Let's develop a different anomaly detection algorithm based on multivariate Gaussian distribution.

Parameters fitting

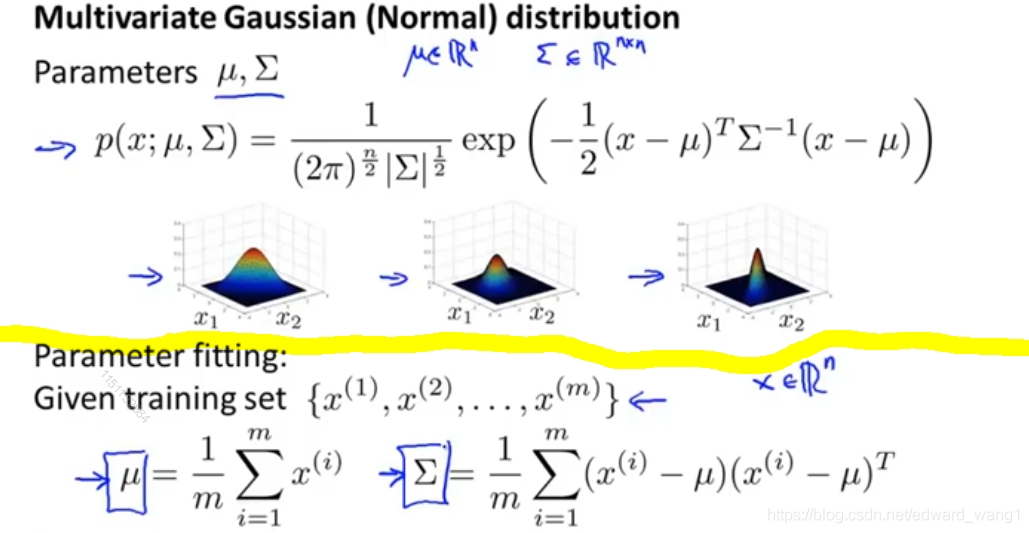

The upper part of figure-1 is a recap for definition of multivariate Gaussian distribution. Also it shows a range of different distributions as verying  and

and  . The lower part shows how to fit the parameters. If I have a set of examples

. The lower part shows how to fit the parameters. If I have a set of examples

Then you set  as the average of all examples. And set

as the average of all examples. And set

So given the data set, we can estimate  and

and  . And get definition of

. And get definition of

Multivariate Gaussian algorithm

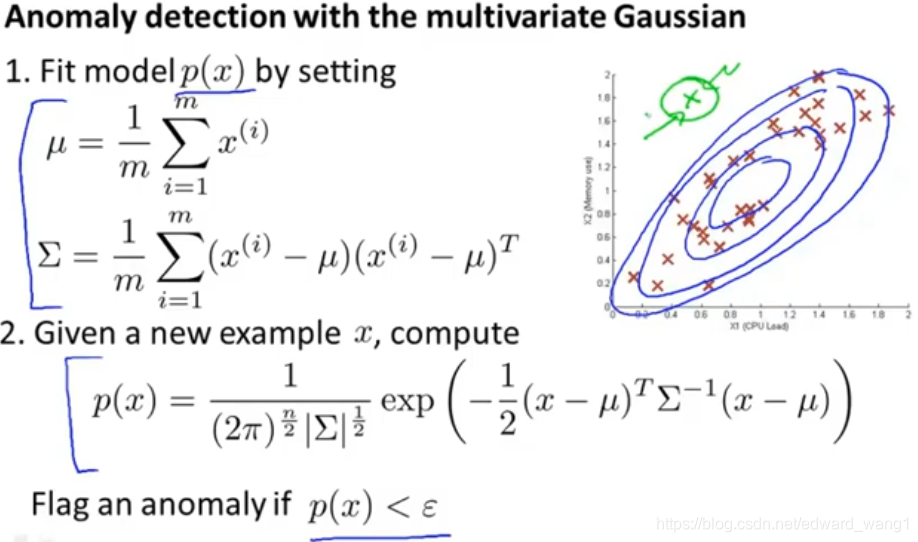

Figure-2 shows the steps of anomaly detection with multivariate Gaussian algorithm.

- First, we take our training set and fit the model

by setting

by setting  and

and  as described in section "Parameters fitting".

as described in section "Parameters fitting". - Next, when you're given a new test example

, the green cross, we need compute

, the green cross, we need compute  using the formula for the multivariate Gaussian distribution.

using the formula for the multivariate Gaussian distribution. - Then, if

, we flag it as an anomaly; otherwise, we don't flag it as an anomaly.

, we flag it as an anomaly; otherwise, we don't flag it as an anomaly.

It turns out, if we were to fit a multivariate Gaussain distribution to this data set (red crosses), you end up with a distribution that places lots of probability in the central regions, slightly less probability in the outer regions. And very low probability at the green cross point. And the green cross example will be correctly flaged as an anomaly.

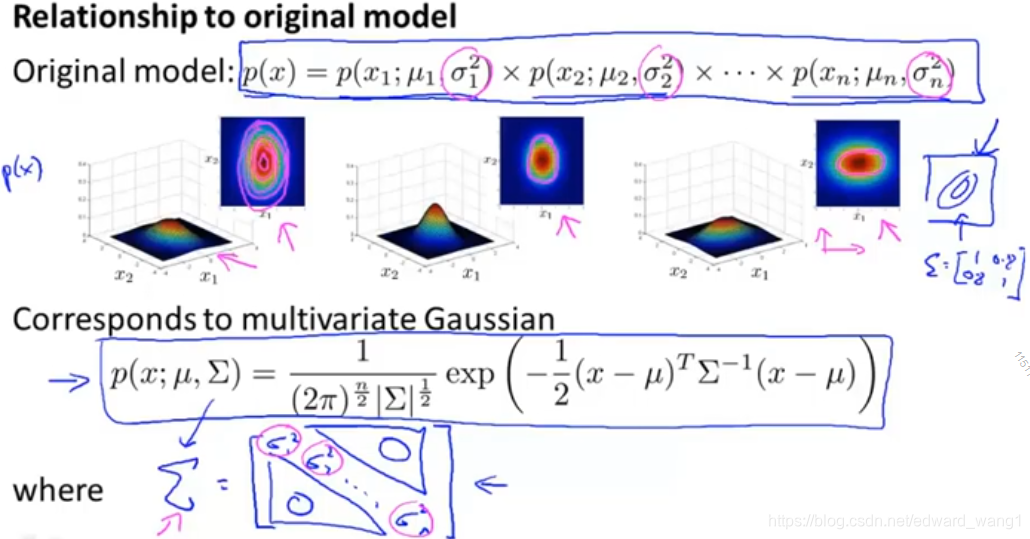

Relationship to original model

The original model corresponds to multivariate Gaussian where the contours of the Gaussian are always axes aligned.

Mathematically, it turns out that the original model

is actually the same as a multivariate Gaussian distribution but with a constraint that everything on the off diagonal of  is 0:

is 0:

if you plug  of original model into

of original model into  , then the two models are actually identical.

, then the two models are actually identical.

So the original model is actually a special case of this multivariate Gaussian model.

Which one to use?

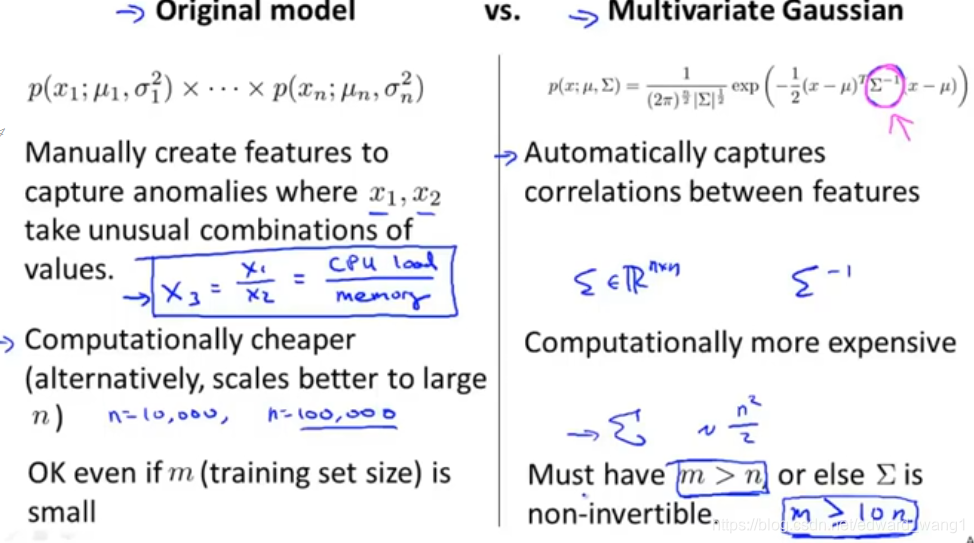

When would you use each of these two models? In general, the original model is probably used somewhat more often; whereas the multivariate Gaussian distribution is used somewhat less but it has the advantage of being able to capture correlations between features. Above figure-4 shows the scenarios.

If the sigma is singular

If you're fitting with multivariate Gaussian and find that  is non-invertible, then there are usually two cases for this:

is non-invertible, then there are usually two cases for this:

- Failed to satisfy

condition

condition - You have redundant features which means that features that are linearly dependent. For example, you had two copies of the same feature; or maybe you have some feature like

.

<end>

1110

1110

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?