We write about a lot of payment card industry-specific staff here on this blog: services, systems, products, best practices, etc. We try to explain, as best we can, how the credit card processing world functions and, more to the point, where your place in it is. Some of the things we write about you really, really need to understand very well, others you need to have at least some basic knowledge of, while still others some of you can do perfectly well not even knowing of their existence or meaning.

The system that I will review in this article falls squarely into the first of the above categories. It is Visa’s payment system, the biggest payment processing platform in the world and the one that is likely to handle the majority of your card transactions. So let’s take a look at how Visa works.

What Is Visa’s Payment System?

Visa’s system includes technology, products, services and marketing programs that facilitate the electronic exchange of information and funds among financial institutions, merchants, consumers, businesses, non-profits and governments. Visa defines the rules that enable financial transactions to be completed safely and reliably, including functional and technical specifications.

Who Participates in Visa’s Payment System?

The following entities take part in each transaction facilitated by Visa’s system.

- Merchant — an entity (business or non-profit) that is authorized to accept Visa-branded cards for the payment of products and services.

- Acquirer (also known as a merchant bank) — a financial institution and a Visa member that contracts with merchants to accept Visa cards for the payment for goods and services.

- Cardholder — an authorized user of Visa cards.

- Issuer — a financial institution and a Visa member that issues Visa cards for use in transactions and enters into agreements with its cardholders for the billing and payment of these transactions.

- Visa Inc. — a publicly-traded corporation that works with financial institutions, which issue Visa cards (the issuers) and / or sign merchants to accept Visa-branded cards for payment of goods and services (the acquirers). Visa provides card products, promotes the Visa brand and establishes the rules and regulations governing the processing of payments involving its cards. Visa also operates the world’s largest retail electronic payments network to facilitate the flow of transactions between acquirers and card issuers.

- VisaNet — part of Visa’s retail electronic payment system, VisaNet is a collection of systems that includes:

- An authorization service through which card issuers can approve or decline individual Visa card transactions.

- A clearing and settlement service which processes transactions electronically between acquirers and issuers to ensure that:

- Visa transaction information is sent from acquirers to issuers for posting to cardholders’ accounts and

- Payments for Visa transactions are facilitated from issuers to acquirers to be credited to the merchant accounts.

Now let’s see how all these participants fit into Visa’s system.

Visa Payment Transaction Flow

Here is how each of the above entities participates in a Visa transaction:

- The cardholder presents the merchant with a card for payment. The card data are read directly from the card by a point-of-sale (POS) device, key-entered into it by the merchant or provided by the cardholder on the merchant’s website or over the phone.

- The merchant transmits the transaction information to the acquirer.

- The acquirer sends a transaction authorization request to Visa.

- Visa sends the authorization request on to the issuer or, in certain circumstances, it may perform “stand-in processing” on behalf of the issuer and approve or decline the transaction.

- The issuer sends back to Visa an authorization response, either approving or rejecting the transaction.

- Visa sends the authorization response on to the acquirer.

- The acquirer routes the authorization response to the merchant.

Here is a visual representation of the process:

Visa Payment Process

A typical Visa transaction involves three stages: authorization, clearing and settlement:

- Authorization is the process of approving or rejecting a transaction by the issuer (represented in the chart above).

- Clearing is the process of transmitting final transaction data from acquirers to issuers for settlement. During this stage are calculated the fees and charges that apply to the transaction.

- Settlement is the actual exchange of funds between acquirers and issuers for all transactions that are cleared.

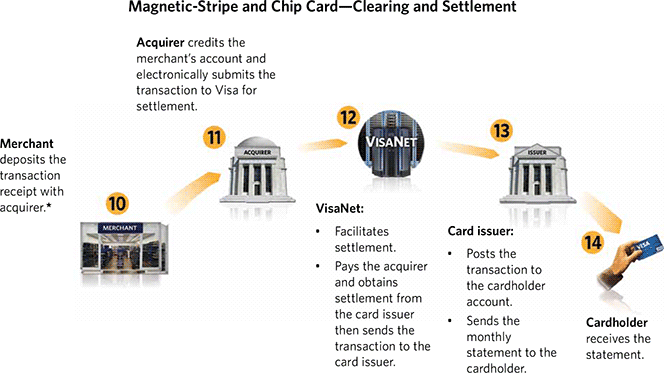

Here is a visual representation of the final two stages of Visa’s payment process:

Your Place in Visa’s Payment Process

As a merchant, your involvement in Visa’s payment process is at the checkout of your store where you take your customers’ cards for payment. Whether you are experienced or new to the job, if you follow a few basic card acceptance procedures, you will do this right the first time and every time. The chart below provides an overview of the Visa card acceptance steps that should be used at your POS terminal.

If you properly follow these card acceptance procedures at the point of sale, you will not be liable for fraud losses, should they occur. And part of your job is to make sure, to the best of your abilities, that each card you accept for payment is authentic. Check the features and security elements of your customer’s card to ensure that it is valid and has not been altered in any way. Here is what you should be looking for:

If any of the Visa card security features are missing or look as though they’ve been altered, you should make a Code 10 call or respond according to your store procedures.

Finally, you’ll have to ensure that the customer signs the sales receipt (where required) and to compare that signature to the one on the back of the card. Depending on the type of Visa card and POS terminal, the customer should be in your full view when signing the receipt or the terminal signature window display. If possible, check the two signatures closely for any obvious inconsistencies in spelling or handwriting. While checking the signature, compare the name and account number on the card to those on the transaction receipt as well.

For magnetic-stripe card transactions, make sure that the last four digits of the account number on the card match those printed on the receipt, as shown below.

When the signature has been obtained, match the one on the back of the card to the signature on the sales receipt. The first initial and spelling of the last name must match.

If the signature looks suspicious or is not matching, adhere to your store procedures or just make a Code 10 call.

The Takeaway

Visa’s payment system handles the bulk of a typical merchant’s card transactions. The specific payment processing tools (e.g. point-of-sale terminals and payment gateways) may vary from one merchant to another and will depend on the transaction setting, but all of them will involve the same principal entities (some transactions may feature one or more additional participants) and will be processed following exactly the same sequence of interactions as described above. You should learn the dynamics of this process and educate yourself on how to best perform your own duties. We have written quite a few articles, guides and manuals to help you out.

Image credit: Visa.

7

7

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?