文章目录

- Introduction

- Data and Sample

- Download Data

- Clean Data

- Extract Estimation Unit and Set Global Variables

- Implement Brogaard Decomposition

- Estimate VAR Coefficients, Matrix B B B, ϵ t \epsilon_t ϵt, Σ e \Sigma_e Σe, and Σ ϵ \Sigma_\epsilon Σϵ

- Estimate 15-step cumulative structural IRFs θ r m \theta_{rm} θrm, θ x \theta_x θx, and θ r \theta_r θr

- Calculate noise term

- Calculate the variance from each component

- Calculate variance contribution

- Pack codes

- Loop over sample

- Conclusion

Introduction

Having recognized the potential of the stock volatility decomposition method introduced by Brogaard et al. (2022, RFS) in my previous blog, I will show how to implement this method to empower your own research in this blog.

For readers with time constraints, the codes for implementing this variance decomposition method can be approched via this link.

As replicating Brogaard et al. (2022, RFS) requires some manipulations on the VAR estimation outputs, I took some time to figure out the theory and estimation of the reduced-form VAR coefficients, Impulse response functions (IRFs), structural IRFS, orthogonalized IRFs, and variance decomposition and summarized what I’ve got in a three-blog series about VAR.

In the first blog, I show the basic logics of VAR model with the simplest 2-variable, 1-lag VAR model. In the second blog, I show how to use var and svar commands to conveniently estimate the VAR model in Stata. In the third blog, I dig deeper, show the theoretical definitions and calculation formula of major outputs in VAR model, and manually calculate them in Stata to thoroughly uncover the black box of the VAR estimation.

For this blog, I will only focus on the paper-specific ideas. Readers who need more background information about VAR estimation can find clues in my three-blog series about VAR.

Data and Sample

The sample used by Brogaard et al. (2022, RFS) consists of all common stocks listed on the NYSE, AMEX, and NASDAQ spanning from 1960 to 2015. Estimation of the VAR model requires daily data on stock returns, market returns, and dollar-signed stock trading volumes.

The reduced-form VAR model below is estimated in stock-year level.

r

m

,

t

=

a

0

∗

+

∑

l

=

1

5

a

1

,

l

∗

r

m

,

t

−

l

+

∑

l

=

1

5

a

2

,

l

∗

x

t

−

l

+

∑

l

=

1

5

a

3

,

l

∗

r

t

−

l

+

e

r

m

,

t

x

t

=

b

0

∗

+

∑

l

=

1

5

b

1

,

l

∗

r

m

,

t

−

l

+

∑

l

=

1

5

b

2

,

l

∗

x

t

−

l

+

∑

l

=

1

5

b

3

,

l

∗

r

t

−

l

+

e

x

,

t

r

t

=

c

0

∗

+

∑

l

=

1

5

c

1

,

l

∗

r

m

,

t

−

l

+

∑

l

=

1

5

c

2

,

l

∗

x

t

−

l

+

∑

l

=

1

5

c

3

,

l

∗

r

t

−

l

+

e

r

,

t

(1)

\begin{aligned} &r_{m, t}=a_0^*+\sum_{l=1}^5 a_{1, l}^* r_{m, t-l}+\sum_{l=1}^5 a_{2, l}^* x_{t-l}+\sum_{l=1}^5 a_{3, l}^* r_{t-l}+e_{r_m, t} \\ &x_t=b_0^*+\sum_{l=1}^5 b_{1, l}^* r_{m, t-l}+\sum_{l=1}^5 b_{2, l}^* x_{t-l}+\sum_{l=1}^5 b_{3, l}^* r_{t-l}+e_{x, t} \\ &r_t=c_0^*+\sum_{l=1}^5 c_{1, l}^* r_{m, t-l}+\sum_{l=1}^5 c_{2, l}^* x_{t-l}+\sum_{l=1}^5 c_{3, l}^* r_{t-l}+e_{r, t} \end{aligned} \tag{1}

rm,t=a0∗+l=1∑5a1,l∗rm,t−l+l=1∑5a2,l∗xt−l+l=1∑5a3,l∗rt−l+erm,txt=b0∗+l=1∑5b1,l∗rm,t−l+l=1∑5b2,l∗xt−l+l=1∑5b3,l∗rt−l+ex,trt=c0∗+l=1∑5c1,l∗rm,t−l+l=1∑5c2,l∗xt−l+l=1∑5c3,l∗rt−l+er,t(1)

where

- r m , t r_{m,t} rm,t is the market return, the corresponding innovation ε r m , t \varepsilon_{r_{m,t}} εrm,t represents innovations in market-wide information

- x t x_t xt is the signed dollar volume of trading in the given stock, the corresponding innovation ε x , t \varepsilon_{x,t} εx,t represents innovations in firm-specific private information

- r t r_t rt is the stock return, the corresponding innovation ε r , t \varepsilon_{r,t} εr,t represents innovations in firm-specific public information

- the authors assume that ε r m , t , ε x , t , ε r , t \\{\varepsilon_{r_m, t}, \varepsilon_{x, t}, \varepsilon_{r, t}\\} εrm,t,εx,t,εr,t are contemporaneously uncorrelated

Download Data

To better serve my research purpose, in this blog I will implement the stock-year level variance decomposition for all common stocks listed on the NYSE, AMEX, and NASDAQ spanning from 2005 to 2021.

The SAS code is as follows. I first log in the WRDS server in SAS. Then I download the daily stock price, trading volume, return, and market return for all common stocks listed on the NYSE, AMEX, and NASDAQ - that’s exactly what the CRSP got. For ease of importing into Stata, I transfer all the downloaded sas dataset into csv format. As the daily CRSP data is too huge, I implement all the above procedures year by year.

libname home "C:\Users\xu-m\Documents\testVAR\rawdata2005-2021sas";

/* log in WRDS server */

%let wrds = wrds.wharton.upenn.edu 4016;

options comamid=TCP remote=WRDS;

signon username=xxx pwd=xxx;

run;

%signoff;

/* download daily stock price, trading volume, return, and market return from CRSP*/

rsubmit;

%macro downyear;

%do year = 2005 %to 2020;

%let firstdate = %sysfunc(mdy(1,1,&year));

%let lastdate = %sysfunc(mdy(12,31,&year));

%put &year;

proc sql;

create table sampleforvar&year as select distinct

cusip, date, ret, prc, vol, numtrd, shrout, hsiccd

from crsp.dsf

where date ge &firstdate and date le &lastdate;

quit;

proc sql;

create table sampleforvar&year as select a.*, b.*

from sampleforvar&year a, crsp.dsi b

where a.date=b.date;

quit;

proc download data=sampleforvar&year out=home.sampleforvar&year; run;

%end;

%mend;

%downyear;

endrsubmit;

/* transfer the downloaded sas dataset into csv format */

%macro expyear;

%do year = 2005 %to 2021;

%let outfile = %sysfunc(cat(C:\Users\xu-m\Documents\testVAR\rawdata2005-2021sas\sampleforvar, &year, .csv));

%let outfile = "%sysfunc(tranwrd(&outfile,%str( ),%str(%" %")))";

proc export data=home.sampleforvar&year outfile=&outfile dbms=csv replace; run;

%end;

%mend;

%expyear;

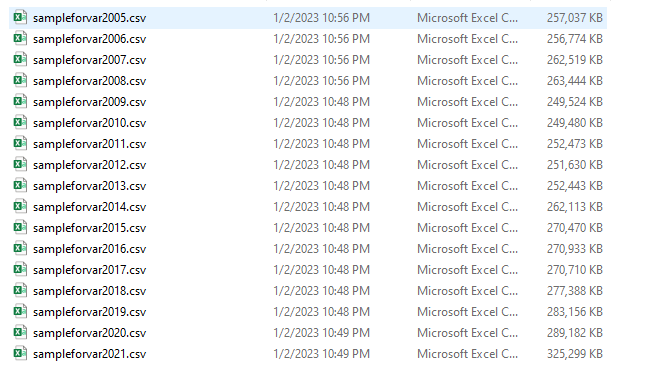

The output of this step is as follows. The raw data for each year is stored in csv file named as sampleforvar + year.

Clean Data

We have two tasks in this step.

- generate the 3 variables

rm,x, andrfor VAR estimation - set time series, which is the prerequisite for using the

svarcommand

Following Brogaard et al. (2022, RFS), the 3 variables for VAR estimation is constructed as follows.

- I use Equal-Weighted Return (

ewretdin CRSP) in basis points as market returnrm - I use the daily Holding Period Return (

retin CRSP) in basis points as stock returnr - I use the daily signed dollar volume in $ thousands as stock order flow

x- The daily signed dollar volume is defined as the product of daily stock price (

prcin CRSP), trading volume (volin CRSP), and the sign of the stocks’ daily return

- The daily signed dollar volume is defined as the product of daily stock price (

To mitigate the impacts of outliers, I winsorized all the above variables at the 5% and 95% levels.

I set the index of trading days within a given stock-year to tag the time series.

The Stata codes are as follows. Note that I use the cusip and year as identifiers. For the convenience of looping over stocks, I generate a unique number cusipcode for each stock.

The output in this step is the yearly dataset named as sampledata +year that is ready for the implementation of the VAR estimation in stock-year level.

* import data

cd C:\Users\xu-m\Documents\testVAR\rawdata2005-2021sas

cap program drop cleanforbrogaard

cap program define cleanforbrogaard

import delimited "sampleforvar`1'.csv",clear

destring ret, force replace

drop if ret==.|prc<0|vol<0

g r = ret*10000

g prcsign = cond(ret>0,1,-1)

g x=vol*prc*prcsign/1000

g rm = ewretd*10000

winsor2 rm x r, cuts(5 95) replace

encode cusip, g(cusipcode)

sort cusipcode date

by cusipcode: g index=_n

xtset cusipcode index

g year = floor(date[1]/10000)

keep cusip cusipcode year index rm x r

save sampledata`1',replace

end

forvalues j = 2005/2021{

cleanforbrogaard `j'

}

Extract Estimation Unit and Set Global Variables

As the VAR estimation is implemented in stock-year level, we need firstly extract the sample for each stock and year with the identifiers cusip and year. All the subsequent manipulations are functioning in the single stock-year dataset as follows.

+----------------------------------------------------------------------+

| cusip r x rm cusipc~e index year |

|----------------------------------------------------------------------|

1. | 00032Q10 266.24 637.6158 54.7 1 1 2020 |

2. | 00032Q10 -1.56 -121.6986 -30.57 1 2 2020 |

3. | 00032Q10 123.44 190.1839 45.48 1 3 2020 |

4. | 00032Q10 233.06 243.7433 -.41 1 4 2020 |

5. | 00032Q10 -599.08 -1396.12 9.139999 1 5 2020 |

|----------------------------------------------------------------------|

6. | 00032Q10 251.22 234.7973 29.41 1 6 2020 |

7. | 00032Q10 -245.06 -288.1359 -12.47 1 7 2020 |

8. | 00032Q10 -178.28 -149.2384 46.14 1 8 2020 |

9. | 00032Q10 -16.5 -76.8955 29.2 1 9 2020 |

10. | 00032Q10 201.65 135.6328 31.06 1 10 2020 |

|----------------------------------------------------------------------|

...

|----------------------------------------------------------------------|

246. | 00032Q10 400 4548.106 -18.55 1 246 2020 |

247. | 00032Q10 -96.15 -1940.581 38.66 1 247 2020 |

248. | 00032Q10 291.26 4240.543 108.42 1 248 2020 |

249. | 00032Q10 -94.34 -937.4673 -2.77 1 249 2020 |

250. | 00032Q10 -285.71 -2000.298 13.5 1 250 2020 |

|----------------------------------------------------------------------|

251. | 00032Q10 -588.24 -2000.485 -84.83 1 251 2020 |

252. | 00032Q10 312.5 1369.296 101.55 1 252 2020 |

253. | 00032Q10 -101.01 -862.252 -10.58 1 253 2020 |

+----------------------------------------------------------------------+

In this step, I also set two global variables that will be repeatedly used in the subsequent procedures.

- the variable names in the VAR system

names - the number of observations in the dataset unit

rownum

The codes for this step are as follows.

* load dataset unit

use sampledata2020,replace

qui keep if cusipcode == 1

list, nolabel

* set global variables

global names "rm x r"

global rownum = _N

Implement Brogaard Decomposition

For now, we’ve collected all the necessary variables, and get the data ready for Brogaard decomposition. Before we actually start to estimate, I would like to provide a big picture for implementing the Brogaard decomposition in a single stock-year dataset.

The tasks we’re going to resolve are as follows.

-

Estimate the reduced-form VAR in Equation (1), saving the residuals e e e and variance/covariance matrix of residuals Σ e \Sigma_e Σe

-

Estimate matrix B B B, which specifies the contemporaneous effects among variables in the VAR system

-

Estimate the structural shocks ϵ t \epsilon_t ϵt and their variance-covariance matrix Σ ϵ \Sigma_\epsilon Σϵ

-

Estimate the 15-step cumulative structural IRFs θ r m \theta_{rm} θrm, θ x \theta_x θx, θ r \theta_r θr, which represent the (permanent) cumulative return responses to unit shocks of the corresponding structural-model innovations

-

Combine the estimated variances of the structural innovations from step 3 with the long-run responses from step 4 to get the variance components and variance shares of each information source using the following formula.

MktInfo = θ r m 2 σ ε r m 2 PrivateInfo = θ x 2 σ ε x 2 PublicInfo = θ r 2 σ ε r 2 . \begin{aligned} \text { MktInfo } &=\theta_{r_m}^2 \sigma_{\varepsilon_{r_m}}^2 \\ \text { PrivateInfo } &=\theta_x^2 \sigma_{\varepsilon_x}^2 \\ \text { PublicInfo } &=\theta_r^2 \sigma_{\varepsilon_r}^2. \end{aligned} MktInfo PrivateInfo PublicInfo =θrm2σεrm2=θx2σεx2=θr2σεr2. -

Estimate the contemporaneous noise term with the following Equation

Δ s = r t − a 0 − θ r m ϵ r m , t − θ x ϵ x , t − θ r ϵ r , t \Delta_s = r_t-a_0-\theta_{rm}\epsilon_{rm,t}-\theta_x\epsilon_{x,t}-\theta_r\epsilon_{r,t} Δs=rt−a0−θrmϵrm,t−θxϵx,t−θrϵr,t

As we’re only interested in the variance of Δ s \Delta_s Δs, which is by construct the variance from noise, we can ignore the constant term a 0 a_0 a0 and use the variance of KaTeX parse error: Undefined control sequence: \* at position 10: \Delta_s^\̲*̲ to represent the noise variance instead, where

KaTeX parse error: Undefined control sequence: \* at position 48: …)=Var(\Delta_s^\̲*̲)\\ \Delta_s^\*… -

Get variance shares by normalizing these variance components

MktInfoShare = θ r m 2 σ ε r m 2 / ( σ w 2 + σ r 2 ) PrivateInfoShare = θ x 2 σ ε x 2 / ( σ w 2 + σ r 2 ) PublicInfoShare = θ r 2 σ ε r 2 / ( σ w 2 + σ r 2 ) NoiseShare = σ s 2 / ( σ w 2 + σ r 2 ) . \begin{aligned} \text { MktInfoShare } &=\theta_{r_m}^2 \sigma_{\varepsilon_{r_m}}^2 /(\sigma_w^2+\sigma_r^2 )\\ \text { PrivateInfoShare } &=\theta_{x}^2 \sigma_{\varepsilon_x}^2 /(\sigma_w^2+\sigma_r^2 ) \\ \text { PublicInfoShare } &=\theta_r^2 \sigma_{\varepsilon_r}^2 /(\sigma_w^2+\sigma_r^2 ) \\ \text { NoiseShare } &=\sigma_s^2 /(\sigma_w^2+\sigma_r^2 ) . \end{aligned} \notag MktInfoShare PrivateInfoShare PublicInfoShare NoiseShare =θrm2σεrm2/(σw2+σr2)=θx2σεx2/(σw2+σr2)=θr2σεr2/(σw2+σr2)=σs2/(σw2+σr2).

Estimate VAR Coefficients, Matrix B B B, ϵ t \epsilon_t ϵt, Σ e \Sigma_e Σe, and Σ ϵ \Sigma_\epsilon Σϵ

I set the lag order as 5 to keep consistent with Broggard et al. (2022, RFS) and then I use svar model to estimate the VAR model, with imposing a Cholesky type restriction to contemporaneous matrix

B

B

B as mentioned in the paper.

The readers can see details about the matrix

B

B

B in Dig into Estimation of VAR Coefficients, IRFs, and Variance Decomposition in Stata and see why svar command can directly estimate it in Estimations of VAR, IRFs, and Variance Decomposition in Stata.

The codes for estimating the reduced-form model are as follows.

* estimate B and coefficients of VAR

matrix A1 = (1,0,0 \ .,1,0 \ .,.,1)

matrix B1 = (.,0,0 \ 0,.,0 \ 0,0,.)

qui svar rm x r, lags(1/5) aeq(A1) beq(B1)

The svar command stores the matrix

B

B

B as e(A), the coefficient matrix as e(b_var) and the variance/covariance matrix of residuals

Σ

e

\Sigma_e

Σe as e(Sigma). So I didn’t estimate them once more but just take them directly from the results of svar estimation.

* store parameter matrix

mat B = e(A)

mat coef = e(b_var)

mat sigma_hat = e(Sigma)

I adjust the freedom of variance/covariance matrix of residuals generated from svar command sigma_hat from

n

n

n to

n

−

1

n-1

n−1 and name the adjusted variance/covariance matrix as sigma_e. It shouldn’t make much difference if the readers ignore this step.

By definition,

ϵ

t

=

B

e

t

\epsilon_t=Be_t

ϵt=Bet

That also implies

Σ

ϵ

=

B

Σ

e

B

\Sigma_\epsilon=B\Sigma_eB

Σϵ=BΣeB

With above formulas, we can calculate the structural shocks

ϵ

t

\epsilon_t

ϵt and their variance/covariance matrix

Σ

ϵ

\Sigma_\epsilon

Σϵ as follows. I stored the structural shocks in a matrix named epsilons and the variance/covariance matrix of structural shocks in a matrix named sigma_epsilon.

** get residuals e_t

foreach var of varlist rm x r{

qui cap predict e_`var', resi equation(`var')

}

** get epsilons

mkmat e_rm e_x e_r, matrix(resi)

mat epsilons = (B*resi')'

* get variance-covariance matrix of residuals and epsilons

mat sigma_e = sigma_hat*_N/(_N-1)

mat sigma_epsilon = B*sigma_e*B'

Estimate 15-step cumulative structural IRFs θ r m \theta_{rm} θrm, θ x \theta_x θx, and θ r \theta_r θr

While the svar command can easily produce the results for IRFs, Orthogonalized IRFs, and Orthogonalized Structural IRFs automatically, what we need are the un-orthogonalized Structural IRFs.

Procedures for estimating θ \theta θ

These un-orthogonalized Structural IRFs can be quickly and conveniently calculated via the following procedures (please see more details in Dig into Estimation of VAR Coefficients, IRFs, and Variance Decomposition in Stata).

- calculate the IRFs Φ i ( i = 1 , 2 , 3... , 15 ) \Phi_i(i=1,2,3...,15) Φi(i=1,2,3...,15) following the following formula, where k k k is the number of variables in the VAR system. A j A_j Aj is the j j j-lag coefficient matrix for the reduced-form VAR

Φ 0 = I k Φ i = Σ j = 1 i Φ i − j A j (2) \Phi_0 = I_k\\ \Phi_i = \Sigma_{j=1}^{i}\Phi_{i-j}A_j \tag{2} Φ0=IkΦi=Σj=1iΦi−jAj(2)

-

post-multiply IRF Φ i \Phi_i Φi with B − 1 B^{-1} B−1 to get (un-orthogonalized) structural IRFs Λ i \Lambda_i Λi for each forward-looking step i = 1 , 2 , 3 , . . , 15 i=1,2,3,..,15 i=1,2,3,..,15

Λ i = Φ i B − 1 (3) \Lambda_i =\Phi_iB^{-1} \tag{3} Λi=ΦiB−1(3) -

Sum all the 15-step (un-orthogonalized) structural IRFs Λ i \Lambda_i Λi to obtain the cumulative structural IRFs.

-

As we are only interested in the 15-step cumulative structural IRFs functioning on the stock returns, which are specified in the third equation in the VAR system, the θ r m \theta_{rm} θrm, θ x \theta_x θx, and θ r \theta_r θr lie on the third row of the 15-step cumulative structural IRF matrix.

Obtain coefficient matrix A j ( j = 1 , 2 , . . . , 5 ) A_j(j=1,2,...,5) Aj(j=1,2,...,5)

To implement the above procedures, the first thing we need to get are the reduced-form coefficient matrix

A

j

(

j

=

1

,

2

,

.

.

.

,

5

)

A_j(j=1,2,...,5)

Aj(j=1,2,...,5). As we have obtained all the reduce-form coefficients with svar command and stored them in a matrix coef in the last step, we don’t have to compute them again but just need to reshape the matrix coef into the shape we need.

The coefficient matrix we currently have coef is a

1

×

48

1\times 48

1×48 matrix. I first reshape it to a

3

×

16

3\times 16

3×16 matrix named newcoef, where each row contains the coefficients for one equation in the VAR system. Within each row, the coefficients are ordered with fixed rules: the coefficients for the first variable rm with 1 to 5 lags, the coefficients for the second variable x with 1 to 5 lags, the coefficients for the third variable x with 1 to 5 lags, and the constant for the corresponding equation. That implies, the coefficients for the same lag can always be found every 5 columns.

With the above observations, I generated matrix A 1 A_1 A1 to A 5 A_5 A5 with the following codes.

* reshape coeficient matrix

cap mat drop newcoef

forvalues i = 1/3{

mat temp= coef[1..1, 1+16*(`i'-1)..16*`i']

mat newcoef = nullmat(newcoef) \ temp

}

* generate a1 to a5

forvalues i = 1/5{

mat A`i' = (newcoef[1..3,`i'], newcoef[1..3,`i'+5], newcoef[1..3,`i'+10])

mat rownames A`i' = $names

mat colnames A`i' = $names

}

I list the 3-lag coefficient matrix A 3 A_3 A3 as an example to show the desired format of coefficient matrix A 1 A_1 A1 to A 5 A_5 A5. For the i j ij ij-th element of the matrix A j A_j Aj, it represents the impact of one-unit reduced-form shock e j t e_{jt} ejt on the Equation with variable i i i as dependent variable.

. mat list A3

A3[3,3]

inflation unrate ffr

inflation -.06574644 .00181085 -.00500138

unrate 1.4581185 .04263687 -1.835178

ffr -.01217184 -.00032878 -.06017122

Calculate IRFs and cumulative un-orthogonalized Structural IRFs

To this stage, we’ve made it clear about the formulas of calculating the IRFs and un-orthogonalized Structural IRFs (please see Equation (2) and (3)) and obtained all the necessary ingredients (coefficient matrix A i A_i Ai and matrix B B B) for the calculations.

The codes for calculating IRFs and cumulative un-orthogonalized Structural IRFs are as follows. I summed up all the un-orthogonalized Structural IRF matrix step by step to get the 15-step cumulative un-orthogonalized Structural IRFs and name it as csirf.

* calculate IRFs and cumulative un-orthogonalized Structural IRFs

mat irf0 = I(3)

mat sirf0 = irf0*inv(B)

mat csirf = sirf0

forvalues i=1/15{

mat irf`i' = J(3,3,0)

forvalues j = 1/5{

if `i' >= `j'{

local temp = `i'-`j'

mat temp2 = irf`temp'*A`j'

mat irf`i' = irf`i'+ temp2

}

}

mat sirf`i' = irf`i'*inv(B)

mat csirf = csirf + sirf`i'

}

mat rownames csirf = $names

Extract θ \theta θ

The 15-step cumulative un-orthogonalized Structural IRF matrix csirf is as follows. The

i

j

ij

ij-th element of this matrix represents the permanent (cumulative) impact of one-unit structural shock

ϵ

j

,

t

\epsilon_{j,t}

ϵj,t on the

i

i

i-th Equation in the VAR system.

. mat list csirf

csirf[3,3]

rm x r

rm 1.0590505 .00356754 .00036924

x 11.662946 .84352094 -1.0125034

r .94265444 .01400394 .76133195

By definition, the elements in the 3rd row of the matrix csirf are

θ

r

m

\theta_{rm}

θrm,

θ

x

\theta_x

θx, and

θ

r

\theta_r

θr respectively.

Thus, we can extract thetas from the matrix csirf and save the thetas into a new matrix named theta.

* extract thetas

mat theta = csirf[3..3, 1..3]

Calculate noise term

As we’ve discussed in the road map, the noise variance is given by the following formula.

KaTeX parse error: Undefined control sequence: \* at position 48: …)=Var(\Delta_s^\̲*̲)\\ \Delta_s^\*…

Intuitively, we need to first calculate

Δ

s

∗

\Delta_s^*

Δs∗ by substracting the combinations of structural shocks

ϵ

t

\epsilon_t

ϵt and the permanent impact of structural shocks on stock returns

θ

\theta

θ from the contemporaneous stock return

r

t

r_t

rt.

As we’ve saved the structural shocks

ϵ

t

\epsilon_t

ϵt in a matrix named epsilons and the permanent impact of structural shocks on stock returns

θ

\theta

θ in a matrix named theta, the contemporaneous noise term

Δ

s

∗

\Delta_s^*

Δs∗ can be calculated with the following codes, where I save the noise term into a matrix named delta_s.

To more conveniently produce the variance of the noise term, I saved the noise term matrix delta_s into a new column named delta_s in the dataset.

* calculate noise

mkmat r, matrix(r)

mat delta_s = r - (theta*epsilons')'

mat colnames delta_s = "delta_s"

svmat delta_s, names(col)

Calculate the variance from each component

Till now, we’ve collected all the ingredients needed to compute the variance contribution of all the four components defined by the Brogaard et al. (2022, RFS).

Firstly, we calculate the variance contribution from three-types of information with the following formula.

MktInfo

=

θ

r

m

2

σ

ε

r

m

2

PrivateInfo

=

θ

x

2

σ

ε

x

2

PublicInfo

=

θ

r

2

σ

ε

r

2

.

\begin{aligned} \text { MktInfo } &=\theta_{r_m}^2 \sigma_{\varepsilon_{r_m}}^2 \\ \text { PrivateInfo } &=\theta_x^2 \sigma_{\varepsilon_x}^2 \\ \text { PublicInfo } &=\theta_r^2 \sigma_{\varepsilon_r}^2. \end{aligned}

MktInfo PrivateInfo PublicInfo =θrm2σεrm2=θx2σεx2=θr2σεr2.

As we’ve saved the thetas in a matrix theta and the variance/covariance matrix of structural shocks

ϵ

t

\epsilon_t

ϵt into a matrix sigma_epsilon, we can calculate the information-based variances as follows.

** calculate information part variance

mat var_epsilon = vecdiag(sigma_epsilon)

mat brogaard = J(1,3,0)

forvalues i = 1/3{

mat brogaard[1,`i']=theta[1, `i']^2*var_epsilon[1, `i']

}

mat brogaard = (brogaard\theta\var_epsilon)

mat rownames brogaard = varpart theta var_epsilon

mat colnames brogaard = $names

Note that I put all the variance components along with the related parameters

θ

\theta

θ and

σ

ϵ

\sigma_\epsilon

σϵ into a new matrix named brogaard. This matrix looks like as follows.

. mat list brogaard

brogaard[3,3]

rm x r

varpart 17851.6 7821.7685 56649.107

theta .94265444 .01400394 .76133195

var_epsilon 20089.638 39884558 97733.84

Secondly, I calculate the variance contribution from noise, which is proxied by the variance of

Δ

s

∗

\Delta_s^*

Δs∗ we’ve calculated above. Of course, I add the noise variance into the result matrix brogaard.

** calculate noise part variance

mat brogaard = (brogaard, J(3,1,0))'

qui sum delta_s

mat brogaard[4,1] = r(sd)^2

mat rownames brogaard = $names "s"

After this step, we’ve figured out the variance contribution from each component defined by the Brogaard paper and saved them into the result matrix brogaard.

The final result matrix brogaard is as follows.

. mat list brogaard

brogaard[4,3]

varpart theta var_epsilon

rm 17851.6 .94265444 20089.638

x 7821.7685 .01400394 39884558

r 56649.107 .76133195 97733.84

s 20275.294 0 0

Calculate variance contribution

To more conveniently calculate the variance contribution, I saved the result matrix brogaard into the dataset. I follow the following formula to calculate the variance contribution of each component and save the percentages into a new variable named varpct.

MktInfoShare

=

θ

r

m

2

σ

ε

r

m

2

/

(

σ

w

2

+

σ

r

2

)

PrivateInfoShare

=

θ

x

2

σ

ε

x

2

/

(

σ

w

2

+

σ

r

2

)

PublicInfoShare

=

θ

r

2

σ

ε

r

2

/

(

σ

w

2

+

σ

r

2

)

NoiseShare

=

σ

s

2

/

(

σ

w

2

+

σ

r

2

)

.

\begin{aligned} \text { MktInfoShare } &=\theta_{r_m}^2 \sigma_{\varepsilon_{r_m}}^2 /(\sigma_w^2+\sigma_r^2 )\\ \text { PrivateInfoShare } &=\theta_{x}^2 \sigma_{\varepsilon_x}^2 /(\sigma_w^2+\sigma_r^2 ) \\ \text { PublicInfoShare } &=\theta_r^2 \sigma_{\varepsilon_r}^2 /(\sigma_w^2+\sigma_r^2 ) \\ \text { NoiseShare } &=\sigma_s^2 /(\sigma_w^2+\sigma_r^2 ) . \end{aligned} \notag

MktInfoShare PrivateInfoShare PublicInfoShare NoiseShare =θrm2σεrm2/(σw2+σr2)=θx2σεx2/(σw2+σr2)=θr2σεr2/(σw2+σr2)=σs2/(σw2+σr2).

keep cusip year

qui keep in 1/4

qui svmat brogaard, names(col)

qui g rownames = ""

local index = 1

foreach name in $names "s"{

qui replace rownames = "`name'" if _n == `index'

local index = `index' + 1

}

egen fullvar = sum(varpart)

qui g varpct = varpart/fullvar*100

Pack codes

Remember the Broggard decomposition is implemented in stock-year level. That means we need to loop over the above codes over the daily observations of each stock in each year. That requires an efficient packing of the codes.

There are two issues worth noted in the packing procedures.

- I require there are at least 50 observations for the estimation of the VAR model

- otherwise, the VAR estimation doesn’t converge or lacks vaidility with too few freedoms

- I require the estimation of VAR model converges

- otherwise, it’s not possible to get converged residuals, which are the prerequisite for the subsequent calculations

cap program drop loopb

cap program define loopb

use sampledata`2',replace

qui keep if cusipcode == `1'

if _N >= 50{

* set global variables

global names "rm x r"

global rownum = _N

* estimate B and coefficients of VAR

matrix A1 = (1,0,0 \ .,1,0 \ .,.,1)

matrix B1 = (.,0,0 \ 0,.,0 \ 0,0,.)

qui svar rm x r, lags(1/5) aeq(A1) beq(B1)

mat B = e(A)

mat coef = e(b_var)

mat sigma_hat = e(Sigma)

* get coefficient matrix of var a1-a5

* reshape coeficient matrix

cap mat drop newcoef

forvalues i = 1/3{

mat temp= coef[1..1, 1+16*(`i'-1)..16*`i']

mat newcoef = nullmat(newcoef) \ temp

}

* generate a1 to a5

forvalues i = 1/5{

mat A`i' = (newcoef[1..3,`i'], newcoef[1..3,`i'+5], newcoef[1..3,`i'+10])

mat rownames A`i' = $names

mat colnames A`i' = $names

}

* get 15-step coefficients of VMA (irf), structual irf (sirf), and cumulative sirf

mat irf0 = I(3)

mat sirf0 = irf0*inv(B)

mat csirf = sirf0

forvalues i=1/15{

mat irf`i' = J(3,3,0)

forvalues j = 1/5{

if `i' >= `j'{

local temp = `i'-`j'

mat temp2 = irf`temp'*A`j'

mat irf`i' = irf`i'+ temp2

}

}

mat sirf`i' = irf`i'*inv(B)

mat csirf = csirf + sirf`i'

}

* extract thetas

mat theta = csirf[3..3, 1..3]

* get reisduals, epsilons, and their variance-covariance matrix

** get residuals

foreach var of varlist rm x r{

qui cap predict e_`var', resi equation(`var')

}

capture confirm variable e_rm

if (_rc == 0){

** get epsilons

mkmat e_rm e_x e_r, matrix(resi)

mat epsilons = (B*resi')'

** get variance-covariance matrix of residuals and epsilons

mat sigma_e = sigma_hat*_N/(_N-1)

mat sigma_epsilon = B*sigma_e*B'

* calculate noise

mkmat r, matrix(r)

mat delta_s = r - (theta*epsilons')'

mat colnames delta_s = "delta_s"

svmat delta_s, names(col)

* calculate variance decomposition of each part

** calculate information part variance

mat var_epsilon = vecdiag(sigma_epsilon)

mat brogaard = J(1,3,0)

forvalues i = 1/3{

mat brogaard[1,`i']=theta[1, `i']^2*var_epsilon[1, `i']

}

mat brogaard = (brogaard\theta\var_epsilon)

mat rownames brogaard = varpart theta var_epsilon

** calculate noise part variance

mat brogaard = (brogaard, J(3,1,0))'

qui sum delta_s

mat brogaard[4,1] = r(sd)^2

mat rownames brogaard = $names "s"

*mat list brogaard

** save the variance decomposition results

keep cusip year

qui keep in 1/4

qui svmat brogaard, names(col)

qui g rownames = ""

local index = 1

foreach name in $names "s"{

qui replace rownames = "`name'" if _n == `index'

local index = `index' + 1

}

egen fullvar = sum(varpart)

qui g varpct = varpart/fullvar*100

* save final results

local savename = "C:\Users\xu-m\Documents\testVAR\resvardecompose\brogaard_'$cusip'_$year.dta"

qui save "`savename'", replace

}

}

end

Loop over sample

I run the packed code over stocks in each year and collected all the results for different years together. Then I reshaped the dataset into panel data. The codes are as follows.

cd C:\Users\xu-m\Documents\testVAR\resvardecompose

* collect results for each year

cap program drop collectbroggardbyyear

cap program define collectbroggardbyyear

clear

set obs 0

save brogaard`1', replace emptyok

local ff : dir . files "*_`1'.dta"

local yearnum : word count "`ff'"

local index = 1

foreach f of local ff {

append using "`f'"

di "`index' of `yearnum' in year `1'"

local index = `index' + 1

}

save brogaard`1', replace

end

* collect all years

clear

set obs 0

save ../brogaard, replace emptyok

forvalues year = 2005/2021{

collectbroggardbyyear `year'

use ../brogaard, replace

append using brogaard`year'

save ../brogaard, replace

}

* reshape into panel data

cd ../

use brogaard, replace

rename fullvar_r sdr

replace rownames = "_"+rownames

reshape wide varpart theta var_epsilon fullvar varpct sdr, i(cusip year) j(rownames) string

rename varpct_rm mktinfo

rename varpct_x privteinfo

rename varpct_r publicinfo

rename varpct_s noise

keep cusip year *info noise

save panelbrogaard, replace

The final outcome is as follows.

. list in 1/20

+-------------------------------------------------------------+

| cusip year public~o mktinfo noise privte~o |

|-------------------------------------------------------------|

1. | 00030710 2014 .4612017 17.60379 58.85497 23.08004 |

2. | 00030710 2015 43.65164 10.60914 12.57214 33.16709 |

3. | 00030710 2016 41.93059 13.32436 6.182855 38.5622 |

4. | 00030710 2017 54.59381 1.191425 14.96389 29.25087 |

5. | 00030710 2018 43.838 25.09339 8.907529 22.16108 |

|-------------------------------------------------------------|

6. | 00030710 2019 30.02275 25.98764 12.31215 31.67746 |

7. | 00032Q10 2018 18.90079 23.99627 36.99344 20.10949 |

8. | 00032Q10 2019 59.49644 5.478648 11.91035 23.11457 |

9. | 00032Q10 2020 55.21476 17.3996 19.76192 7.623722 |

10. | 00032Q10 2021 51.75403 25.38084 12.44535 10.41978 |

|-------------------------------------------------------------|

11. | 00036020 2005 40.70956 7.924543 26.06547 25.30043 |

12. | 00036020 2006 38.53111 21.68062 6.496971 33.29131 |

13. | 00036020 2007 32.78075 4.495751 27.55989 35.1636 |

14. | 00036020 2008 21.36486 47.52046 16.44107 14.6736 |

15. | 00036020 2009 34.37528 31.25706 17.96114 16.40653 |

|-------------------------------------------------------------|

16. | 00036020 2010 39.55574 34.02036 8.709065 17.71484 |

17. | 00036020 2011 21.50586 17.19429 46.27998 15.01987 |

18. | 00036020 2012 52.9045 11.12552 11.89774 24.07223 |

19. | 00036020 2013 12.02968 14.62235 16.48395 56.86403 |

20. | 00036020 2014 31.94392 42.19098 8.426245 17.43885 |

+-------------------------------------------------------------

Conclusion

In this blog, I replicated the stock volatility decomposition method introduced by Brogaard et al. (2022, RFS). Given the potential of this information-based decomposition method as I’ve discussed in Theory for the information-based decomposition of stock price, I hope this blog can help the readers make use of this method to empower their own research.

2837

2837

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?