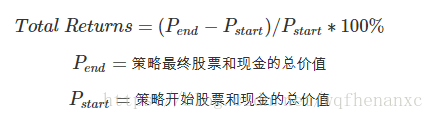

Total Returns(策略收益)

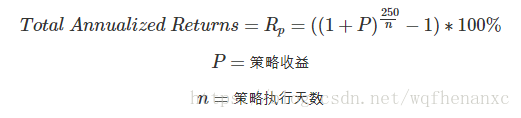

Total Annualized Returns(策略年化收益)

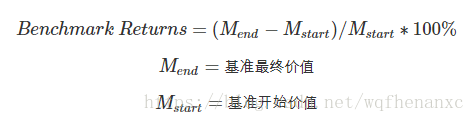

Benchmark Returns(基准收益)

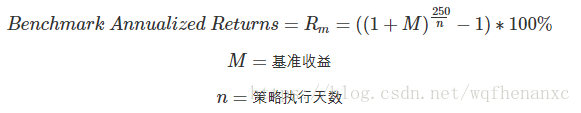

Benchmark Annualized Returns(基准年化收益)

Alpha(阿尔法)

投资中面临着系统性风险(即Beta)和非系统性风险(即Alpha),Alpha是投资者获得与市场波动无关的回报。比如投资者获得了15%的回报,其基准获得了10%的回报,那么Alpha或者价值增值的部分就是5%。

| Alpha值 | 解释 |

|---|---|

| α>0 | 策略相对于风险,获得了超额收益 |

| α=0 | 策略相对于风险,获得了适当收益 |

| α<0 | 策略相对于风险,获得了较少收益 |

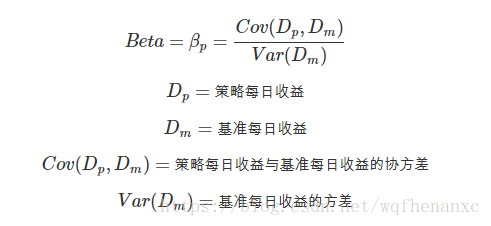

Beta(贝塔)

表示投资的系统性风险,反映了策略对大盘变化的敏感性。例如一个策略的Beta为1.5,则大盘涨1%的时候,策略可能涨1.5%,反之亦然;如果一个策略的Beta为-1.5,说明大盘涨1%的时候,策略可能跌1.5%,反之亦然。

| Beta值 | 解释 |

|---|---|

| β<0 | 投资组合和基准的走向通常反方向,如空头头寸类 |

| β=0 | 投资组合和基准的走向没有相关性,如固定收益类 |

| 0<β<1 | 投资组合和基准的走向相同,但是比基准的移动幅度更小 |

| β=1 | 投资组合和基准的走向相同,并且和基准的移动幅度贴近 |

| β>1 | 投资组合和基准的走向相同,但是比基准的移动幅度更大 |

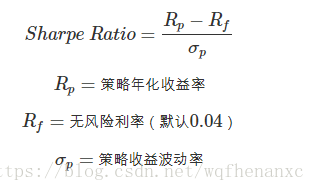

Sharpe(夏普比率)

表示每承受一单位总风险,会产生多少的超额报酬,可以同时对策略的收益与风险进行综合考虑。

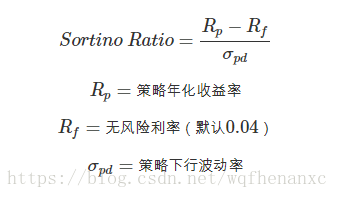

Sortino(索提诺比率)

表示每承担一单位的下行风险,将会获得多少超额回报。

Information Ratio(信息比率)

衡量单位超额风险带来的超额收益。信息比率越大,说明该策略单位跟踪误差所获得的超额收益越高,因此,信息比率较大的策略的表现要优于信息比率较低的基准。合理的投资目标应该是在承担适度风险下,尽可能追求高信息比率。

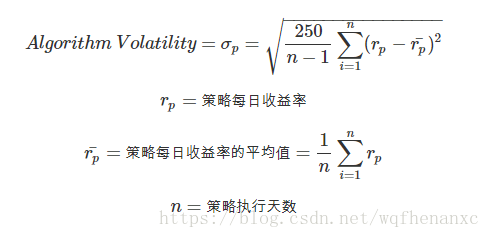

Algorithm Volatility(策略波动率)

用来测量策略的风险性,波动越大代表策略风险越高。

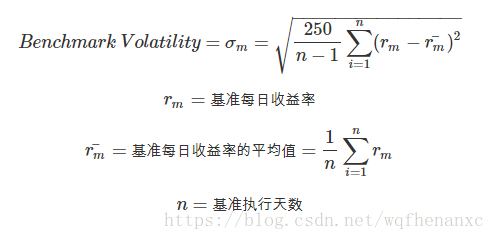

Benchmark Volatility(基准波动率)

用来测量基准的风险性,波动越大代表基准风险越高。

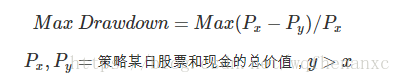

Max Drawdown(最大回撤)

描述策略可能出现的最糟糕的情况,最极端可能的亏损情况。

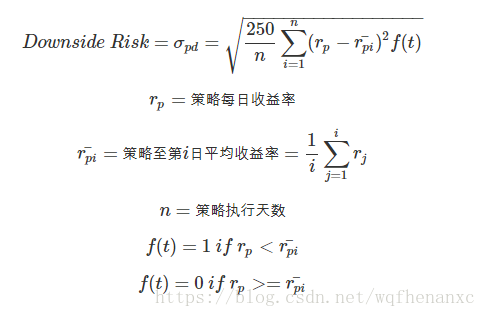

Downside Risk(下行波动率)

策略收益下行波动率。和普通收益波动率相比,下行标准差区分了好的和坏的波动。

胜率(%)

盈利次数在总交易次数中的占比。

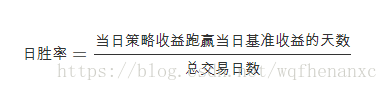

日胜率(%)

策略盈利超过基准盈利的天数在总交易数中的占比。

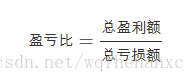

盈亏比

周期盈利亏损的比例。

下面一段关于alpha和beta的论述,我觉得很有道理,(转自https://www.zhihu.com/question/314729120/answer/615028020)

我们用的数据都是别人有的,用的算法模型方法,也是别人都知道的,所以哪里来的alpha?

其实不存在着绝对的alpha,所有的alpha都是来源于beta,股票的波动不仅跟大盘有关,还跟一系列beta因子有关,例如某个板块近期表现较好,该板块的股票就表现出了alpha,国家实施货币宽松政策,对M2较敏感的股票就表现出alpha,所有获得的alpha都是因为赌对了beta。

从事后的角度,总是有办法回测出非常漂亮的alpha曲线,但这个没什么意义。

要获得alpha还是要靠人的认知来对未来做出预判。

多因子alpha策略的核心不是挖掘有效的因子,也不是去找一个牛逼的算法,跟传统主观投资一样,核心依然还是对市场的认知,量化仅仅只是投资认知模型化的工具,它无法弥补人对市场的无知。

368

368

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?