指数平滑异同移动平均线MACD

MACD是股票交易中常见的一个技术分析工具,同时也是一个我认为分析可执行度高并且效果优秀的一种手段。其是于1970年代由Gerald Appel提出,它主要是利用了双指数移动平均线,即是求得一条快速的指数移动平均线EMA12和一条慢的指数移动平均线EMA26,再进行相减得到差离值DIF。进而将得到的DIF取9日加权移动平均DEA,最后得到MACD。MACD指标由一组曲线和柱形图构成,它反映的是股票价格变化额趋势周期等特征,通过这些特征便可以很好的挖掘出股票买卖交易的最佳时机。

实现

分析过程可以参考前面的博文,量化交易——传统技术分析相对强弱指数RSI的原理及实现,这里不细讲。

相关代码:

import numpy as np

import math

import random

import json

import matplotlib.pyplot as plt

import sys

sys.setrecursionlimit(10000)

#date|open|high|low|close|volume|adjsuted

def get_stock_hist(num):

s_his=np.genfromtxt('C:/Users/Haipeng/Desktop/python/Korea/Korea_{:03d}.csv'.format(num), delimiter=',')

s_hi=s_his[1:][:]

days=s_hi.shape[0]

this_stock = []

for i in range(1,days,1):

this_day = [i]

for k in range(1,7):

this_day.append(s_hi[i][k])

this_stock.append(this_day)

print 'Maximum date is ',len(this_stock)

return this_stock

def get_price(D, p_tpe):

if p_tpe=='close':

pos=4;

elif p_tpe=='open':

pos=1;

elif p_tpe=='high':

pos=2;

elif p_tpe=='low':

pos=3;

else:

pos=5

price=stock_hist[D-1][pos];

return price

def get_ma(D, N):

p_used=np.zeros(N);

for i in range(1,N+1,1):

p_used[i-1]=stock_hist[(D-1)-(i-1)][4];

ma=np.mean(p_used);

return ma

def get_mar(fro,to,N):

ma = []

for i in range(fro,to+1):

ma.append(get_ma(i,N))

return ma

#Date\Open\High\Low\Close

def get_tuples(fro,to):

res =[]

for d in range(fro,to+1):

tmp = []

tmp.append(d)

tmp.append(get_price(d,'open'))

tmp.append(get_price(d,'high'))

tmp.append(get_price(d,'low'))

tmp.append(get_price(d,'close'))

res.append(tmp)

return res

def get_volume(fro,to):

res = []

for d in range(fro,to+1):

num = 1

try:

if get_price(d,'close')<get_price(d-1,'close'):

num = -1

except:

pass

res.append(num*get_price(d,'volume'))

return res

# MACD

def get_MACD(D):

EMA12 = 0

EMA26 = 0

DEM = 0

DIF = 0

for i in range(1,D):

if i==1:

EMA12 = get_price(i+1,'close')*2.0/13+(1-2.0/13)*get_price(i,'close')

EMA26 = get_price(i+1,'close')*2.0/27+(1-2.0/27)*get_price(i,'close')

DIF = EMA12 - EMA26

DEM = DIF*2.0/10

else:

EMA12 = get_price(i+1,'close')*2.0/13+(1-2.0/13)*EMA12

EMA26 = get_price(i+1,'close')*2.0/27+(1-2.0/27)*EMA26

DIF = EMA12 - EMA26

DEM = DIF*2.0/10+DEM*(1-2.0/10)

OSC = DIF-DEM

return [DIF,DEM,OSC]

def get_DIF_DEM_OSC(fro,to):

res = [[],[],[]]

for d in range(fro,to+1):

tmp = get_MACD(d)

res[0].append(tmp[0])

res[1].append(tmp[1])

res[2].append(tmp[2])

return res绘制k线图及MACD指标

画图代码:

def plot_MACD(fro,to):

volume = get_volume(fro,to)

tmp = get_DIF_DEM_OSC(fro,to)

DIF = tmp[0]

DEM = tmp[1]

OSC = tmp[2]

ma5 = get_mar(fro,to,5)

ma10 = get_mar(fro,to,10)

ma20 = get_mar(fro,to,20)

tuples = get_tuples(fro,to)

date = [d for d in range(fro,to+1)]

fig = plt.figure(figsize=(8,5))

p1 = plt.subplot2grid((5,4),(0,0),rowspan=3,colspan=4,axisbg='k')

p1.set_title("Moving Average Convergence / Divergence(MACD)")

p1.set_ylabel("Price")

p1.plot(date,ma5,'m')

p1.plot(date,ma10,'b')

p1.plot(date,ma20,'y')

p1.legend(('MA5','MA10','MA20'))

p1.grid(True,color='w')

candlestick_ohlc(p1, tuples, width=0.7,colorup='r',colordown="g")

p2 = plt.subplot2grid((5,4),(3,0),colspan=4,axisbg='c')

p2.set_ylabel("Volume")

colors = []

for i in range(len(volume)):

if volume[i]<0:

colors.append('green')

volume[i] = -volume[i]

else:

colors.append('red')

p2.bar(date,volume,color=colors)

p3 = plt.subplot2grid((5,4),(4,0),colspan=4,axisbg='m')

p3.set_ylabel("MACD")

p3.set_xlabel("Dates")

p3.plot(date,DIF, 'r-')

p3.plot(date,DEM, 'g-')

p3.bar(date,OSC,facecolor = 'yellowgreen',edgecolor = 'gold')

p3.legend(('DIF','DEM','MACD bar / OSC'),loc='upper left')

plt.subplots_adjust(hspace=0)

plt.show()# show the plot on the screen

#select stock 18

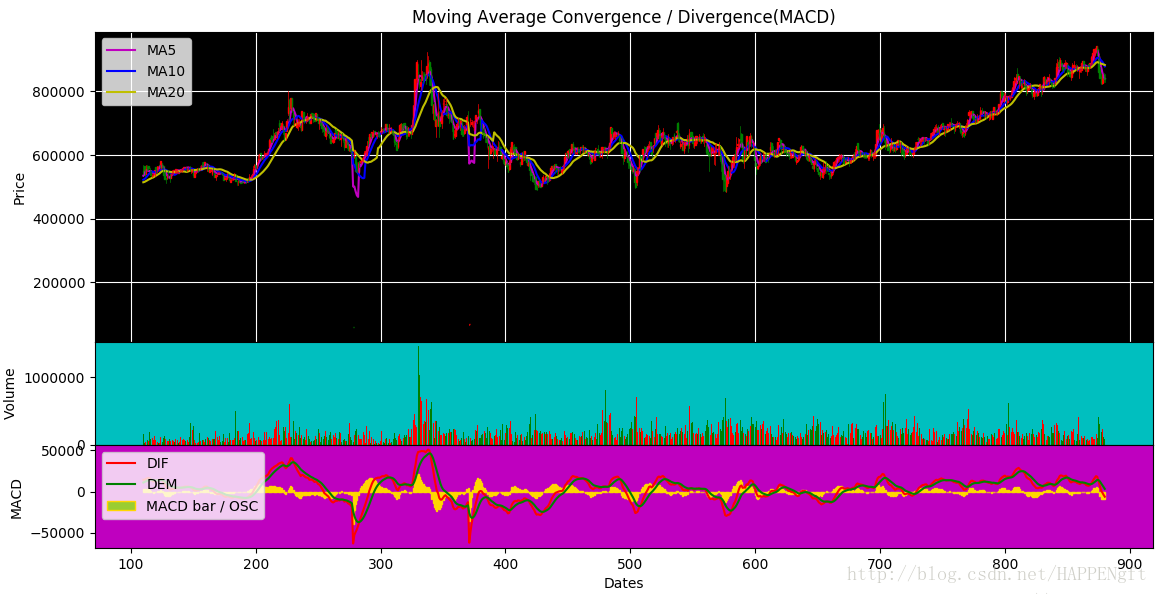

stock_hist = get_stock_hist(18)

#Date from 110 to 880

plot_MACD(110,880)图像1:

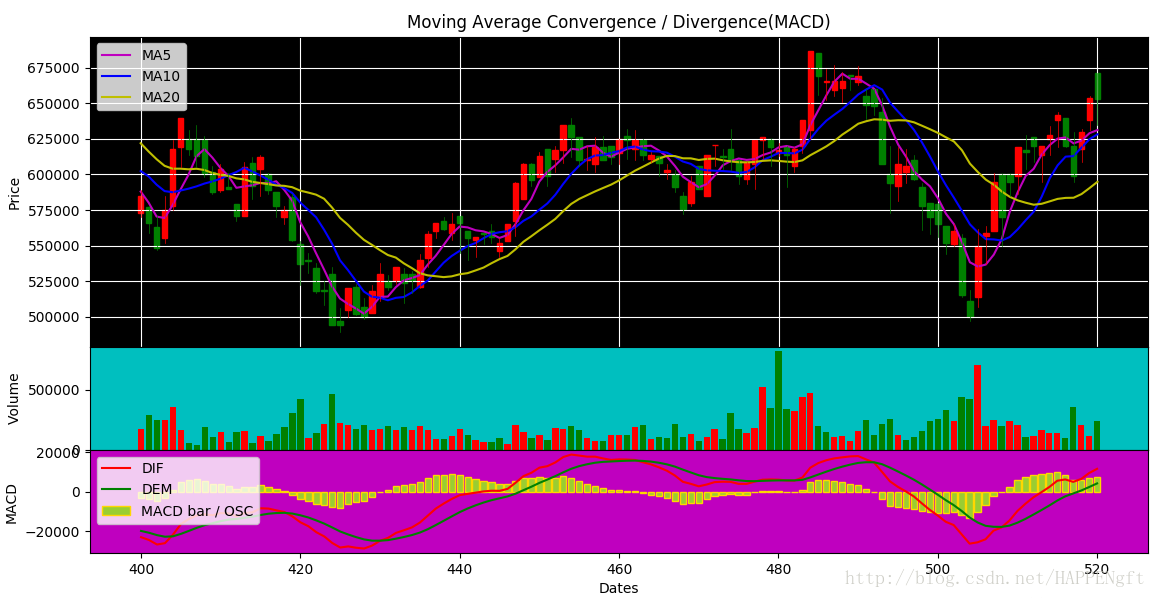

图像2:

#Date from 400 to 520

plot_MACD(400,520)欢迎交流~

1万+

1万+

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?