In marketing , customer lifetime value (CLV), lifetime customer value (LCV), or lifetime value (LTV) is the net present value of the cash flows attributed to the relationship with a customer. The use of customer lifetime value as a marketing metric tends to place greater emphasis on customer service and long-term customer satisfaction, rather than on maximizing short-term sales. One of the first accounts of it is in the 1988 book Database Marketing, and includes detailed worked examples [ 1] [ 2] .

Customer lifetime value has intuitive appeal as a marketing concept, because in theory it represents exactly how much each customer is worth in monetary terms, and therefore exactly how much a marketing department should be willing to spend to acquire each customer. In reality, it is difficult to make accurate calculations of customer lifetime value. The specific calculation depends on the nature of the customer relationship. Customer relationships are often divided into two categories. In contractual or retention situations, customers who do not renew are considered "lost for good". Magazine subscriptions and car insurance are examples of customer retention situations. The other category is referred to as customer migrations situations. In customer migration situations, a customer who does not buy (in a given period or from a given catalog) is still considered a customer of the firm because she may very well buy at some point in the future. In customer retention situations, the firm knows when the relationship is over. One of the challenges for firms in customer migration situations is that the firm may not know when the relationship is over (as far as the customer is concerned) [ 3] .

Calculation in customer retention cases

Most models to calculate CLV apply to the customer retention situation. These models make several simplifying assumptions and often involve the following inputs:

- Churn rate , the percentage of customers who end their relationship with a company in a given period. One minus the churn rate is the retention rate . Most models can be written using either churn rate or retention rate. If the model uses only one churn rate, the assumption is that the churn rate is constant across the life of the customer relationship.

- Discount rate , the cost of capital used to discount future revenue from a customer. Discounting is an advanced topic that is frequently ignored in customer lifetime value calculations. The current interest rate is sometimes used as a simple (but incorrect) proxy for discount rate .

- Contribution margin .

- Retention cost , the amount of money a company has to spend in a given period to retain an existing customer. Retention costs include customer support, billing, promotional incentives, etc.

- Period , the unit of time into which a customer relationship is divided for analysis. A year is the most commonly used period. Customer lifetime value is a multi-period calculation, usually stretching 3–7 years into the future. In practice, analysis beyond this point is viewed as too speculative to be reliable. The number of periods used in the calculation is sometimes referred to as the model horizon .

Thus, one of the ways to calculate CLV, where period is a year, is as follows [ 4] :

,

,

where GC is yearly gross contribution per customer, M is the (relevant) retention costs per customer per year (this formula assumes the retention activities are paid for each mid year and they only affect those who were retained in the previous year), n is the horizon (in years), r is the yearly retention rate, d is the yearly discount rate.

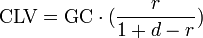

It is often helpful to estimate customer lifetime value with a simple model to make initial assessments of customer segments and targeting. Possibly the simplest way to estimate CLV is to assume constant and long-lasting values for contribution margin, retention rate, and discount rates, as follows:

Uses

Lifetime value is typically used to judge the appropriateness of the costs of acquisition of a customer. For example, if a new customer costs $50 to acquire (COCA, or cost of customer acquisition), and their lifetime value is $60, then the customer is judged to be profitable, and acquisition of additional similar customers is acceptable.

Additionally, CLV is used to calculate customer equity .

404

404

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?