先声明,本博客为个人作业不一定为标准答案,仅供参考

11.1 题目如下

(1)

m=5和m=10的平滑结果:

> example11_1<-read.csv("D:/作业/统计学R/《统计学—基于R》(第4版)—例题和习题数据(公开资源)/exercise/chap11/exercise11_1.csv")

> example11_1<-ts(example11_1,start=1)

> library(DescTools)

> ma5<-MoveAvg(example11_1[,2],order=5,align="center",endrule="keep")

> ma10<-MoveAvg(example11_1[,2],order=10,align="center",endrule="NA")

> data.frame(时间=example11_1[,1],收盘价格=example11_1[,2],ma5,ma10)

时间 收盘价格 ma5 ma10

1 1 33.82 33.820 NA

2 2 33.64 33.640 NA

3 3 34.00 33.964 NA

4 4 34.09 34.054 NA

5 5 34.27 34.126 NA

6 6 34.27 34.090 33.9505

7 7 34.00 34.054 33.9230

8 8 33.82 33.964 33.8770

9 9 33.91 33.820 33.7995

10 10 33.82 33.692 33.6905

11 11 33.55 33.600 33.5455

12 12 33.36 33.454 33.3915

13 13 33.36 33.290 33.2600

14 14 33.18 33.108 33.1420

15 15 33.00 32.946 33.0145

16 16 32.64 32.802 32.8865

17 17 32.55 32.712 32.7590

18 18 32.64 32.602 32.6050

19 19 32.73 32.546 32.4645

20 20 32.45 32.436 32.3780

21 21 32.36 32.236 32.3320

22 22 32.00 32.108 32.3085

23 23 31.64 32.090 32.2990

24 24 32.09 32.090 32.2990

25 25 32.36 32.162 32.2990

26 26 32.36 32.362 32.3035

27 27 32.36 32.490 32.3215

28 28 32.64 32.508 32.3710

29 29 32.73 32.526 32.4525

30 30 32.45 32.508 32.5390

31 31 32.45 32.452 NA

32 32 32.27 32.506 NA

33 33 32.36 32.652 NA

34 34 33.00 33.000 NA

35 35 33.18 33.180 NA图形比较如下:

> plot(example11_1[,2],type='o',xlab="时间",ylab="收盘价格")

> lines(ma5,type='o',lty=2,col="red")

> lines(ma10,type='o',lty=6,col="blue")

> legend(x="topright",legend=c("收盘价格","ma5","ma10"),lty=c(1,2,6),col=c("black","red","blue"),fill=c(1,2,4),cex=0.8)

(2)

(a)

简单指数平滑预测:

> cpiforecast<-HoltWinters(example11_1[,2],beta=FALSE,gamma=FALSE)

> cpiforecast$fitted

Time Series:

Start = 2

End = 35

Frequency = 1

xhat level

2 33.82000 33.82000

3 33.64001 33.64001

4 33.99998 33.99998

5 34.09000 34.09000

6 34.26999 34.26999

7 34.27000 34.27000

8 34.00001 34.00001

9 33.82001 33.82001

10 33.91000 33.91000

11 33.82000 33.82000

12 33.55001 33.55001

13 33.36001 33.36001

14 33.36000 33.36000

15 33.18001 33.18001

16 33.00001 33.00001

17 32.64002 32.64002

18 32.55000 32.55000

19 32.64000 32.64000

20 32.73000 32.73000

21 32.45001 32.45001

22 32.36000 32.36000

23 32.00002 32.00002

24 31.64002 31.64002

25 32.08998 32.08998

26 32.35999 32.35999

27 32.36000 32.36000

28 32.36000 32.36000

29 32.63999 32.63999

30 32.73000 32.73000

31 32.45001 32.45001

32 32.45000 32.45000

33 32.27001 32.27001

34 32.36000 32.36000

35 32.99997 32.99997简单指数平滑拟合图:

> plot(example11_1[,2],type='o',xlab="时间",ylab="收盘价格")

> lines(example11_1[,1][-1],cpiforecast$fitted[,1],type='o',lty=2,col="blue")

> legend(x="topright",legend=c("观测值","拟合值"),lty=1:2,col=c(1,4),fill=c("black","blue"),cex=0.8)

简单指数平滑下一期预测值:

> library(forecast)

> cpiforecast1<-forecast(cpiforecast,h=1)

> cpiforecast1

Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

36 33.17999 32.87182 33.48816 32.70869 33.6513简单指数平滑预测图:

> plot(cpiforecast1,type='o',xlab="时间",ylab="收盘价格",main="简单指数平滑预测")

(灰色区域是预测值的置信区间,浅灰色为95%置信区间,深灰色为80%置信区间)

Holt指数平滑预测:

> powerforecast<-HoltWinters(example11_1[,2],gamma=FALSE)

> powerforecast$fitted

Time Series:

Start = 3

End = 35

Frequency = 1

xhat level trend

3 33.46000 33.64 -0.18000000

4 33.89869 34.00 -0.10131106

5 34.01657 34.09 -0.07343316

6 34.23350 34.27 -0.03650281

7 34.23882 34.27 -0.03118361

8 33.93402 34.00 -0.06598400

9 33.73740 33.82 -0.08259844

10 33.85255 33.91 -0.05744735

11 33.75781 33.82 -0.06219093

12 33.45753 33.55 -0.09247292

13 33.25332 33.36 -0.10668460

14 33.26886 33.36 -0.09113849

15 33.07591 33.18 -0.10408741

16 32.88485 33.00 -0.11514941

17 32.48917 32.64 -0.15082911

18 32.40803 32.55 -0.14196507

19 32.53184 32.64 -0.10816306

20 32.65071 32.73 -0.07928669

21 32.34147 32.45 -0.10853468

22 32.25417 32.36 -0.10583381

23 31.85713 32.00 -0.14287097

24 31.46549 31.64 -0.17451107

25 32.00649 32.09 -0.08350715

26 32.32801 32.36 -0.03199400

27 32.33267 32.36 -0.02733182

28 32.33665 32.36 -0.02334902

29 32.66086 32.64 0.02085508

30 32.76093 32.73 0.03093089

31 32.43562 32.45 -0.01437804

32 32.43772 32.45 -0.01228287

33 32.23328 32.27 -0.03672265

34 32.34174 32.36 -0.01825659

35 33.07766 33.00 0.07766473Holt指数平滑拟合图:

> plot(example11_1[,2],type='o',xlab="时间",ylab="收盘价格")

> lines(example11_1[,1][c(-1,-2)],powerforecast$fitted[,1],type='o',lty=2,col="blue")

> legend(x="topright",legend=c("观测值","拟合值"),lty=1:2,col=c(1,4),fill=c("black","blue"),cex=0.8)

Holt指数平滑下一期预测值:

> powerforecast1<-forecast(powerforecast,h=1)

> powerforecast1

Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

36 33.27258 32.95429 33.59086 32.7858 33.75935Holt指数平滑预测图:

> plot(powerforecast1,type='o',xlab="时间",ylab="收盘价格",main="Holt指数平滑预测")

简单指数和Holt指数预测的残差比较:

> example11_1<-read.csv("D:/作业/统计学R/《统计学—基于R》(第4版)—例题和习题数据(公开资源)/exercise/chap11/exercise11_1.csv")

> example11_1<-ts(example11_1,start=1)

> library(forecast)

> cpiforecast<-HoltWinters(example11_1[,2],beta=FALSE,gamma=FALSE)

> cpiforecast1<-forecast(cpiforecast,h=1)

> powerforecast1<-forecast(powerforecast,h=1)

> residual1<-cpiforecast1$residuals

> residual2<-powerforecast1$residuals

> plot(as.numeric(residual1),pch=1,ylim=c(-1,1),xlim=c(0,40),xlab="时间",ylab="收盘价格")

> points(residual2,pch=19,col="blue")

> abline(h=0,lty=2,col=2)

> legend(x="topright",legend=c("简单指数预测残差","Holt指数预测残差"),pch=c(1,19),col=c("black","blue"),cex=1)

(b)

一元线性回归预测值:

> example11_1<-read.csv("D:/作业/统计学R/《统计学—基于R》(第4版)—例题和习题数据(公开资源)/exercise/chap11/exercise11_1.csv")

> fit<-lm(收盘价格~时间,data=example11_1)

> predata<-predict(fit,data.frame(时间=1:36))

> predata

1 2 3 4 5 6 7 8 9 10

33.95995 33.90407 33.84819 33.79231 33.73643 33.68055 33.62468 33.56880 33.51292 33.45704

11 12 13 14 15 16 17 18 19 20

33.40116 33.34528 33.28940 33.23352 33.17764 33.12176 33.06588 33.01000 32.95412 32.89824

21 22 23 24 25 26 27 28 29 30

32.84236 32.78648 32.73060 32.67472 32.61884 32.56296 32.50708 32.45120 32.39532 32.33945

31 32 33 34 35 36

32.28357 32.22769 32.17181 32.11593 32.06005 32.00417 一元线性回归预测图:

> plot(1:36,predata,type='o',lty=2,col="blue",xlab="时间",ylab="收盘价格")

> lines(example11_1[,1],example11_1[,2],type='o',pch=19)

> legend(x="topright",legend=c("观测值","预测值"),lty=1:2,col=c(1,4),fill=c("black","blue"),cex=0.8)

> abline(v=35,lty=6,col=2)

指数预测值:

> example11_1<-read.csv("D:/作业/统计学R/《统计学—基于R》(第4版)—例题和习题数据(公开资源)/exercise/chap11/exercise11_1.csv")

> example11_1<-ts(example11_1,start=1)

> y<-log(example11_1[,2])

> x<-1:35

> fit<-lm(y~x)

> predata<-exp(predict(fit,data.frame(x=1:36)))

> predata

1 2 3 4 5 6 7 8

33.96096 33.90380 33.84673 33.78976 33.73288 33.67610 33.61942 33.56283

9 10 11 12 13 14 15 16

33.50633 33.44993 33.39363 33.33742 33.28131 33.22529 33.16936 33.11353

17 18 19 20 21 22 23 24

33.05779 33.00215 32.94660 32.89114 32.83578 32.78051 32.72533 32.67025

25 26 27 28 29 30 31 32

32.61526 32.56036 32.50555 32.45084 32.39622 32.34169 32.28725 32.23290

33 34 35 36

32.17865 32.12448 32.07041 32.01643 指数预测图:

> plot(1:36,predata,type='o',lty=2,col="blue",xlab="时间",ylab="收盘价格")

> points(example11_1[,1],example11_1[,2],type='o',pch=19)

> legend(x="topright",legend=c("观测值","预测值"),lty=1:2,col=c(1,4),fill=c("black","blue"),cex=0.8)

> abline(v=35,lty=6,col=2)

一元线性回归预测和指数预测的残差比较:

> example11_1<-read.csv("D:/作业/统计学R/《统计学—基于R》(第4版)—例题和习题数据(公开资源)/exercise/chap11/exercise11_1.csv")

> example11_1<-ts(example11_1,start=1)

> fit1<-lm(收盘价格~时间,data=example11_1)

> y<-log(example11_1[,2])

> x<-1:35

> fit2<-lm(y~x)

> predata2<-exp(predict(fit2,data.frame(x=1:36)))

> predata2<-ts(predata2,start=1)

> residual2<-example11_1[,2]-predata2

> residual1<-fit1$residuals

> plot(as.numeric(residual1),pch=1,ylim=c(-1,1),xlim=c(0,40),xlab="时间",ylab="收盘价格")

> points(residual2,pch=19,col="blue")

> legend(x="topright",legend=c("一元线性回归预测残差","指数预测残差"),pch=c(1,19),col=c("black","blue"),cex=1)

(c)

二阶曲线预测:

> example11_1<-read.csv("D:/作业/统计学R/《统计学—基于R》(第4版)—例题和习题数据(公开资源)/exercise/chap11/exercise11_1.csv")

> y<-example11_1[,2]

> x<-1:35

> fit1<-lm(y~x+I(x^2))

> predata1<-predict(fit1,data.frame(x=1:36))

> predata1

1 2 3 4 5 6 7 8

34.53224 34.37537 34.22462 34.07999 33.94148 33.80909 33.68282 33.56267

9 10 11 12 13 14 15 16

33.44865 33.34074 33.23896 33.14329 33.05375 32.97033 32.89303 32.82185

17 18 19 20 21 22 23 24

32.75678 32.69784 32.64503 32.59833 32.55775 32.52329 32.49496 32.47274

25 26 27 28 29 30 31 32

32.45664 32.44667 32.44282 32.44508 32.45347 32.46798 32.48861 32.51536

33 34 35 36

32.54823 32.58722 32.63233 32.68356三阶曲线预测:

> example11_1<-read.csv("D:/作业/统计学R/《统计学—基于R》(第4版)—例题和习题数据(公开资源)/exercise/chap11/exercise11_1.csv")

> y<-example11_1[,2]

> x<-1:35

> fit2<-lm(y~x+I(x^2)+I(x^3))

> predata2<-predict(fit2,data.frame(x=1:36))

> predata2

1 2 3 4 5 6 7 8

33.94676 33.99653 34.02111 34.02246 34.00253 33.96329 33.90668 33.83467

9 10 11 12 13 14 15 16

33.74922 33.65227 33.54579 33.43173 33.31205 33.18871 33.06366 32.93886

17 18 19 20 21 22 23 24

32.81627 32.69784 32.58554 32.48131 32.38711 32.30491 32.23666 32.18431

25 26 27 28 29 30 31 32

32.14982 32.13515 32.14225 32.17309 32.22961 32.31378 32.42756 32.57289

33 34 35 36

32.75174 32.96606 33.21781 33.50895 二阶曲线和三阶曲线预测图:

> plot(1:36,predata2,type='o',lty=2,col="red",xlab="时间",ylab="收盘价格",main="二阶曲线和三阶曲线预测图")

> lines(1:36,predata1,type='o',lty=3,col="blue")

> points(example11_1[,1],example11_1[,2],type='o',pch=19)

> legend(x="bottomleft",legend=c("观测值","二阶曲线","三阶曲线"),lty=1:3,col=c("black","blue","red"),fill=c("black","blue","red"))

> abline(v=35,lty=6,col=2)

二阶曲线和三阶曲线预测的残差比较:

> example11_1<-read.csv("D:/作业/统计学R/《统计学—基于R》(第4版)—例题和习题数据(公开资源)/exercise/chap11/exercise11_1.csv")

> y<-example11_1[,2]

> x<-1:35

> fit1<-lm(y~x+I(x^2))

> fit2<-lm(y~x+I(x^2)+I(x^3))

> plot(fit1$residuals,pch=1,ylim=c(-1,1),xlim=c(0,40),xlab="时间",ylab="收盘价格")

> points(fit2$residuals,pch=19,col="blue")

> legend(x="topright",legend=c("二阶曲线预测残差","三阶曲线预测残差"),pch=c(1,19),col=c("black","blue"),cex=1)

11.2 题目如下

(1)

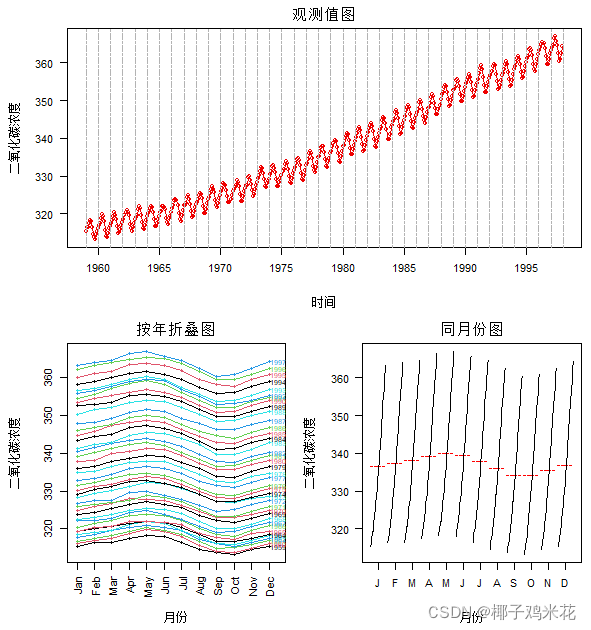

观测值图、按年折叠图、同月份图:

> library(reshape2)

> library(forecast)

> df<-melt(co2,variable.name="年份",value.name = "二氧化碳浓度")

> df.ts<-ts(df[,1],start=1959,frequency=12)

> layout(matrix(c(1,1,2,3),nrow=2,ncol=2,byrow=TRUE))

> par(mai=c(0.7,0.7,0.3,0.1),las=1,mgp=c(3.5,1,0),lab=c(6,6,1),cex=0.7,cex.lab=1,font.main=1)

> plot(df.ts,type='o',col="red2",xlab="时间",ylab="二氧化碳浓度",main="观测值图")

> abline(v=c(1959:1998),lty=6,col="gray70")

> par(las=3)

> seasonplot(df.ts,col=1:5,xlab="月份",ylab="二氧化碳浓度",main="按年折叠图",year.labels=TRUE,cex=0.6)

> par(las=1)

> monthplot(df.ts,xlab="月份",ylab="二氧化碳浓度",lty.base=6,col.base="red",cex=0.8,main="同月份图")

(2)

Winter指数平滑预测:

观测值和拟合值图:

> saleforecast<-HoltWinters(df.ts)

> plot(df.ts,type='o',col="grey40",xlab="年份",ylab="二氧化碳浓度")

> lines(saleforecast$fitted[,1],type='o',lty=5,col="blue")

> legend(x="topleft",legend=c("观测值","拟合值"),lty=c(1,5),col=c(1,4),fill=c(1,4))

1998年和1999年的预测值:

> library(forecast)

> saleforecast1<-forecast(saleforecast,h=24)

> saleforecast1

Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

Jan 1998 365.1079 364.7139 365.5019 364.5053 365.7105

Feb 1998 365.9664 365.5228 366.4100 365.2879 366.6449

Mar 1998 366.7343 366.2453 367.2234 365.9864 367.4823

Apr 1998 368.1364 367.6051 368.6678 367.3238 368.9490

May 1998 368.6674 368.0961 369.2386 367.7937 369.5410

Jun 1998 367.9508 367.3416 368.5599 367.0192 368.8824

Jul 1998 366.5318 365.8863 367.1772 365.5446 367.5189

Aug 1998 364.3799 363.6995 365.0604 363.3392 365.4206

Sep 1998 362.4731 361.7587 363.1874 361.3806 363.5656

Oct 1998 362.7520 362.0048 363.4993 361.6093 363.8948

Nov 1998 364.2203 363.4411 364.9996 363.0285 365.4121

Dec 1998 365.6741 364.8636 366.4847 364.4345 366.9138

Jan 1999 366.6048 365.7349 367.4747 365.2744 367.9353

Feb 1999 367.4633 366.5643 368.3623 366.0884 368.8383

Mar 1999 368.2313 367.3036 369.1590 366.8125 369.6500

Apr 1999 369.6333 368.6774 370.5893 368.1713 371.0954

May 1999 370.1643 369.1804 371.1482 368.6596 371.6690

Jun 1999 369.4477 368.4363 370.4592 367.9008 370.9946

Jul 1999 368.0287 366.9900 369.0674 366.4401 369.6173

Aug 1999 365.8769 364.8111 366.9426 364.2469 367.5068

Sep 1999 363.9700 362.8775 365.0625 362.2991 365.6409

Oct 1999 364.2490 363.1299 365.3680 362.5375 365.9604

Nov 1999 365.7172 364.5718 366.8626 363.9655 367.4690

Dec 1999 367.1710 365.9995 368.3426 365.3793 368.9628预测图:

> plot(saleforecast1,xlab="年份",ylab="二氧化碳浓度",main="Winter模型的预测图")

> abline(v=1998,lty=6,col=2)

分解法预测:

成分分解图:

> library(reshape2)

> df<-melt(co2,variable.name="年份",value.name = "二氧化碳浓度")

> df.ts<-ts(df[,1],start=1959,frequency=12)

> salecompose<-decompose(df.ts,type="multiplicative")

> plot(salecompose,type='o',col="red4")

1998年和1999年各月份的预测值:

> seasonaladjust<-co2/salecompose$seasonal

> x<-1:length(seasonaladjust)

> fit<-lm(seasonaladjust~x)

> predata<-predict(fit,data.frame(x=469:492))*rep(salecompose$seasonal[1:12],1)

> predata<-ts(predata,start=1998,frequency = 12)

> predata

Jan Feb Mar Apr

1998 362.6057 363.4286 364.3609 365.6973

1999 363.9160 364.7414 365.6767 367.0176

May Jun Jul Aug

1998 366.3293 365.7196 364.2036 362.0834

1999 367.6515 367.0391 365.5173 363.3890

Sep Oct Nov Dec

1998 360.2463 360.1374 361.5225 362.8225

1999 361.5449 361.4353 362.8249 364.1292(x=469:492,469为从length(seasonaladjust)后一位开始,492为468+12*2即后两年)

绘制观测值和观测值图:

> predata<-predict(fit,data.frame(x=1:492))*rep(salecompose$seasonal[1:12],1)

> predata<-ts(predata,start=1959,frequency = 12)

> plot(predata,type='o',lty=2,col="blue",xlab="年份",ylab="二氧化碳浓度")

> plot(predata,lty=2,col="blue",xlab="年份",ylab="二氧化碳浓度")

> lines(df.ts)

> legend(x="topleft",legend=c("观测值","预测值"),lty=1:2,col=c("black","blue"),fill=c("black","blue"))

> abline(v=1998,lty=6,col=2)

Winter模型预测与分解模型预测残差的比较:

> residuals1<-df.ts-predict(fit,data.frame(x=1:468))*salecompose$seasonal

> saleforecast<-HoltWinters(df.ts)

> residuals2<-df.ts-saleforecast$fitted[,1]

> plot(as.numeric(residuals1),pch=1,ylim=c(-4,4),xlab="时间",ylab="残差")

> points(as.numeric(residuals2),pch=19,col="blue")

> abline(h=0,lty=2,col=2)

> legend(x="topright",legend=c("分解预测残差","Winter模型预测残差"),pch=c(1,16),col=c("black","blue"),cex=0.7)

(这个图看上去有点奇怪不知道是不是哪里不对,但我目前没有找到不对的地方,如有错误请告知一下)

本次记录就到这,如有错误可指出~~画好多图啊!!

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?