

## [4,] 3 -3.36 0.01

## [5,] 4 -3.00 0.01

## Type 2: with drift no trend

## lag ADF p.value

## [1,] 0 -8.47 0.01

## [2,] 1 -6.03 0.01

## [3,] 2 -5.88 0.01

## [4,] 3 -5.41 0.01

## [5,] 4 -5.17 0.01

## Type 3: with drift and trend

## lag ADF p.value

## [1,] 0 -8.46 0.01

## [2,] 1 -6.02 0.01

## [3,] 2 -5.86 0.01

## [4,] 3 -5.38 0.01

## [5,] 4 -5.14 0.01

## ----

## Note: in fact, p.value = 0.01 means p.value <= 0.01

3.3 短期利率序列单整性检验

1.平稳性检验

运行程序:

adf.test(SF) #短期利率序列平稳性检验

运行结果:

## Augmented Dickey-Fuller Test

## alternative: stationary

##

## Type 1: no drift no trend

## lag ADF p.value

## [1,] 0 -0.512 0.496

## [2,] 1 -0.687 0.433

## [3,] 2 -0.373 0.536

## [4,] 3 -0.579 0.471

## [5,] 4 -0.528 0.490

## Type 2: with drift no trend

## lag ADF p.value

## [1,] 0 -1.96 0.346

## [2,] 1 -2.27 0.225

## [3,] 2 -1.86 0.384

## [4,] 3 -2.13 0.278

## [5,] 4 -2.03 0.316

## Type 3: with drift and trend

## lag ADF p.value

## [1,] 0 -2.24 0.474

## [2,] 1 -2.85 0.220

## [3,] 2 -1.91 0.610

## [4,] 3 -2.66 0.298

## [5,] 4 -2.55 0.343

## ----

## Note: in fact, p.value = 0.01 means p.value <= 0.01

2.一阶差分后平稳性检验

运行程序:

adf.test(diff(SF)) #一阶差分短期利率序列平稳性检验

运行结果:

## Augmented Dickey-Fuller Test

## alternative: stationary

##

## Type 1: no drift no trend

## lag ADF p.value

## [1,] 0 -9.79 0.01

## [2,] 1 -10.03 0.01

## [3,] 2 -6.07 0.01

## [4,] 3 -5.61 0.01

## [5,] 4 -4.15 0.01

## Type 2: with drift no trend

## lag ADF p.value

## [1,] 0 -9.77 0.01

## [2,] 1 -10.02 0.01

## [3,] 2 -6.07 0.01

## [4,] 3 -5.61 0.01

## [5,] 4 -4.15 0.01

## Type 3: with drift and trend

## lag ADF p.value

## [1,] 0 -9.78 0.01

## [2,] 1 -10.06 0.01

## [3,] 2 -6.10 0.01

## [4,] 3 -5.64 0.01

## [5,] 4 -4.18 0.01

## ----

## Note: in fact, p.value = 0.01 means p.value <= 0.01

3.4 长期利率序列单整性检验

1.平稳性检验

运行程序:

adf.test(LF) #长期利率序列平稳性检验

运行结果:

## Augmented Dickey-Fuller Test

## alternative: stationary

##

## Type 1: no drift no trend

## lag ADF p.value

## [1,] 0 0.783 0.867

## [2,] 1 0.451 0.772

## [3,] 2 0.454 0.773

## [4,] 3 0.297 0.728

## [5,] 4 0.324 0.736

## Type 2: with drift no trend

## lag ADF p.value

## [1,] 0 -1.08 0.667

## [2,] 1 -1.29 0.594

## [3,] 2 -1.30 0.591

## [4,] 3 -1.40 0.557

## [5,] 4 -1.32 0.584

## Type 3: with drift and trend

## lag ADF p.value

## [1,] 0 -1.72 0.691

## [2,] 1 -2.32 0.438

## [3,] 2 -2.34 0.431

## [4,] 3 -3.01 0.156

## [5,] 4 -3.00 0.161

## ----

## Note: in fact, p.value = 0.01 means p.value <= 0.01

2.一阶差分后平稳性检验

运行程序:

adf.test(diff(LF)) #长阶差分短期利率序列平稳性检验

运行结果:

## Augmented Dickey-Fuller Test

## alternative: stationary

##

## Type 1: no drift no trend

## lag ADF p.value

## [1,] 0 -8.98 0.01

## [2,] 1 -7.02 0.01

## [3,] 2 -4.96 0.01

## [4,] 3 -4.68 0.01

## [5,] 4 -5.10 0.01

## Type 2: with drift no trend

## lag ADF p.value

## [1,] 0 -9.05 0.01

## [2,] 1 -7.11 0.01

## [3,] 2 -5.05 0.01

## [4,] 3 -4.77 0.01

## [5,] 4 -5.22 0.01

## Type 3: with drift and trend

## lag ADF p.value

## [1,] 0 -9.02 0.01

## [2,] 1 -7.09 0.01

## [3,] 2 -5.03 0.01

## [4,] 3 -4.74 0.01

## [5,] 4 -5.20 0.01

## ----

## Note: in fact, p.value = 0.01 means p.value <= 0.01

根据各变量的单位根检验,发现,这四个变量原始时序数据都存在单位根,一阶差分后平稳,表明这四个序列均为一阶单整序列。

4 各序列ARIMA模型拟合

4.1 log(M1)的ARIMA模型拟合

4.1.1 模型定阶

运行程序:

par(mfrow=c(1,2)) #创建1×2画布

M1<-na.omit(M1) #去除空值

acf(diff(M1),sub="图5 log(M)自相关图") #自相关图

pacf(diff(M1),sub="图6 log(M)偏自相关图") #偏自相关图

运行结果:

结合log(M)序列的ACF、Pacf特征,对其建立ARIMA(1,1,0)模型。

4.1.2 模型拟合

运行程序:

fit1<-arima(M1,order = c(1,1,0)) #拟合ARIMA(1,1,0)模型

fit1

运行结果:

##

## Call:

## arima(x = M1, order = c(1, 1, 0))

##

## Coefficients:

## ar1

## 0.5811

## s.e. 0.0699

##

## sigma^2 estimated as 0.0001071: log likelihood = 422.15, aic = -840.29

4.1.3 残差检验

运行程序:

ts.diag(fit1) #残差检验

运行结果:

根据结果显示,拟合效果较好。且残差序列为白噪声序列。该ARIMA模型为:

∇ l n ( M t ) = 1 1 − 0.5811 B ϵ t \nabla ln(M_t)=\frac{1}{1-0.5811B} \epsilon_t ∇ln(Mt)=1−0.5811B1ϵt

4.2 log(GNP)的ARIMA模型拟合

4.2.1 模型定阶

运行程序:

par(mfrow=c(1,2)) #创建1×2画布

acf(diff(GNP),sub="图8 log(GNP)自相关图") #自相关图

pacf(diff(GNP),sub="图9 log(GNP)偏自相关图") #偏自相关图

运行结果:

结合log(M)序列的ACF、Pacf特征,对其建立ARIMA(1,1,2)模型。

4.2.2 模型拟合

运行程序:

fit2<-arima(GNP,order = c(1,1,2)) #拟合ARIMA(1,1,2)模型

fit2

运行结果:

##

## Call:

## arima(x = GNP, order = c(1, 1, 2))

##

## Coefficients:

## ar1 ma1 ma2

## 0.9999 -0.7650 -0.2249

## s.e. 0.0004 0.0722 0.0706

##

## sigma^2 estimated as 9.719e-05: log likelihood = 430.54, aic = -853.09

4.2.3 残差检验

运行程序:

ts.diag(fit2) #残差检验

运行结果:

根据结果显示,拟合效果较好。且残差序列为白噪声序列。该ARIMA模型为:

∇ l n ( G N P t ) = 1 − 0.765 B − 0.2249 B 2 1 − 0.9999 B ϵ t \nabla ln(GNP_t)=\frac{1-0.765B-0.2249B^2}{1-0.9999B} \epsilon_t ∇ln(GNPt)=1−0.9999B1−0.765B−0.2249B2ϵt

4.3 短期利率序列的ARIMA模型拟合

4.3.1 模型定阶

运行程序:

par(mfrow=c(1,2)) #创建1×2画布

acf(diff(SF),sub="图11 短期利率自相关图") #自相关图

pacf(diff(SF),sub="图12 短期利率偏自相关图 #偏自相关图

运行结果:

结合log(M)序列的ACF、Pacf特征,对其建立ARIMA(7,1,0)模型。

4.4.2 模型拟合

运行程序:

fit3<-arima(SF,order = c(7,1,0)) #拟合ARIMA(7,1,0)模型

fit3

运行结果:

##

## Call:

## arima(x = SF, order = c(7, 1, 0))

##

## Coefficients:

## ar1 ar2 ar3 ar4 ar5 ar6 ar7

## 0.2788 -0.3515 0.2863 -0.0879 0.1233 -0.0918 -0.2366

## s.e. 0.0832 0.0860 0.0903 0.0930 0.0896 0.0847 0.0819

##

## sigma^2 estimated as 5.599e-05: log likelihood = 468.76, aic = -921.53

4.4.4 疏系数模型拟合

运行程序:

fit31<-arima(SF,order = c(7,1,0),transform.pars=F,fixed=c(NA,NA,NA,0,0,0,NA)) #拟合ARIMA(7,1,0)疏系数模型

fit31

运行结果:

##

## Call:

## arima(x = SF, order = c(7, 1, 0), transform.pars = F, fixed = c(NA, NA, NA,

## 0, 0, 0, NA))

##

## Coefficients:

## ar1 ar2 ar3 ar4 ar5 ar6 ar7

## 0.2477 -0.3080 0.2223 0 0 0 -0.2907

## s.e. 0.0796 0.0776 0.0792 0 0 0 0.0742

##

## sigma^2 estimated as 5.699e-05: log likelihood = 467.61, aic = -925.22

4.3.4 残差检验

运行程序:

ts.diag(fit31) #残差检验

运行结果:

根据结果显示,拟合效果较好。且残差序列为白噪声序列。该ARIMA模型为:

∇ S F t = 1 1 − 0.2477 B + 0.3080 B 2 − 0.2223 B 3 + 0.2907 B 7 ϵ t \nabla SF_t=\frac{1}{1-0.2477B+0.3080B^2-0.2223B^3+0.2907B^7} \epsilon_t ∇SFt=1−0.2477B+0.3080B2−0.2223B3+0.2907B71ϵt

4.4 长期利率序列的ARIMA模型拟合

4.4.1 模型定阶

运行程序:

library(forecast)

par(mfrow=c(1,2)) #创建1×2画布

acf(diff(LF),sub="图14 长期利率自相关图") #自相关图

pacf(diff(LF),sub="图15 长期利率自相关图") #偏自相关图

运行结果:

结合log(M)序列的ACF、Pacf特征,对其建立ARIMA(14,1,0)模型。

4.4.2 模型拟合

运行程序:

fit4<-arima(LF,order=c(14,1,0)) #拟合ARIMA(14,1,0)模型

fit4

运行结果:

##

## Call:

## arima(x = LF, order = c(14, 1, 0))

##

## Coefficients:

## ar1 ar2 ar3 ar4 ar5 ar6 ar7 ar8

## 0.2619 -0.0558 0.1885 -0.0039 -0.1647 -0.0194 -0.0940 0.0245

## s.e. 0.0815 0.0836 0.0843 0.0853 0.0848 0.0852 0.0846 0.0871

## ar9 ar10 ar11 ar12 ar13 ar14

## 0.0934 0.0383 -0.1036 0.1030 -0.1081 0.2992

## s.e. 0.0871 0.0859 0.0859 0.0849 0.0873 0.0854

##

## sigma^2 estimated as 1.392e-05: log likelihood = 562.28, aic = -1094.56

4.4.3 疏系数模型拟合

运行程序:

fit41<-arima(LF,order = c(14,1,0),transform.pars=F,fixed=c(NA,0,0,0,NA,0,0,0,0,0,0,0,0,NA)) #拟合ARIMA(14,1,0)疏系数模型

fit41

运行结果:

##

## Call:

## arima(x = LF, order = c(14, 1, 0), transform.pars = F, fixed = c(NA, 0, 0, 0,

## NA, 0, 0, 0, 0, 0, 0, 0, 0, NA))

##

## Coefficients:

## ar1 ar2 ar3 ar4 ar5 ar6 ar7 ar8 ar9 ar10 ar11 ar12

## 0.2392 0 0 0 -0.1675 0 0 0 0 0 0 0

## s.e. 0.0785 0 0 0 0.0794 0 0 0 0 0 0 0

## ar13 ar14

## 0 0.2566

## s.e. 0 0.0835

##

## sigma^2 estimated as 1.516e-05: log likelihood = 556.84, aic = -1105.69

4.4.4 残差检验

运行程序:

ts.diag(fit41) #残差检验

运行结果:

根据结果显示,拟合效果较好。且残差序列为白噪声序列。该ARIMA模型为:

∇ L F t = 1 1 − 0.2392 B + 0.1672 B 5 − 0.2566 B 14 ϵ t \nabla LF_t=\frac{1}{1-0.2392B+0.1672B^5-0.2566B^{14}} \epsilon_t ∇LFt=1−0.2392B+0.1672B5−0.2566B141ϵt

775

775

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?