目录

业务说明

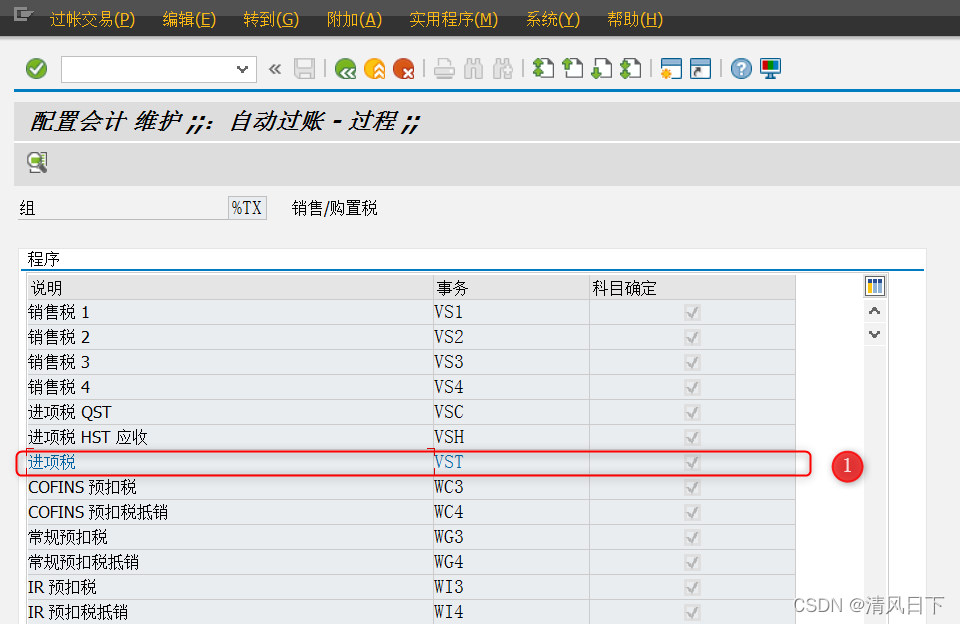

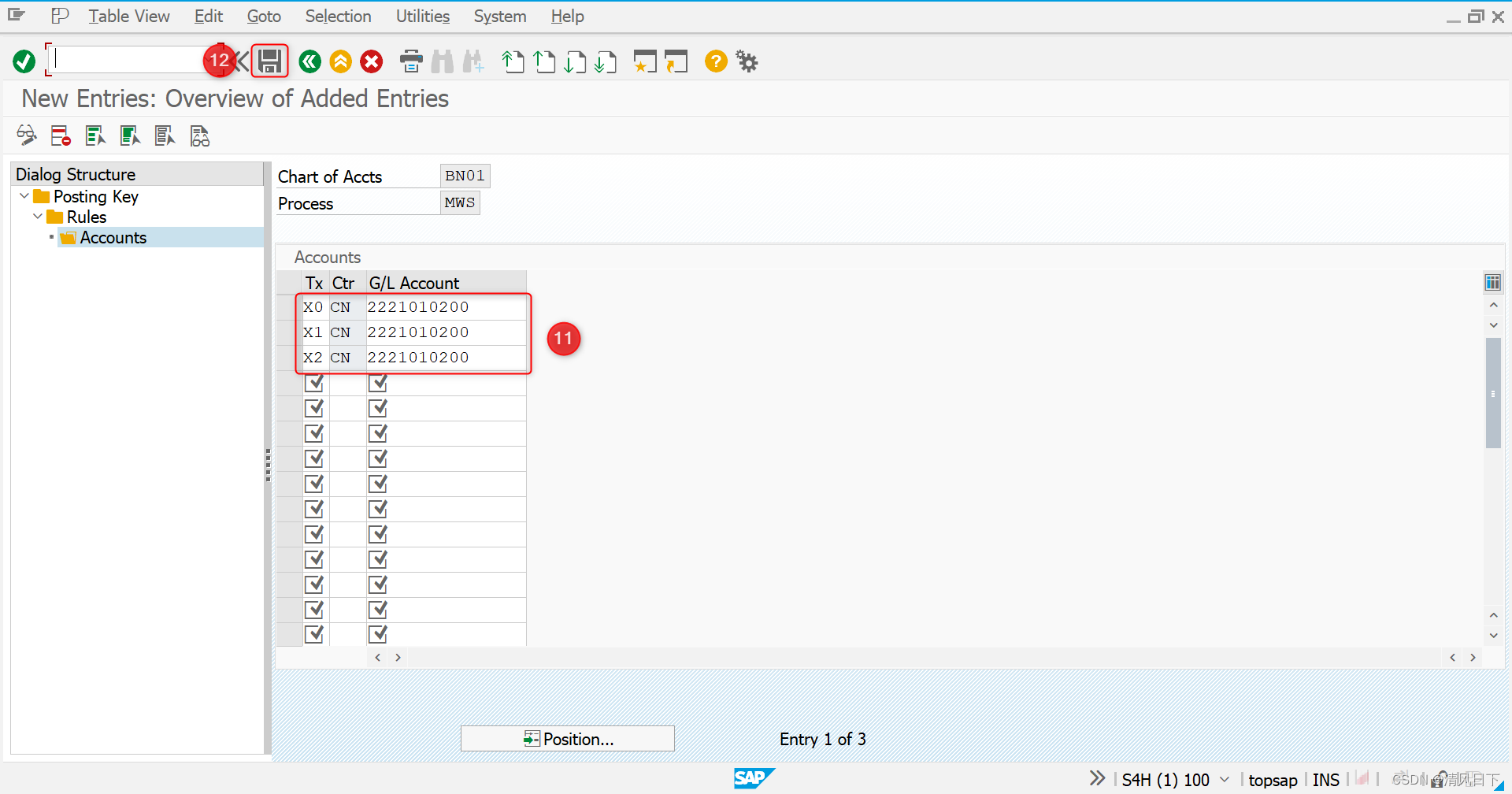

定义税务科目

事务码: OB40

SPRO路径

SPRO->财务会计->财务会计全局设置->销售税/采购税->过账->定义税务科目

后台配置系统操作步骤

第1步,SPRO路径进入

第2步,选择需要维护的项目(VST-进项税/MWS-销项税)双击进入

第3步,维护账户并保存

![]()

配置完成!

2021年12月24日 写于芜湖

2024年配置练习记录1

备注:VST用于进项税的配置,MWS用于销项税的配置,上面的只是VST的配置。

配置完成!

2024年1月22日 写于上海

2024年配置练习记录2-英文

2024 SAP FI module configuration practice recording as following:

Configuration Subject: Define Tax Accounts

SPRO Path: Financial Accounting->Financial Accounting Global Settings->Tax on Sales/Purchases->Posting->Define Tax Accounts

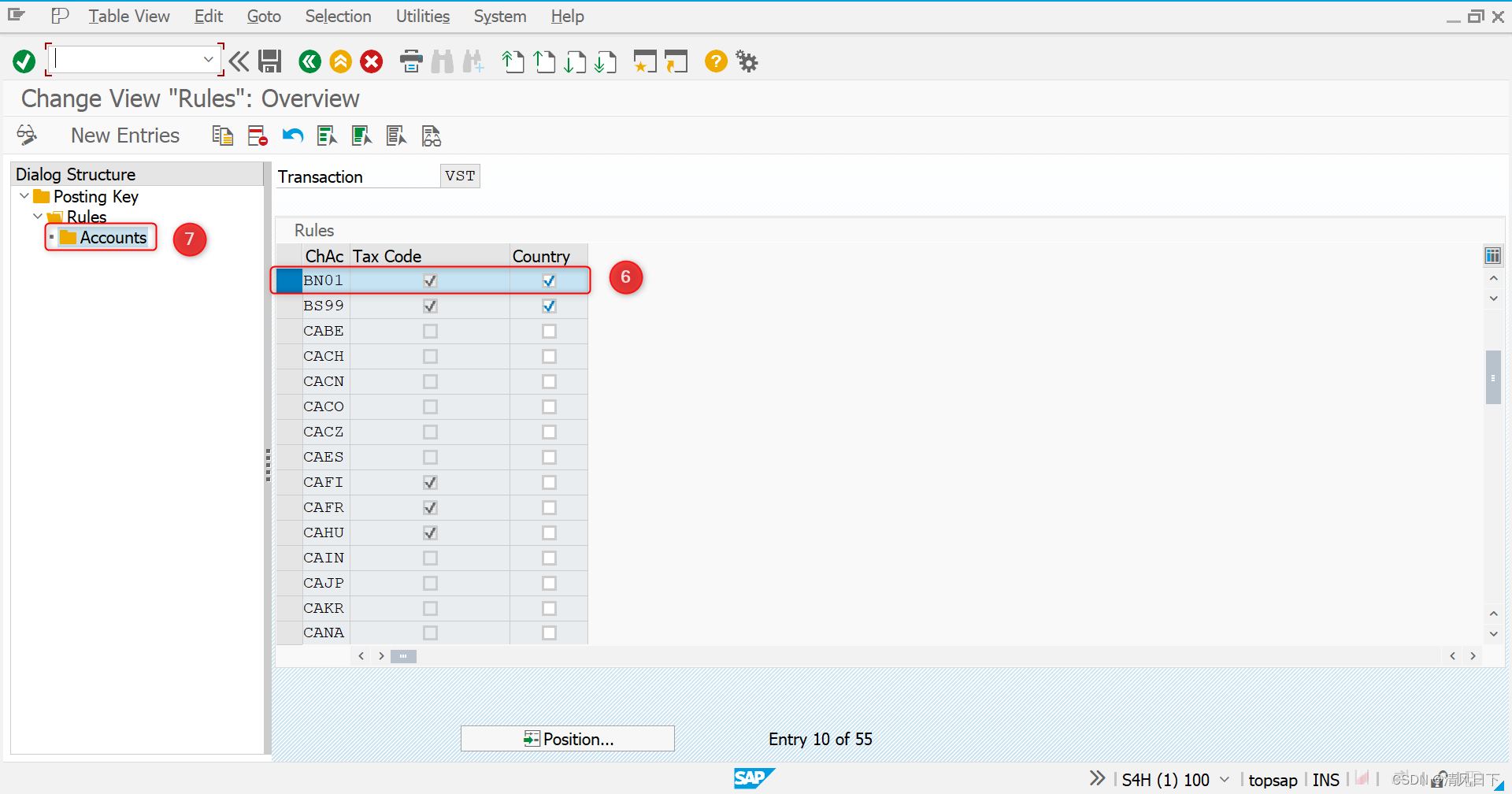

#1 Configure for VST-Input Tax

Saved First and then Accounts.

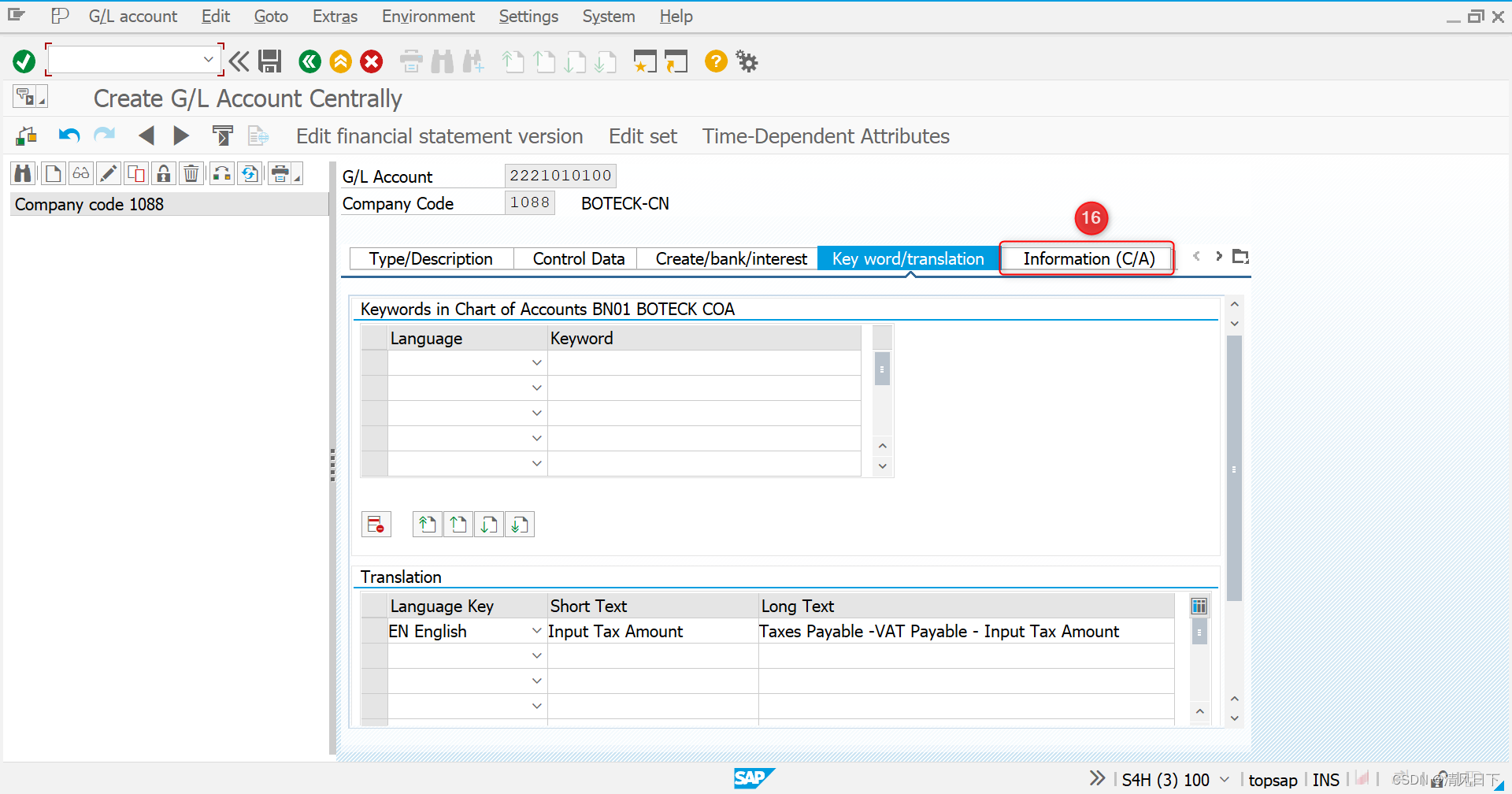

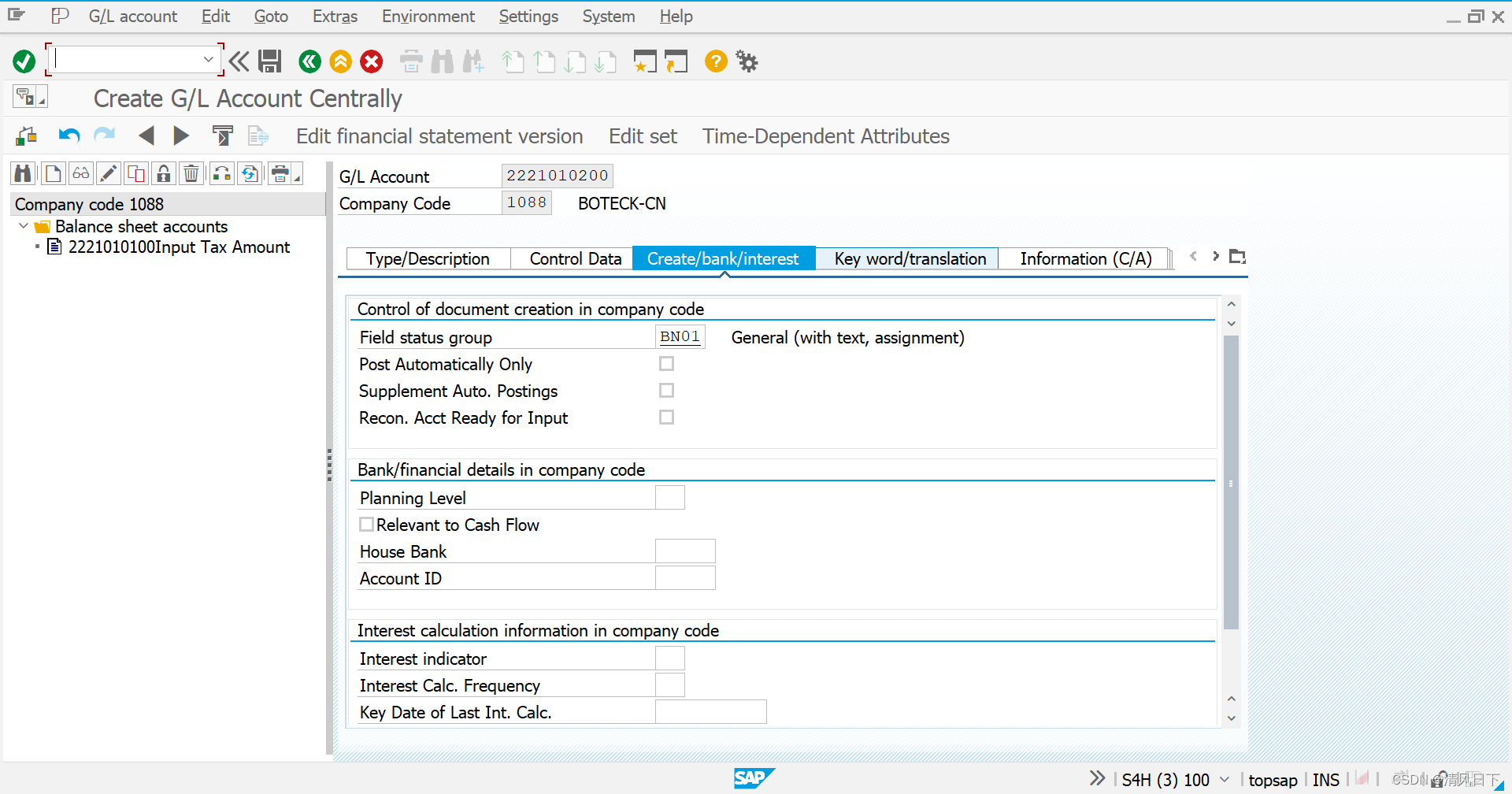

Before maintain the Tax Accounts and we must maintain G/L Account first in foreground through T-Code: FS00 to update the table SKA1.

T-Code FS00

If there is one error pop-up about P&L statement account type and we can find the solution through links: 31 SAP报错:损益报表科目类型在科目表 BN01 中未定义(No P&L statement account type is defined in chart of accounts BN01)_sap 损益表科目类型在 没有定义-CSDN博客

SKA1-G/L Account Master (Chart of Accounts)

Continue to do the configuration as following:

#2 Configure for MWS-Output Tax

Tips: Need to define Output Tax Account first through T-Code: FS00 as following:

SKA1-G/L Account Master (Chart of Accounts)

Continue to do the Output Tax Account configuration as following:

T030K-Tax Accounts Determination

Done.

Created on 30rd March, 2024

20250204更新内容

进项税税码对于的税务科目具体参数如下:

事务码FS00创建税务科目

2221010001应交税费-进项税

更新完毕!

FI 模块目录(FI Module Catalogue): 0 FI配置-财务会计-配置清单(FI Module SPRO Config List)

上一篇(Previous Article): 19 FI配置-财务会计-定义销售/采购税代码(Define Tax Codes for Sales and Purchases)

下一篇(Next Article): 21 FI配置-财务会计-为非征税事务分配税务代码(Assign Tax Codes for Non-Taxable Transactions)

本文介绍如何使用SAP系统的OB40事务码配置税务科目,包括进项税(VST)和销项税(MWS)的配置流程。通过T-Code FS00更新SKA1表来维护总账科目,确保损益报表科目类型的正确设置。

本文介绍如何使用SAP系统的OB40事务码配置税务科目,包括进项税(VST)和销项税(MWS)的配置流程。通过T-Code FS00更新SKA1表来维护总账科目,确保损益报表科目类型的正确设置。

2万+

2万+

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?