微信支付商业版 结算周期

Economics is an inexact science, finance and investing even more so (some would call them art). But if there’s one thing in economics that you can consistently count on over the long run, it’s the tendency of things to mean revert thanks to the business cycle.

经济学是一门不精确的科学,金融和投资更是如此(有人称它们为艺术)。 但是,如果从长远来看,经济学中有一件事可以一贯地指望着,那就是由于商业周期的缘故,事物趋于恢复的趋势。

You’ve probably heard of the Law of Large Numbers. It states that when we run an experiment a large number of times, the average of the results tend towards the expected value (a.k.a. the mean). In economics and finance, which deal more with time-series data, there’s also a tendency, albeit weaker, for the data to revert towards its long-term mean. For example, look at the way the unemployment rate ebbs and flows across economic cycles, but regularly comes back to its mean (the orange line):

您可能听说过大数定律。 它指出,当我们进行大量实验时,结果的平均值趋向于期望值(即平均值)。 在经济学和金融学中,它们更多地处理时间序列数据,尽管这种趋势较弱,但也存在一种趋势,即数据会恢复其长期均值。 例如,看一下失业率在整个经济周期中起伏波动的方式,但是经常回到平均值(橙色线):

Of course this is different from the law of large numbers where the idea is that we’re repeating the same experiment over and over. In economics, things are never the same — many of the forces driving things a decade ago are often significantly different today. Thus, the magnitude and pace of mean reversion can vary over time. Additionally, the exact value of the mean is also uncertain and could potentially change over time.

当然,这与大数定律不同,大数定律的思想是我们要一遍又一遍地重复相同的实验。 在经济学上,情况从来都不是一样的-十年前推动事物发展的许多力量如今通常大不相同。 因此,均值回归的幅度和步伐会随时间变化。 此外,平均值的确切值也不确定,并且可能随时间变化。

And yet, the most powerful forces that drive the business cycle are reasonably consistent, which explains why despite constant change many economic variables like unemployment still tend to reliably mean revert:

然而,驱动商业周期的最强大力量在一定程度上是一致的,这解释了为什么尽管不断变化,失业等许多经济变量仍然倾向于可靠地意味着恢复:

- Though the federal reserve may skew dovish or hawkish depending on who’s at the helm (with a heavy bias towards dovish), its mandate is to steer the economy towards full employment (and stable inflation) using monetary policy. The Fed generally prefers steady economic growth, low unemployment, and rising asset prices. The reason rising asset prices (especially real estate) is preferred is because it begets credit expansion (rising asset values drives lending via healthier bank balance sheets, demand for debt, and more loan collateral), a critical component of economic growth. 尽管美联储可能会偏向鸽派或鹰派,取决于谁在掌权(偏向鸽派),但其任务是使用货币政策引导经济朝着充分就业(以及稳定的通胀)方向发展。 美联储普遍倾向于稳定的经济增长,低失业率和资产价格上涨。 首选资产价格上涨(尤其是房地产价格上涨)的原因是,它会引发信贷扩张(资产价值上升通过更健康的银行资产负债表,债务需求以及更多的贷款抵押品来驱动贷款),这是经济增长的关键组成部分。

- The U.S. government is also heavily incentivized to get people employed (happy citizens, better approval ratings, and more tax revenue) via fiscal stimulus. 美国政府也受到了很大的激励,希望通过财政刺激措施来雇用人们(快乐的公民,更好的批准率以及更多的税收收入)。

- Over-investment and excessive job growth in an over-heating industry or economy ultimately self-corrects — too much supply and competition (often accompanied by a demand shock) push down prices and profits. And the businesses that joined the party too late often end up bankrupt. 过热的行业或经济中的过度投资和过度的工作增长最终会自我纠正-过多的供应和竞争(通常伴随着需求冲击)压低了价格和利润。 加入党太晚的企业往往破产。

- During times of below average unemployment (tight labor market), high salary growth pushes up inflation. If inflation rises enough for the Fed to start raising interest rates, then this also serves to slow economic growth (by slowing down credit growth — less credit, a.k.a. borrowing, means less money in everyone’s pockets and less consumer spending). Often, the Fed ends up raising rates one too many times pushing the economy into recession and unemployment up past its mean. 在失业率低于平均水平(劳动力市场紧张)的时期,高工资增长会推高通胀。 如果通胀上升到足以使美联储开始加息的水平,那么这也将减缓经济增长(通过放慢信贷增长-减少信贷,又名借款,意味着每个人的口袋里的钱减少和消费者支出的减少)。 通常,美联储最终会多次加息,从而使经济陷入衰退,失业率超过平均水平。

- A beaten down industry or economy eventually recovers. Once the excess supply has been removed (via defaults or consolidation), the price wars cease and companies can earn a reasonable return on their investment again. This, along with the impacts of expansionary monetary and fiscal policy, cause a new wave of economic expansion and unemployment declines. 遭受重创的行业或经济最终将复苏。 一旦消除了多余的供应(通过违约或合并),价格战便会停止,公司可以再次获得合理的投资回报。 这与扩张性的货币和财政政策的影响一起,引起了新一轮的经济扩张和失业率下降。

周期 (The Cycle)

Before we look at more variables that are impacted by the cycle, let’s map out its approximate shape and driving forces:

在查看更多受周期影响的变量之前,让我们先绘制出其近似形状和驱动力:

Each cycle is different, the industries that drive the excess are rarely the same — in the late 1990s it was Dotcom, during 2005–2008 it was housing and banks. But the forces at play are similar:

每个周期都不同,导致过剩的行业很少相同–在1990年代后期是Dotcom,在2005-2008年期间是住房和银行。 但是作用的力量是相似的:

过热 (Overheating)

A tight labor market along with strong corporate profits and investment spending drive wage growth and credit growth, which leads to lots of dollars flying around and inflation. This spurs interest rate increases (by the Federal Reserve).

紧张的劳动力市场以及强劲的公司利润和投资支出推动工资增长和信贷增长,从而导致大量资金流失和通货膨胀。 这刺激了利率上升(美联储)。

经济衰退 (Recession)

Higher interest rates hurt asset prices and make borrowing less attractive — the net effect is less spending, less economic growth, job losses, and ultimately recession (but no more inflation).

较高的利率会损害资产价格,并使借贷的吸引力降低-最终的结果是支出减少,经济增长减少,工作机会减少,最终导致衰退(但通货膨胀率却没有增加)。

复苏 (Recovery)

Once inflation is under control, the Fed is able to focus on its full employment mandate, and lower interest rates and/or print money (quantitative easing) with the aim of stimulating credit growth and asset prices. Often, expansionary monetary policy is accompanied by fiscal stimulus from the government as well — lowering rates on its own is usually not enough to reverse a severe recession.

一旦通货膨胀得到控制,美联储便可以专注于其全部就业任务,并降低利率和/或印制货币(量化宽松),以刺激信贷增长和资产价格。 通常,扩张性货币政策还伴随着政府的财政刺激措施-单靠降低利率通常不足以扭转严重的衰退。

And with many of their competitors gone and their operations leaner, surviving businesses gradually return to making money and begin hiring again.

随着许多竞争对手的消失和业务的精简,幸存的企业逐渐恢复赚钱并重新开始招聘。

And the cycle begins anew…

周期又开始了……

通过经济变量观察周期 (Observing The Cycle Through Economic Variables)

Earlier we saw how the cycle causes unemployment to ebb and flow — though it’s probably more accurate to think of the unemployment rate as a major driver of the cycle (employment generally lags economic growth, but has a major feedback impact on most major economic variables).

早些时候,我们看到了周期如何导致失业潮起潮落—尽管将失业率视为周期的主要驱动因素可能更准确(就业通常滞后于经济增长,但对大多数主要经济变量具有重要的反馈影响) 。

What are some other ones? The year-over-year change in industrial production (which is highly correlated to GDP) is another one. Notice how the blue line remains above the orange line when the economy is growing and pierces below it during recessions. Also observe the current low value, which hints at the shrinkage in the economy due to the ongoing pandemic. The good news is that it’s already begun to mean revert, but it’s still a long ways below what we would expect of a healthy and expanding economy.

还有什么? 工业生产的逐年变化(与GDP高度相关)是另一种变化。 请注意,当经济增长时,蓝线如何保持在橙色线之上,而在经济衰退期间,蓝线会跌破橙色线。 还要注意当前的低值,这暗示着由于持续的大流行而导致的经济萎缩。 好消息是它已经开始意味着恢复,但距离我们对健康和不断发展的经济的期望还差很远。

Keep in mind that despite the tendency to revert towards the mean, the data rarely stays at the mean for very long. So you shouldn’t think of the mean as a level that you will frequently observe in the future.

请记住,尽管有趋向于均值的趋势,但数据很少会长时间停留在均值上。 因此,您不应将平均值视为将来会经常观察到的水平。

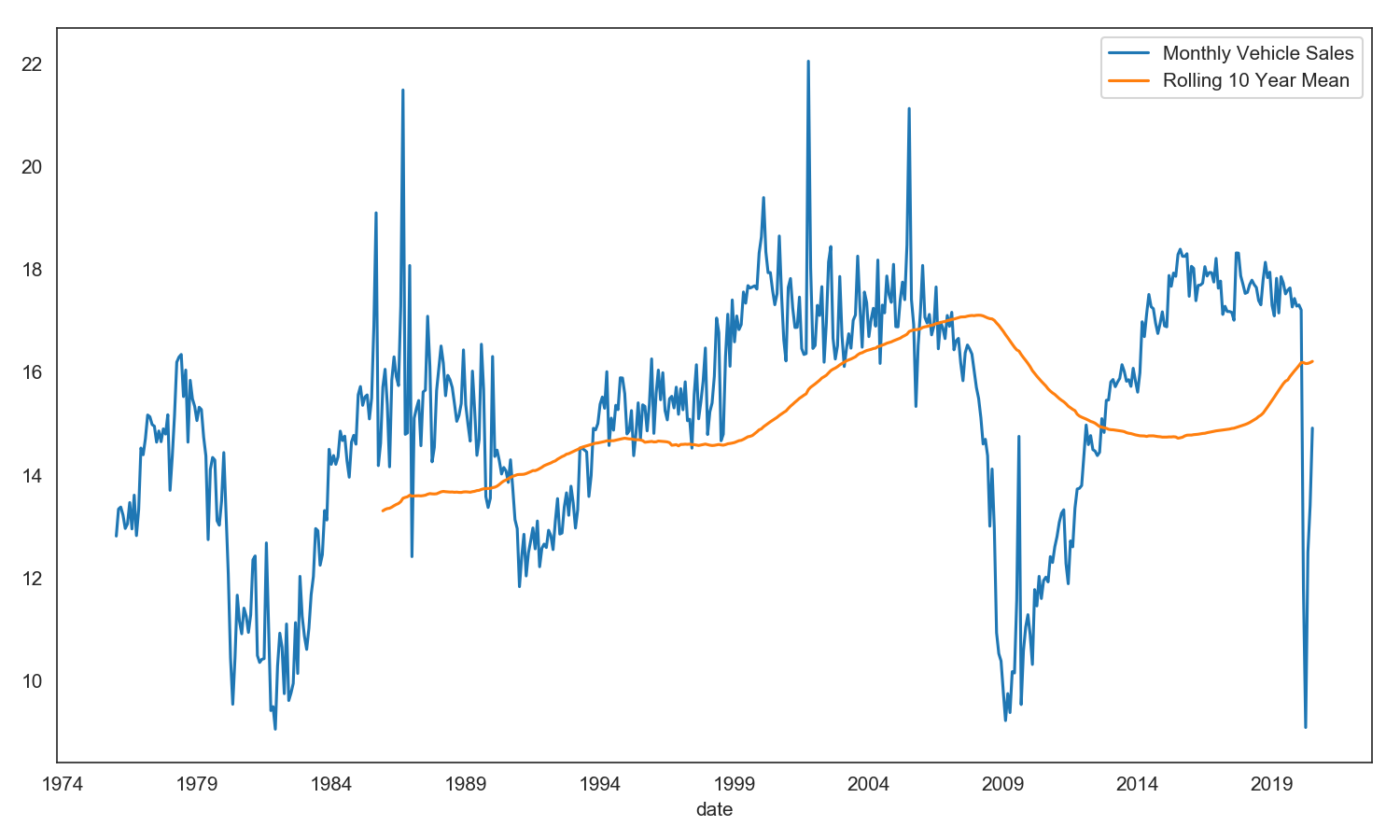

I added total monthly vehicle sales as well — vehicle sales are also very sensitive to the economic cycle as people tend to put off large purchases when the economy is not doing well. Notice how close the blue line is to coming back to the orange line. This means that despite the pandemic, the current pace of vehicle sales is almost back to what could be considered a normal level.

我还增加了每月的汽车总销售量,汽车销售对经济周期也非常敏感,因为人们在经济状况不佳时往往会推迟购买大笔商品。 请注意,蓝线与回到橙色线的距离有多近。 这意味着,尽管出现了大流行,但当前的汽车销售速度几乎已恢复到正常水平。

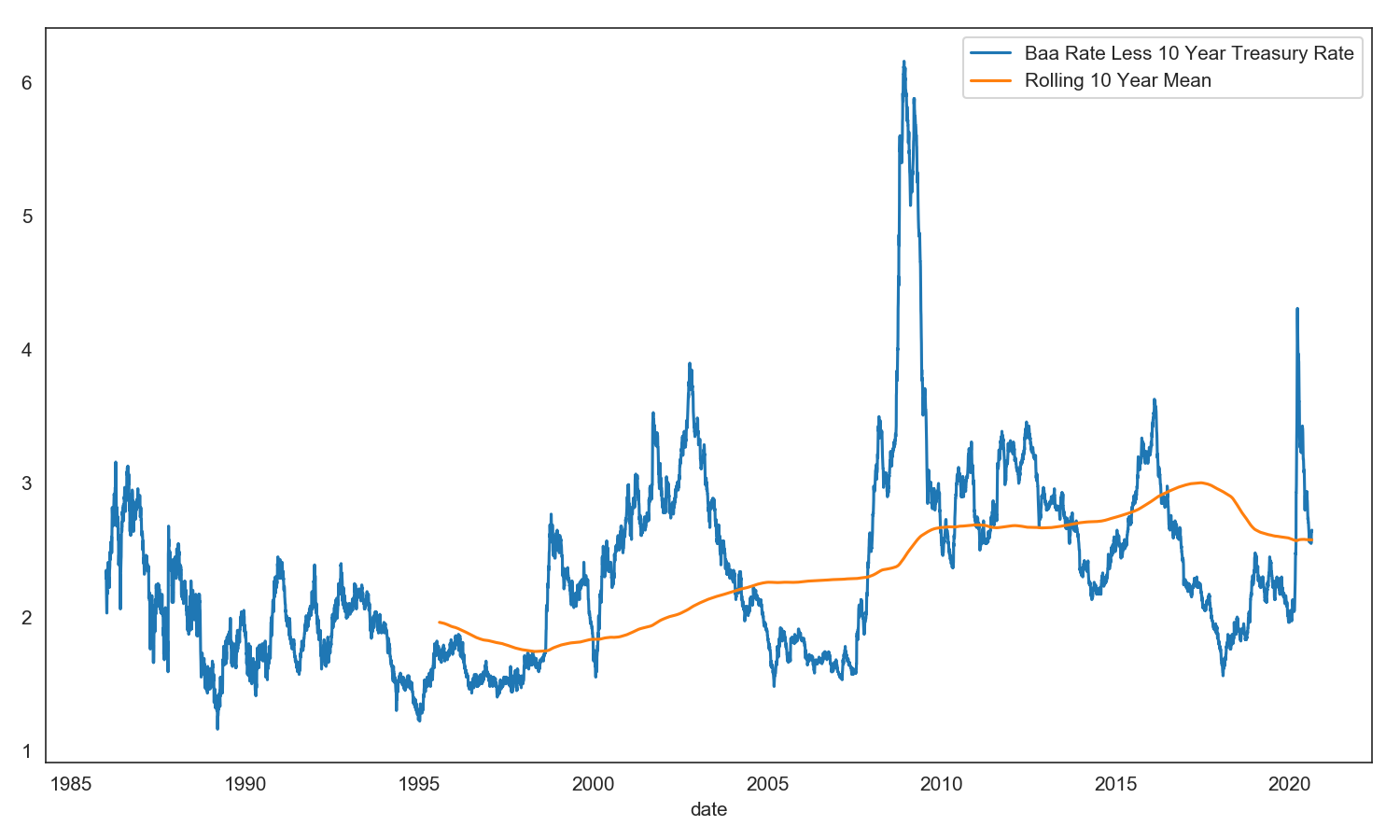

A favorite one of mine to watch is credit spreads, which measures the extra yield that lenders demand to bear bankruptcy risk. It’s the difference between the interest rate on corporate bonds (Baa is the lowest rating that’s still investment grade) and the interest rate on safe bonds (U.S. Treasury bonds). I like it because it’s a function of both what’s been going on recently (have a lot of companies been defaulting?) and the bond market’s expectations of the future (will a lot of companies start defaulting over the next few years?). It’s a good gauge of the market’s appetite for risk — below average yields implies that investors believe everything is great and above average yields mean that investors are panicking or close to it.

值得关注的矿山之一是信用点差,它可以衡量贷方要求承担破产风险的额外收益。 这是公司债券的利率(Baa是仍为投资级别的最低评级)与安全债券的利率(美国国库券)之间的差。 我之所以喜欢它,是因为它既是最近正在发生的事情(有很多公司正在违约吗?)又是债券市场对未来的期望(在未来几年内很多公司会开始违约吗?)的函数。 这是衡量市场风险偏好的良好指标-低于平均收益率意味着投资者认为一切都很好,而高于平均收益率则意味着投资者感到恐慌或接近风险。

It looks like investors were pretty panicked a few months ago but have largely calmed down since then.

几个月前,投资者似乎感到非常恐慌,但此后基本上平静下来了。

One thing we can do is look at the de-trended version of each time series — to remove the trend, we just subtract the mean (the blue line less the orange line). Let’s overlay the de-trended (and Z-scored) variables on top of each other to see how they relate:

我们可以做的一件事是查看每个时间序列的去趋势版本-要删除趋势,我们只减去均值(蓝色线减去橙色线)。 让我们将去趋势的(和Z评分的 )变量相互叠加,以了解它们之间的关系:

We can see that the series do generally move together, though unemployment clearly lags the other two. As I mentioned earlier, unemployment generally lags other economic data because businesses tend to be slow to fire and slow to rehire (as they feel their way through the business cycle in real-time). The current pandemic is an exception where involuntary shutdowns forced thousands of businesses to close and millions of people into unemployment virtually overnight — so there’s no lag this time around.

我们可以看到,尽管失业率明显落后于其他两个国家,但总体而言,这两个系列确实在一起。 正如我前面提到的,失业率通常落后于其他经济数据,因为企业往往开火慢,招聘慢(因为他们实时地感觉到整个商业周期的方式)。 当前的流行病是一个例外,非自愿关闭迫使数千家企业关闭,数百万人几乎在一夜之间陷入失业-因此这次没有滞后。

If you find it hard to tell that they’re correlated from the previous graph, below is the correlation matrix. Vehicle sales and industrial production are highly correlated (note that industrial production and vehicle sales have been inverted to make them directionally consistent with unemployment — so when vehicle sales appears high in the plot, it actually denotes a below average value). Unemployment appears less correlated because it moves with a lag compared to the other two variables (if we lagged the unemployment time series by a few months, we would see a much higher correlation).

如果您很难从上一张图中看出它们之间是相关的,则下面是相关矩阵。 汽车销售和工业生产高度相关(请注意,工业生产和汽车销售已经倒置,使其与失业在方向上保持一致,因此,当图中汽车销售出现高位时,实际上表示低于平均值)。 与其他两个变量相比,失业与失业的相关性似乎较低(如果我们将失业时间序列滞后几个月,则相关性会更高)。

Lastly, we can take a look at how spreads, which include the investment market’s expectations (which can be very inaccurate) of the future relate to the average of the three macroeconomic variables we plotted earlier (the time series are plotted as Z-scores).

最后,我们可以看一下点差,其中包括投资市场对未来的期望(可能非常不准确)与我们之前绘制的三个宏观经济变量的平均值的关系(时间序列绘制为Z得分) 。

They generally move together (correlation=0.63). That’s one of the dirty secrets of finance — variables that are supposed to be forward-looking because they are based on market prices (and the way markets supposedly embed and capture all the available information) are actually pretty reactive. Meaning that they move in tune (or even slightly behind) economic data, and almost never ahead of it. True shocks happen out of the blue and pretty much always blindside investors.

它们通常一起移动(相关系数= 0.63)。 那是金融的肮脏秘密之一-变量应该是前瞻性的,因为它们基于市场价格(以及市场嵌入和捕获所有可用信息的方式)实际上是相当被动的。 这意味着它们会与经济数据保持一致(甚至略微落后),几乎永远不会超前。 真正的冲击出人意料,几乎总是盲目的投资者。

One interesting thing is how differently corporate bond investors view 2008 vs. today. Despite a similar sized negative shock to the economy, credit spreads barely budged during this pandemic and have already recovered back to the rolling 10 year mean. Back in 2008, the initial shock to credit spreads was much larger and the recovery took longer.

一件有趣的事情是,公司债券投资者对2008年和今天的看法有何不同。 尽管对经济造成了类似规模的负面冲击,但在这种大流行期间,信用利差几乎没有变化,已经恢复到滚动的10年平均值。 早在2008年,信贷利差的最初冲击就更大了,复苏所需的时间更长。

结论 (Conclusion)

Macroeconomics is a very deep subject and this post only scratches the surface of the business cycle. Even though I titled it “Understanding The Business Cycle”, I doubt anyone reading this without prior knowledge and experience would come out of it with a deep understanding of the business cycle. Rather, it’s more critical that you recognize that the business cycle exists — and that it’s responsible for much of the ebb and flow of our economic and financial lives.

宏观经济学是一个非常深入的主题,这篇文章仅涉及商业周期的表面。 即使我将其标题为“了解商业周期”,但我怀疑任何在没有先验知识和经验的情况下阅读本文的人都会对商业周期有深刻的了解。 相反,更重要的是,您要认识到存在商业周期,并且它对我们的经济和金融生活的起伏不定负有责任。

When I think of the business cycle, it reminds me of that old saying, “History doesn’t repeat itself, but it often does rhyme”. Keeping that in mind, we should not only recognize the existence of the business cycle, but also put at least some effort and thought towards preparing for the next phase of the cycle while we’re still in the current one. Cheers!

当我想到经济周期时,它使我想起了那句老话:“历史不会重演,但通常会押韵。” 牢记这一点,我们不仅应该认识到业务周期的存在,而且还应该付出至少一些努力和思想,以便在我们仍处于当前周期的同时为周期的下一阶段做准备。 干杯!

翻译自: https://towardsdatascience.com/understanding-the-business-cycle-79794263d49b

微信支付商业版 结算周期

1万+

1万+

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?