导入计算库

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

plt.style.use("fivethirtyeight")

plt.rcParams["font.sans-serif"] = ["Microsoft YaHei"]

plt.rcParams["axes.unicode_minus"] = False

from sklearn.preprocessing import OneHotEncoder

import statsmodels.api as sm

from statsmodels.graphics.tsaplots import plot_acf,plot_pacf

from pandas.tseries.offsets import DateOffset

from statsmodels.tsa.arima.model import ARIMA

import warnings

warnings.filterwarnings("ignore")

导入数据

path_train = "../preocess_data/train_data_o.csv"

path_test = "../data/test_data.csv"

data = pd.read_csv(path_train)

data_test = pd.read_csv(path_test)

data["运营日期"] = pd.to_datetime(data["运营日期"] )

data_test["运营日期"] = pd.to_datetime(data_test["日期"])

data.drop(["行ID","日期"],axis=1,inplace=True)

data_test.drop(["行ID","日期"],axis=1,inplace=True)

折扣编码

enc = OneHotEncoder(drop="if_binary")

enc.fit(data["折扣"].values.reshape(-1,1))

enc.transform(data["折扣"].values.reshape(-1,1)).toarray()

enc.transform(data_test["折扣"].values.reshape(-1,1)).toarray()

array([[0.],

[0.],

[0.],

...,

[1.],

[0.],

[0.]])

data["折扣"] = enc.transform(data["折扣"].values.reshape(-1,1)).toarray()

data_test["折扣"] = enc.transform(data_test["折扣"].values.reshape(-1,1)).toarray()

日期衍生

def time_derivation(t,col="运营日期"):

t["year"] = t[col].dt.year

t["month"] = t[col].dt.month

t["day"] = t[col].dt.day

t["quarter"] = t[col].dt.quarter

t["weekofyear"] = t[col].dt.weekofyear

t["dayofweek"] = t[col].dt.dayofweek+1

t["weekend"] = (t["dayofweek"]>5).astype(int)

return t

data_train = time_derivation(data)

data_test_ = time_derivation(data_test)

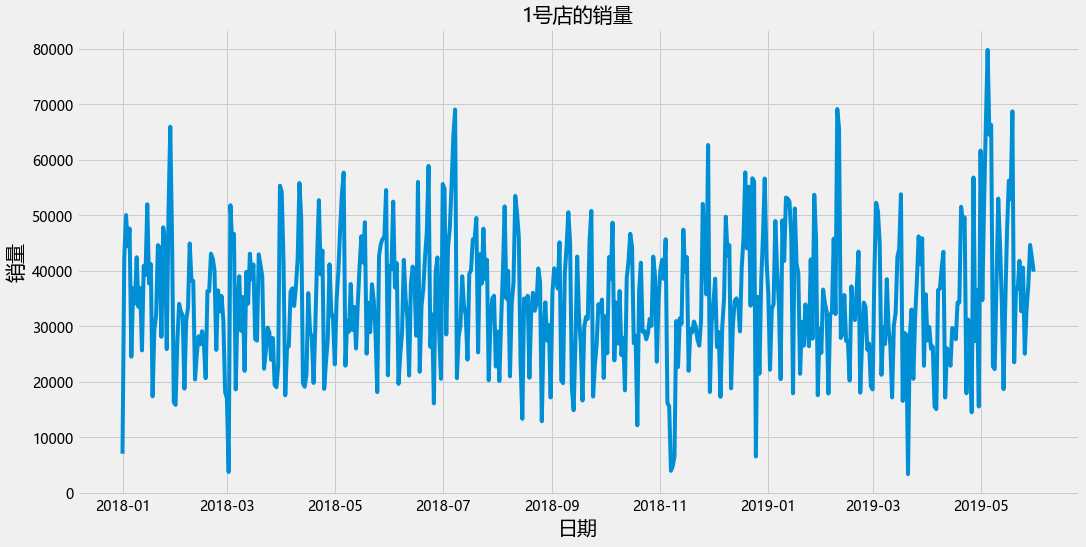

对每家店进行探索

对第一家尝试

# 训练集合

data_train_1 = data_train[data_train["商店ID"] ==1]

# 测试集合

data_test_1 = data_test_[data_test_["商店ID"] ==1]

plt.figure(figsize=(16,8))

plt.plot(data_train_1["运营日期"],data_train_1["销量"])

plt.xlabel("日期",fontsize= 20)

plt.ylabel("销量",fontsize= 20)

plt.title("1号店的销量",fontsize=20)

Text(0.5, 1.0, '1号店的销量')

data_train_1

| 商店ID | 商店类型 | 位置 | 地区 | 节假日 | 折扣 | 销量 | 运营日期 | year | month | day | quarter | weekofyear | dayofweek | weekend | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 1 | S1 | L3 | R1 | 1 | 1.0 | 7011.84 | 2018-01-01 | 2018 | 1 | 1 | 1 | 1 | 1 | 0 |

| 607 | 1 | S1 | L3 | R1 | 0 | 1.0 | 42369.00 | 2018-01-02 | 2018 | 1 | 2 | 1 | 1 | 2 | 0 |

| 1046 | 1 | S1 | L3 | R1 | 0 | 1.0 | 50037.00 | 2018-01-03 | 2018 | 1 | 3 | 1 | 1 | 3 | 0 |

| 1207 | 1 | S1 | L3 | R1 | 0 | 1.0 | 44397.00 | 2018-01-04 | 2018 | 1 | 4 | 1 | 1 | 4 | 0 |

| 1752 | 1 | S1 | L3 | R1 | 0 | 1.0 | 47604.00 | 2018-01-05 | 2018 | 1 | 5 | 1 | 1 | 5 | 0 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 186569 | 1 | S1 | L3 | R1 | 0 | 1.0 | 33075.00 | 2019-05-27 | 2019 | 5 | 27 | 2 | 22 | 1 | 0 |

| 187165 | 1 | S1 | L3 | R1 | 0 | 1.0 | 37317.00 | 2019-05-28 | 2019 | 5 | 28 | 2 | 22 | 2 | 0 |

| 187391 | 1 | S1 | L3 | R1 | 0 | 1.0 | 44652.00 | 2019-05-29 | 2019 | 5 | 29 | 2 | 22 | 3 | 0 |

| 187962 | 1 | S1 | L3 | R1 | 0 | 1.0 | 42387.00 | 2019-05-30 | 2019 | 5 | 30 | 2 | 22 | 4 | 0 |

| 188113 | 1 | S1 | L3 | R1 | 1 | 1.0 | 39843.78 | 2019-05-31 | 2019 | 5 | 31 | 2 | 22 | 5 | 0 |

516 rows × 15 columns

假设检验: 平稳性检验

**原假设:**数据是不平稳序列,如果该假设未被拒绝,则表示时间序列中有单位根。

**备择假设:**数据是平稳的,拒绝原假设,说明该时间序列中没有单位根,数据平稳。

- p>0.05 无法拒绝原假设,数据有单位根并且不平稳。

- p<=0.05 拒绝原假设,数据没有单位根,并且数据是平稳的。

from statsmodels.tsa.stattools import adfuller

data_train_1["销量"].std()

11816.030434190745

result = adfuller(data_train_1["销量"])

result

(-4.0896913250202225,

0.0010072301346594798,

13,

502,

{'1%': -3.4434437319767452,

'5%': -2.8673146875484368,

'10%': -2.569845688481135},

10594.579494253907)

def adfuller_test(data):

from statsmodels.tsa.stattools import adfuller

result = adfuller(data)

labels = ["ADF Test Statistic","P-Value"]

for value,label in zip(result,labels):

print(label+":"+str(value))

if result[1]<=0.05:

print("拒绝原假设,数据具有平稳性!")

else:

print("无法拒绝原假设,数据不平稳!")

return result[1]

p_value = adfuller_test(data_train_1["销量"])

p_value

ADF Test Statistic:-4.0896913250202225

P-Value:0.0010072301346594798

拒绝原假设,数据具有平稳性!

0.0010072301346594798

def diff_test(data,col = "销量"):

columns = ["D1","D2","D3","D4","D5","D6","D7","D8","D9","D10","D11","D12","D24"]

pvalues = []

stds = []

for idx,degree in enumerate([*range(1,13),24]):

print("{}步差分".format(degree))

data[columns[idx]] = data[col] - data[col].shift(idx+1)

pvalue_ = adfuller_test(data[columns[idx]].dropna())

std_ = data[columns[idx]].std()

pvalues.append(pvalue_)

stds.append(std_)

print("差分后数据的标准差为{}".format(std_))

print("\n")

return pvalues,stds

pvalues,stds= diff_test(data_train_1,col = "销量")

1步差分

ADF Test Statistic:-8.464898318877633

P-Value:1.5318720959824456e-13

拒绝原假设,数据具有平稳性!

差分后数据的标准差为13817.551491473438

2步差分

ADF Test Statistic:-8.522739847666854

P-Value:1.0895357544082096e-13

拒绝原假设,数据具有平稳性!

差分后数据的标准差为15742.483969864334

3步差分

ADF Test Statistic:-8.735227057175196

P-Value:3.113347686828788e-14

拒绝原假设,数据具有平稳性!

差分后数据的标准差为17859.203983779495

4步差分

ADF Test Statistic:-9.58524793091614

P-Value:2.1057694542062046e-16

拒绝原假设,数据具有平稳性!

差分后数据的标准差为16987.96156086255

5步差分

ADF Test Statistic:-8.960763076444596

P-Value:8.236684531392401e-15

拒绝原假设,数据具有平稳性!

差分后数据的标准差为17033.86992851215

6步差分

ADF Test Statistic:-7.769437143794817

P-Value:9.003228411011962e-12

拒绝原假设,数据具有平稳性!

差分后数据的标准差为15529.629177726565

7步差分

ADF Test Statistic:-7.083109863637503

P-Value:4.611558193984965e-10

拒绝原假设,数据具有平稳性!

差分后数据的标准差为17024.943907771467

8步差分

ADF Test Statistic:-7.869282346208565

P-Value:5.035687145492254e-12

拒绝原假设,数据具有平稳性!

差分后数据的标准差为17695.94594762459

9步差分

ADF Test Statistic:-7.26305598879107

P-Value:1.662101581895993e-10

拒绝原假设,数据具有平稳性!

差分后数据的标准差为18068.592304247017

10步差分

ADF Test Statistic:-8.276441746470041

P-Value:4.642809018487743e-13

拒绝原假设,数据具有平稳性!

差分后数据的标准差为16707.40284171362

11步差分

ADF Test Statistic:-6.82747605010546

P-Value:1.931318243001963e-09

拒绝原假设,数据具有平稳性!

差分后数据的标准差为15272.56312237816

12步差分

ADF Test Statistic:-7.204131545505776

P-Value:2.3239728071593555e-10

拒绝原假设,数据具有平稳性!

差分后数据的标准差为13708.569562249815

24步差分

ADF Test Statistic:-6.063721465758527

P-Value:1.1955709996228333e-07

拒绝原假设,数据具有平稳性!

差分后数据的标准差为15386.586684555326

data_train_1["D12"].plot()

<AxesSubplot:>

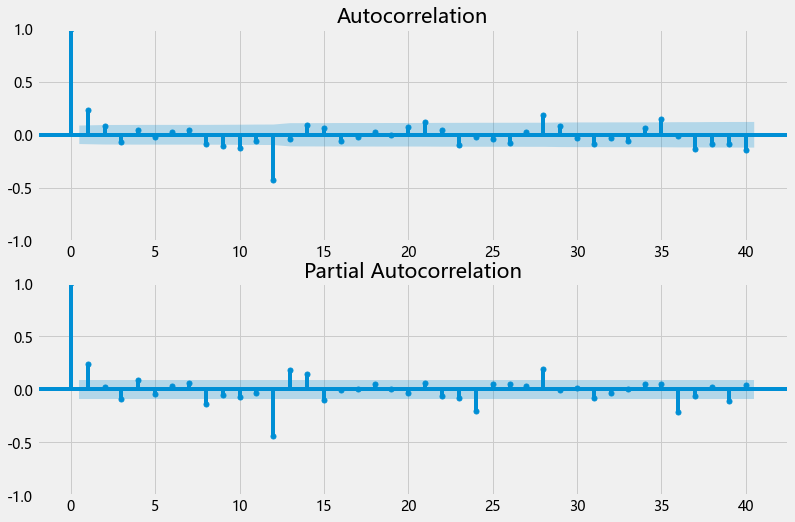

fig = plt.figure(figsize=(12,8))

ax1 = fig.add_subplot(211)

fig = sm.graphics.tsa.plot_acf(data_train_1["D12"].dropna(),lags=40,ax=ax1)

ax2 = fig.add_subplot(212)

fig = sm.graphics.tsa.plot_pacf(data_train_1["D12"].dropna(),lags=40,ax=ax2)

diff = [data_train_1["销量"],data_train_1["销量"].diff().dropna()

,data_train_1["销量"].diff().diff().dropna()

,data_train_1["销量"].diff().diff().diff().dropna()

]

titles = ["d=0","d=1","d=2","d=3"]

fig, (ax1, ax2, ax3, ax4) = plt.subplots(4,1,figsize=(8,14))

for idx, ts, fig, title in zip(range(4),diff,[ax1,ax2,ax3,ax4],titles):

print("{}阶差分的标准差为{}".format(idx,ts.std()))

plot_acf(ts, ax=fig, title=title)

0阶差分的标准差为11816.030434190745

1阶差分的标准差为13817.551491473438

2阶差分的标准差为22637.790854681327

3阶差分的标准差为41052.92772437857

由上图可知,d = 0,原始数据不会出现过差分的情况

data_train__1 =data_train_1[["运营日期","销量",'D1', 'D2',

'D3', 'D4', 'D5', 'D6', 'D7', 'D8', 'D9', 'D10', 'D11', 'D12', 'D24']].copy()

data_train__1

| 运营日期 | 销量 | D1 | D2 | D3 | D4 | D5 | D6 | D7 | D8 | D9 | D10 | D11 | D12 | D24 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 2018-01-01 | 7011.84 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 607 | 2018-01-02 | 42369.00 | 35357.16 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 1046 | 2018-01-03 | 50037.00 | 7668.00 | 43025.16 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 1207 | 2018-01-04 | 44397.00 | -5640.00 | 2028.00 | 37385.16 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 1752 | 2018-01-05 | 47604.00 | 3207.00 | -2433.00 | 5235.00 | 40592.16 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 186569 | 2019-05-27 | 33075.00 | 8040.00 | -7479.00 | 375.00 | -8715.00 | -3678.00 | -3537.00 | 9579.00 | -35658.00 | -19802.82 | -23178.00 | -14544.00 | -1383.00 | 14415.00 |

| 187165 | 2019-05-28 | 37317.00 | 4242.00 | 12282.00 | -3237.00 | 4617.00 | -4473.00 | 564.00 | 705.00 | 13821.00 | -31416.00 | -15560.82 | -18936.00 | -10302.00 | 2859.00 |

| 187391 | 2019-05-29 | 44652.00 | 7335.00 | 11577.00 | 19617.00 | 4098.00 | 11952.00 | 2862.00 | 7899.00 | 8040.00 | 21156.00 | -24081.00 | -8225.82 | -11601.00 | -2967.00 |

| 187962 | 2019-05-30 | 42387.00 | -2265.00 | 5070.00 | 9312.00 | 17352.00 | 1833.00 | 9687.00 | 597.00 | 5634.00 | 5775.00 | 18891.00 | -26346.00 | -10490.82 | -13866.00 |

| 188113 | 2019-05-31 | 39843.78 | -2543.22 | -4808.22 | 2526.78 | 6768.78 | 14808.78 | -710.22 | 7143.78 | -1946.22 | 3090.78 | 3231.78 | 16347.78 | -28889.22 | -13034.04 |

516 rows × 15 columns

data_train__1.index =pd.DatetimeIndex(data_train__1.index.values)

arima_0 = ARIMA(endog = data_train__1["销量"],order = (1,0,1))

ARIMA(endog =data_train__1["销量"],seasonal_order=(5,1,3,3))

arima_0 = arima_0.fit()

data_train__1["arima"] = arima_0.predict(start =456,endogd = 516,dynamic =True)

arima_0 = ARIMA(endog =data_train__1["销量"],seasonal_order=(5,1,3,3))

arima_0 = arima_0.fit()

data_train__1["arima"] = arima_0.predict(start =456,endogd = 516,dynamic =True)

arima_0.predict(start =516,endogd = 577)

516 26816.992973

dtype: float64

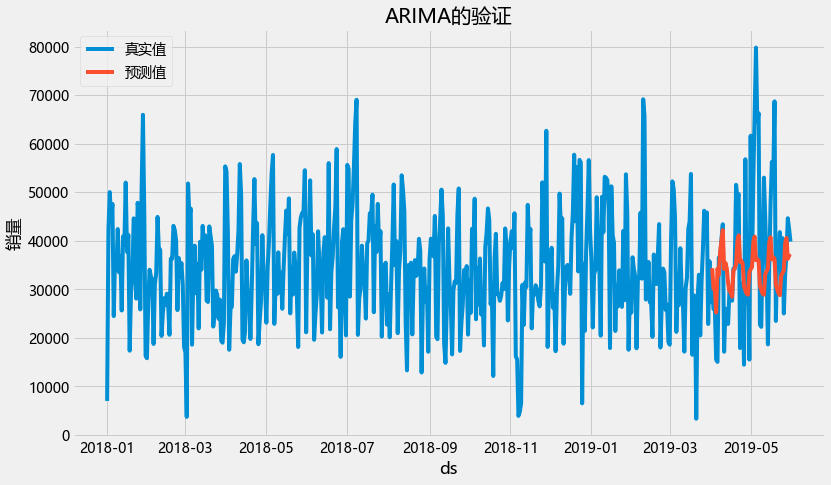

plt.figure(figsize=(12,7))

plt.plot(data_train__1["运营日期"],data_train__1["销量"],label="真实值")

plt.plot(data_train__1["运营日期"],data_train__1["arima"],label="预测值")

plt.xlabel("ds")

plt.ylabel("销量")

plt.title("ARIMA的验证")

plt.legend()

<matplotlib.legend.Legend at 0x14693679cc8>

def symmetric_mean_absolute_percentage_error(y_true, y_pred):

y_true, y_pred = np.array(y_true), np.array(y_pred)

return np.sum(np.abs(y_true - y_pred) * 2) / np.sum(np.abs(y_true) + np.abs(y_pred))

def arima_smape(y_true, y_pred):

smape_val = symmetric_mean_absolute_percentage_error(y_true, y_pred)

return 'SMAPE', smape_val, False

data_train__1[["运营日期","arima"]].loc[]

| 运营日期 | arima | |

|---|---|---|

| 1970-01-01 00:00:00.000000000 | 2018-01-01 | NaN |

| 1970-01-01 00:00:00.000000607 | 2018-01-02 | NaN |

| 1970-01-01 00:00:00.000001046 | 2018-01-03 | NaN |

| 1970-01-01 00:00:00.000001207 | 2018-01-04 | NaN |

| 1970-01-01 00:00:00.000001752 | 2018-01-05 | NaN |

| ... | ... | ... |

| 1970-01-01 00:00:00.000186569 | 2019-05-27 | 39525.339871 |

| 1970-01-01 00:00:00.000187165 | 2019-05-28 | 40588.767755 |

| 1970-01-01 00:00:00.000187391 | 2019-05-29 | 36283.064445 |

| 1970-01-01 00:00:00.000187962 | 2019-05-30 | 36961.130673 |

| 1970-01-01 00:00:00.000188113 | 2019-05-31 | 36744.677331 |

516 rows × 2 columns

np.array(data_train__1.tail(60)["销量"])

array([29886. , 25941. , 26334. , 15522. , 15056.34, 36531. ,

36753. , 40422. , 43416. , 17151. , 26004. , 24963.84,

22871.25, 29687.04, 29430. , 27664.2 , 34278. , 34278. ,

51531. , 48954.45, 49641. , 17910. , 31206. , 27207. ,

14484. , 56808. , 27330. , 36516. , 15531. , 61656. ,

34710. , 52362. , 66564. , 79806. , 64491. , 66288. ,

22731. , 22276.38, 37437. , 53016. , 44736. , 34479. ,

18660. , 34458. , 47619. , 56253. , 52877.82, 68733. ,

23496. , 36612. , 36753. , 41790. , 32700. , 40554. ,

25035. , 33075. , 37317. , 44652. , 42387. , 39843.78])

np.array(data_train__1.tail(60)["arima"])

array([34356.47414133, 30091.17999724, 30376.52066402, 25228.70141222,

34244.25905574, 32995.51895358, 37726.00344591, 40044.53290539,

42214.3534088 , 34202.13819704, 35451.01651558, 34338.58535838,

31275.42293545, 29675.36232876, 29506.96478827, 28477.909069 ,

33900.40136957, 34297.3848415 , 35255.19304449, 39942.21217251,

41116.3200547 , 35621.55813049, 35888.26578326, 35328.00500634,

30599.00844142, 29755.72777736, 29110.97021646, 28915.11380027,

33544.52883198, 34129.90655345, 34610.741271 , 39822.63505499,

40867.2933485 , 36014.714246 , 36260.94281065, 35881.50575625,

30702.6187137 , 29872.99671427, 29123.33802667, 28896.08000654,

33185.78296174, 33751.32898899, 34267.22060165, 39685.9774967 ,

40729.80605295, 36178.33135918, 36617.97940246, 36327.50562255,

30948.14619832, 30019.91310149, 29228.82155029, 28809.38738525,

32836.70491725, 33341.59736765, 33974.7119752 , 39525.33987072,

40588.76775503, 36283.06444474, 36961.13067342, 36744.67733075])

from sklearn.metrics import mean_squared_error

mean_squared_error(np.array(data_train__1.tail(60)["销量"]).reshape(-1,1),

np.array(data_train__1.tail(60)["arima"]).reshape(-1,1))**0.5

14166.52822810936

arima_smape(np.array(data_train__1.tail(60)["销量"]).reshape(-1,1),

np.array(data_train__1.tail(60)["arima"]).reshape(-1,1))

('SMAPE', 0.2935515805745867, False)

很显然,预测失效。

print(arima_0.summary(alpha = 0.05))

SARIMAX Results

==============================================================================

Dep. Variable: 销量 No. Observations: 516

Model: ARIMA(1, 0, 1) Log Likelihood -5543.620

Date: Mon, 05 Dec 2022 AIC 11095.239

Time: 19:40:59 BIC 11112.224

Sample: 0 HQIC 11101.895

- 516

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 3.47e+04 745.604 46.537 0.000 3.32e+04 3.62e+04

ar.L1 0.3295 0.128 2.566 0.010 0.078 0.581

ma.L1 -0.0161 0.148 -0.109 0.914 -0.307 0.275

sigma2 1.243e+08 0.001 8.4e+10 0.000 1.24e+08 1.24e+08

===================================================================================

Ljung-Box (L1) (Q): 0.01 Jarque-Bera (JB): 0.76

Prob(Q): 0.93 Prob(JB): 0.68

Heteroskedasticity (H): 1.48 Skew: 0.02

Prob(H) (two-sided): 0.01 Kurtosis: 3.18

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

[2] Covariance matrix is singular or near-singular, with condition number 1e+27. Standard errors may be unstable.

arima_0.resid

1970-01-01 00:00:00.000000000 -27686.602325

1970-01-01 00:00:00.000000607 16390.813526

1970-01-01 00:00:00.000001046 13075.357759

1970-01-01 00:00:00.000001207 4855.537661

1970-01-01 00:00:00.000001752 9788.351222

...

1970-01-01 00:00:00.000186569 1375.328883

1970-01-01 00:00:00.000187165 3175.598301

1970-01-01 00:00:00.000187391 9141.968919

1970-01-01 00:00:00.000187962 4556.391375

1970-01-01 00:00:00.000188113 2685.556382

Length: 516, dtype: float64

LJung-Box test : 检验样本和样本之间的相关性,LBQ下的Prob(Q)项大于0.05时候模型可用,否则可以考虑更换模型的超参数组合。

**Heteroskedasticity test:**异方差检验用于检验序列中的方差是否稳定。 异方差检验下的Prob(H)项大于0.05时候模型可用,否则可以考虑更换模型的超参数组合。

Jarque-Bera test: 雅克贝拉检验是正态性检验中的一种方法,用于检验当前序列是否符合正太分布。雅克贝拉检验下的Prob(JB)项大于0.05时候模型可用,否则可以考虑更换模型的超参数组合。

确定模型

data_arima = data_train__1["销量"].copy()

arimas = arimas = [ARIMA(endog = data_arima,order=(1,0,1))

,ARIMA(endog = data_arima,order=(1,0,2))

,ARIMA(endog = data_arima,order=(2,0,1))

,ARIMA(endog = data_arima,order=(2,0,2))

,ARIMA(endog = data_arima,order=(1,0,3))

,ARIMA(endog = data_arima,order=(3,0,1))

,ARIMA(endog = data_arima,order=(3,0,2))

,ARIMA(endog = data_arima,order=(2,0,3))

,ARIMA(endog = data_arima,order=(3,0,3))

]

sarimas = [ARIMA(endog = data_arima,seasonal_order=(1,0,1,12))

,ARIMA(endog = data_arima,seasonal_order=(1,0,2,12))

,ARIMA(endog = data_arima,seasonal_order=(2,0,1,12))

,ARIMA(endog = data_arima,seasonal_order=(2,0,2,12))

,ARIMA(endog = data_arima,seasonal_order=(1,0,3,12))

,ARIMA(endog = data_arima,seasonal_order=(3,0,1,12))

,ARIMA(endog = data_arima,seasonal_order=(3,0,2,12))

,ARIMA(endog = data_arima,seasonal_order=(2,0,3,12))

,ARIMA(endog = data_arima,seasonal_order=(3,0,3,12))

,ARIMA(endog = data_arima,seasonal_order=(1,0,1,4))

,ARIMA(endog = data_arima,seasonal_order=(1,0,2,4))

,ARIMA(endog = data_arima,seasonal_order=(2,0,1,4))

,ARIMA(endog = data_arima,seasonal_order=(2,0,2,4))

,ARIMA(endog = data_arima,seasonal_order=(1,0,3,4))

,ARIMA(endog = data_arima,seasonal_order=(3,0,1,4))

,ARIMA(endog = data_arima,seasonal_order=(3,0,2,4))

,ARIMA(endog = data_arima,seasonal_order=(2,0,3,4))

,ARIMA(endog = data_arima,seasonal_order=(3,0,3,4)) ,

]

sarimas_ = [

ARIMA(endog = data_arima,seasonal_order=(4,0,1,12))

,ARIMA(endog = data_arima,seasonal_order=(4,0,2,12))

,ARIMA(endog = data_arima,seasonal_order=(4,0,3,12))

,ARIMA(endog = data_arima,seasonal_order=(4,0,4,12))

,ARIMA(endog = data_arima,seasonal_order=(4,0,1,3))

,ARIMA(endog = data_arima,seasonal_order=(4,0,2,3))

,ARIMA(endog = data_arima,seasonal_order=(4,0,3,3))

,ARIMA(endog = data_arima,seasonal_order=(4,0,4,3))

,ARIMA(endog = data_arima,seasonal_order=(4,0,1,4))

,ARIMA(endog = data_arima,seasonal_order=(4,0,2,4))

,ARIMA(endog = data_arima,seasonal_order=(4,0,3,4))

,ARIMA(endog = data_arima,seasonal_order=(4,0,4,4))

]

sarimas__ = [

ARIMA(endog = data_arima,seasonal_order=(5,0,1,12))

,ARIMA(endog = data_arima,seasonal_order=(5,0,2,12))

,ARIMA(endog = data_arima,seasonal_order=(5,0,3,12))

,ARIMA(endog = data_arima,seasonal_order=(5,0,4,12))

,ARIMA(endog = data_arima,seasonal_order=(5,0,5,12))

,ARIMA(endog = data_arima,seasonal_order=(5,0,1,3))

,ARIMA(endog = data_arima,seasonal_order=(5,0,2,3))

,ARIMA(endog = data_arima,seasonal_order=(5,0,3,3))

,ARIMA(endog = data_arima,seasonal_order=(5,0,4,3))

,ARIMA(endog = data_arima,seasonal_order=(5,0,5,3))

,ARIMA(endog = data_arima,seasonal_order=(5,0,1,4))

,ARIMA(endog = data_arima,seasonal_order=(5,0,2,4))

,ARIMA(endog = data_arima,seasonal_order=(5,0,3,4))

,ARIMA(endog = data_arima,seasonal_order=(5,0,4,4))

,ARIMA(endog = data_arima,seasonal_order=(5,0,5,4))

]

sarimas___ = [

ARIMA(endog = data_arima,seasonal_order=(5,1,1,12))

,ARIMA(endog = data_arima,seasonal_order=(5,1,2,12))

,ARIMA(endog = data_arima,seasonal_order=(5,1,3,12))

,ARIMA(endog = data_arima,seasonal_order=(5,1,4,12))

,ARIMA(endog = data_arima,seasonal_order=(5,1,5,12))

,ARIMA(endog = data_arima,seasonal_order=(5,1,1,3))

,ARIMA(endog = data_arima,seasonal_order=(5,1,2,3))

,ARIMA(endog = data_arima,seasonal_order=(5,1,3,3))

,ARIMA(endog = data_arima,seasonal_order=(5,1,4,3))

,ARIMA(endog = data_arima,seasonal_order=(5,1,5,3))

,ARIMA(endog = data_arima,seasonal_order=(5,1,1,4))

,ARIMA(endog = data_arima,seasonal_order=(5,1,2,4))

,ARIMA(endog = data_arima,seasonal_order=(5,1,3,4))

,ARIMA(endog = data_arima,seasonal_order=(5,1,4,4))

,ARIMA(endog = data_arima,seasonal_order=(5,1,5,4))

]

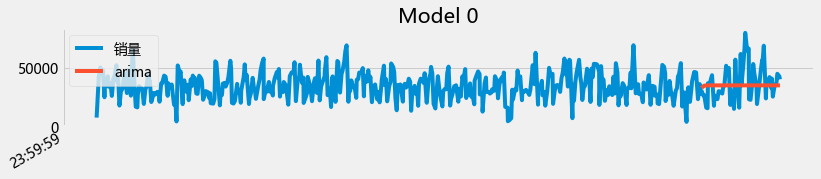

def plot_summary(models,summary=True,model_name=[]):

for idx,model in enumerate(models):

m = model.fit()

if summary:

print("\n")

print(model_name[idx])

print(m.summary(alpha=0.01))

else:

data_train__1["arima"] = m.predict(start =456,endogd = 516,dynamic=True)

data_train__1[["销量","arima"]].plot(figsize=(12,2),title="Model {}".format(idx))

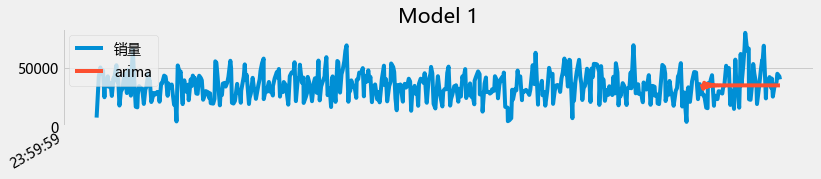

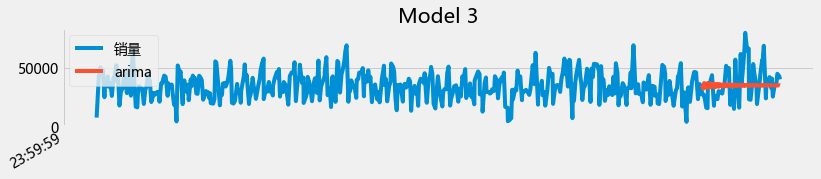

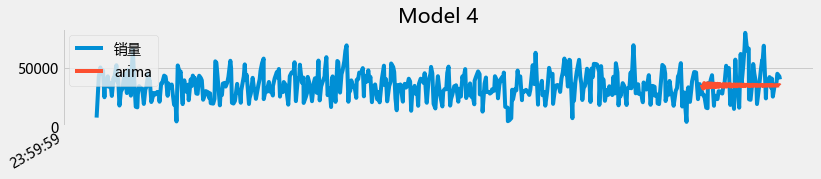

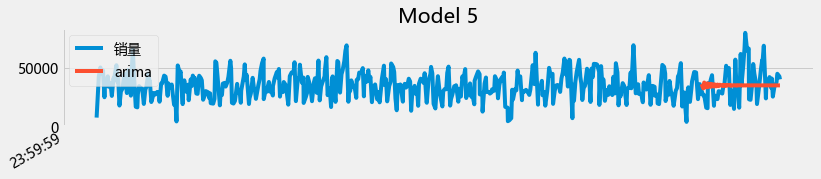

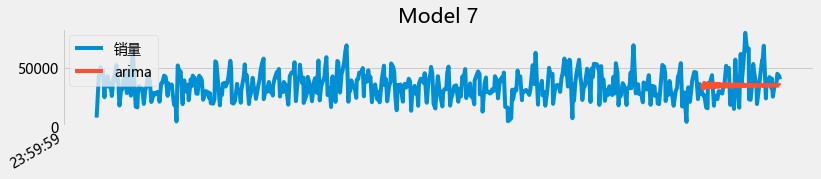

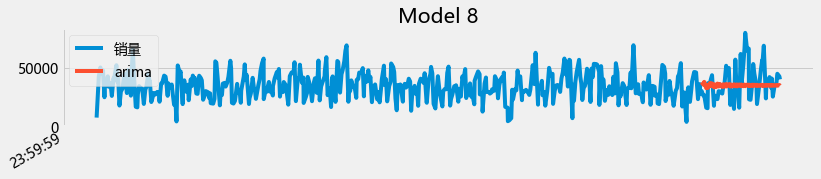

plot_summary(arimas,False)

从上面的图初步来看,用arima 直接预测未来两个月的是有困难的。至此,ARIMA和prophet都对每天的销量预测进行了尝试(并且对其进行了初步的掌握),但是效果目前都不让人满意,因此,对每天的销量预测可以继续尝试:

- 从时间窗历史数据预测未来的时刻,就从构造特征的角度去考虑,或者二者相结合。

- 机器学习的角度思考。

- 深度学习的角度思考。

思考: 在这里发现数据是平稳的,但是如果从机器学习的角度来考虑的话,在arima中, 一般获取差分当中不存在过差分问题的、方差较小、噪音较少的阶数作为d的取值。方差较小的话,从方差过滤的角度来讲是否可以考虑去时序化呢?

4185

4185

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?