When I first popped up this idea of writing something about this new way of product costing in real-time enterprise last year, I was also thinking about other things, like how PLM and MES can effectively and efficiently work together to facilitate an ECO process which is a major process in manufacturing, and how can MES provide sufficient timely data to feed APS. Sorry my main background was in CIMS/MES area, so I'm focusing on the information systems for manufacturing.

The word silos been repeatedly mentioned. Why? Because it's a highly connected manufacturing world,even though apparently no one noticed that in the past when they deploy different application systems which became the application silos commonly. And manufacturers are facing the rapidly changed customer requirements in market place and ever-increasing competition intensity. To be agile, be correct and fast on move is critical to success even survival. And the term real-time,which appears to me, was normally and commonly used in production areas,through function components in such systems as PLC/SCADA/MES, collecting the real time data or status of the production equipment or supporting facilities,finally showing red and greens in the monitors to let supervisors have a clear and real-time view over the production status. Now this term has extended to enterprise and its value chain. Yes, real-time enterprise.

The break of silos and reach the goal of real-time enterprise will need a lot of technologies, which I will assume here in this article are all ready to use. Actually they are. The ideas of ISA95/106, Event Driven architecture, SOA, Discrete manufacturing Reference Architecture and of course BPM. It's just like people are always saying nowadays - the ability of integrate innovations and technologies is more important than the ability of innovate. And here we start.

Here’re 2 major concerns:

1) All these traditional product costing methods hide the very detailed information, which is not paid attention to the past but is more and more important. These methods split product cost into: direct material, direct labor and overhead. The tricky thing or say everything about traditional costing methods is the allocation of overhead, so called overhead rate. It brings in more and more issues when the product mix increasing. Even the activity based costing method, by dividing the manufacturing process into different activity levels then allocate back the cost of each activity level to product cost, still are not sufficient.

2) Also, all these traditional product costing methods has a natural lag in providing cost data, this does notfit the blueprint of real-time enterprise, how it can be real-time if the costing information can’t been visualized in real-time?

So I’m trying to look at it at another way.

The making of a product takes a lot of activities, every activity use material, energy, tool and labor (maybe not all of it) as input to generate some output. The basic rule in the whole discussion here is to track the cost of each activity in the manufacturing and the cost is allocated according to material, energy, tool and labor. Also to remember that activities, might be value added or non-value added. Value added activities add up the value of the WIP, while non-value added activities are just incurring cost.

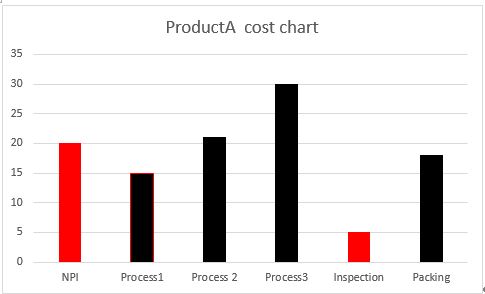

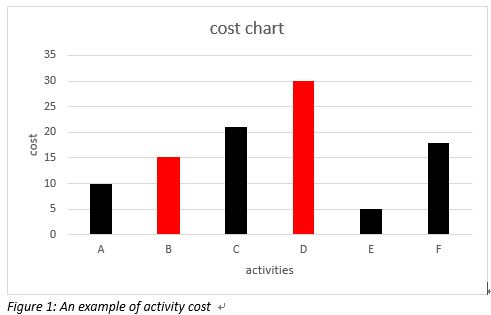

We can draw picture here, to illustrate a fictional cost maps of a product. Use black and red to identify value added and non-value added activities. It shows activity B and D are non-value added.

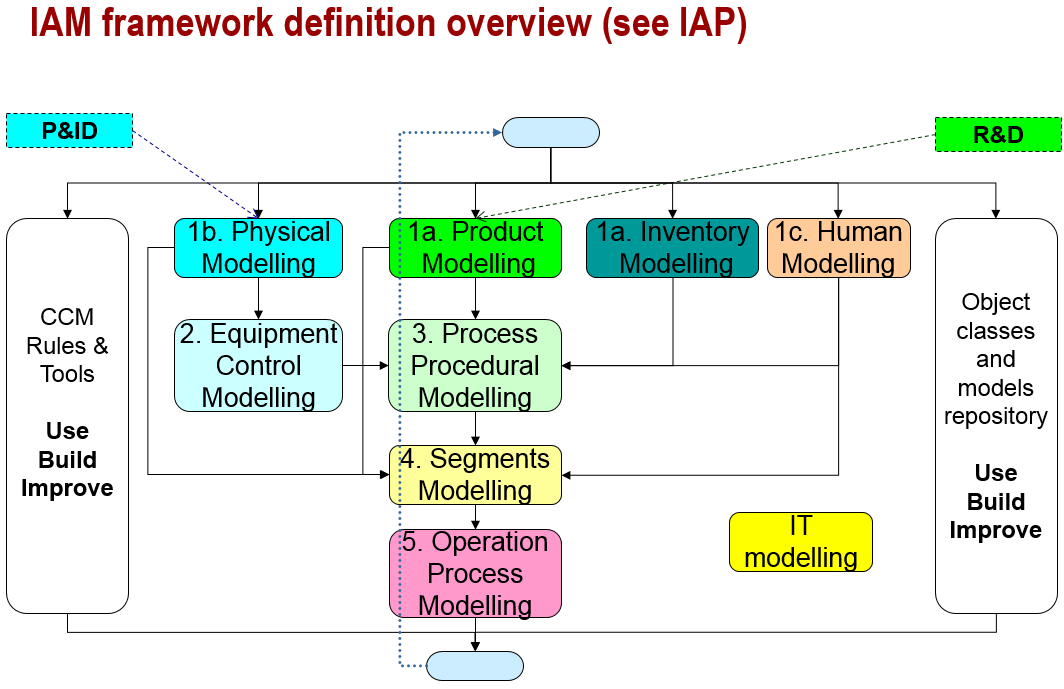

ISA88 breaks down the whole manufacturing of a product into many small process procedurals which are not identical to each other, (see below picture, the process procedural modelling, in the manufacturing process, it is consist of inputs from equipment, labor, inventory and product modelling but the energy part not included).

Figure2: The IAM framework definition overview,

Source:isa8895_overview_introduction_modeling_v3_en

Look at the product cost in a PLM view,there is cost in the design or NPI process, then during production, and later in distribution/service, and so on. Because I want to have the real-time and true cost of a product, and more and more frequently, the manufacturing business are facing the change from MTS/MTO/ATO to ETO in order to keep up with the rapidly changing customer requirements. So the design or NPI cost for a product should be included and allocated to the product itself even before the commissioning of the material lot in the production line begins.

The design, NPI process, or ECO, these’re not directly happening in the manufacturing process, the work and effort staffs have done in these process reflecting the cost of payroll. For these supporting activities/processes, the cost should be accumulated in a cost pool. How much time the R&D engineers spend on designing, process engineer spend on recipe tuning, can be tracked by working time and through link to payroll information in the HR function module. Assume a product kind call ProductA in MM, we book are cord to debit the cost incurred during these supporting activities in NPI process. This cost, according to the nature of the product, we can ‘depreciate’it or just add it up to WIP. In this case we assume it’s an ETO product, we just added it to WIP.

And I think it’s more reasonable that we treat these supporting activity into non-value added, because the design itself doesn't change the status or component of the raw material will be produced.

Then comes to the manufacturing activities in the shop floor.

Material, energy, equipment and labor, we need to track the consumption of these 4 aspects in every process procedure, as detailed as possible, here we will need SCADA/MES these factory system to collect the data and track the data.

For material consumed, no matter it is raw material, purified water, CDA or special gas, we can get the data from the MFCs for each process run.

For energy consumed, there’s also meters at the power control cabinet that data can be collected and accumulated for each process run.

For labor time, if any, can be tracked according to each job.

For equipment time, if any, it's easier,just recording the start and end time.

Then SCADA/MES push the quantity of material consumed, the power used, the labor times and the equipment time information to FICO module after each process run (by product lot or else, it depends) through ESB using B2MML.

After getting the real-time consumption of these 4 aspect, it's possible to summarize cost of each activity by multiplying the unit cost, then a real-time cost chart in the FICO module like Figure 1 can be created, showing the total real cost incurred, real value added and non-value added cost (showing the non-value added cost in order to decrease or eliminate it in the future).

Figure3 ProductA ending cost chart.

Strive for real-time manufacturing enterprise is not easy, like realization of this little piece of real-time product costing idea. But I believe in it, and yet there are still too much detail not mentioned in this discussion. 1) There should be discussions of how to define the unit cost of machine time. It's mainly depreciation of the machine, but there’re idle or machine down time, how to allocate due to different idle reasons. The AM module should be involved in determine the hour rate of machines, cause maintenance and other activities will change constantly how the real hour rate will be. 2) By-product and scrap information is not considered. Definitely the MES system should push the information to ESBtoo. And there’re more.

-------------------------------------------------------------

Following added by Yu at Sep 16th 2013.

The process procedure modelling should go as deep as possible, in a way that each procedure can identify the consumption of at least one of the 4 cost elements.Material, Energy, Equipment and Payroll. If the activity itself can't identify one of the consumption of some elements, the cost report of these elements it could not identify should go to its upper level activities.

So in the end the transactions in FICO module should be: Credit the 4 cost elements, debit the activity's output.

Look at equipment cost in detail.

Equipment cost in this real-time product cost is generated from depreciation. The initial cost of an equipment, including cost of equipment contract negotiation, freight in, installation and so on, should be aggregated into a equipment cost account, and depreciated in a predefined rate, for say 10 years. During operation, it will be gradually depreciated. Any maintenance activity will increase the cost of equipment(The working hours of maintenance engineers, the spare parts used for replacement. )

Thus the total cost of an equipment changes(or say increases all the time during its life cycle.) after each maintenance occurred. Credit the payroll account and spare parts account, debit the equipment total cost account.

The FICO module is responsible for maintaining this 'cost pool' of each equipment, Credit the payroll and material inventory, Debit the account after each maintenance(This will need the AM module to push the maintenance report to FICO module, reporting the working hours and spare parts, then FICO check with HR management for the hour rate of workers, and MM module for the cost of spareparts used.) Thus the hour rate for the equipment will changed, according to the remaining time period of depreciation, it's maintained by FICO module at real-time.

initial cost - depreciated value + maintenance

equipment hour rate = --------------------------------------------------------------

the remaining hours to be depreciated

This depreciation happens all the time, no matter it's idle or production time according to SEMI E10. At every equipment status change, the MES push a report to FICO module, if it's idle to production, the cost should allocate to Idle, if it's production to Idle, it should allocate to products,

For example, a product lot ProductLotA started process in equipment EQ001 at 9:00 am and ended at 9:30.

The MES would report a transaction might as following:

<ProductCostReport_EquipmentTime>

<Activity_Level>Process_Equipment</Activity_Level>

<EQ_ID>EQ001</EQ_ID>

<Process_ID>Process001</Process_ID>

<Start_Time>20130916090000<Start_Time>

<End_Time>20130916093000<End_Time>

<ProductLotID>Lot001</ProductLotId>

Then the FICO module will use the equipment hour rate times half hour, credit the amount get and debit the WIP cost of Lot001 at Process001.

Similarly, there're account for equipment IDLE, equipment Down, it's very useful to monitoring how is the trends.

1694

1694

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?