Abstract

we attempt to determine if firms that select their entry mode based on transaction cost, institutional context, and cultural context variables perform better than firms that make other mode choices.

Firms whose mode choice could be predicted by the extended transaction cost model performed significantly better, on both financial and non-financial measures, than did firms whose mode choice could not be predicted by the extended transaction cost model. Implications for future research are discussed.

Introduction

The objective of this paper is to enhance our understanding of the impact of transaction cost, institutional and cultural context variables on international entry mode choice and mode performance.

First, we provide a theoretical and empirical extension to the work of Brouthers and Brouthers (2000) and Delios and Beamish (1999), in determining entry mode choice based on institutional context, cultural context, as well as transaction cost variables.

Second, building on the work of Brouthers et al. (1999) and Shaver (1998), we explore the normative value of this extended transaction cost model by comparing the financial and non-financial performance of mode choices that are predicted by the extended transaction cost model with the performance of other mode choices

ENTRY MODE CHOICE

Hypothesis 1: Firms perceiving high transaction costs (high finding, negotiation and monitoring costs) in a market tend to use wholly owned modes while firms perceiving low transaction costs tend to use joint venture modes.

Hypot hesis 2: Firms making high asset specific investments tend to use wholly owned modes of entry while firms making low asset specific investments tend to use joint venture modes.

Hypothesi s 3: Firms entering countries with few legal restrictions on mode of entry tend to use wholly owned modes while firms entering countries with many legal restrictions on mode of entry tend to use joint venture modes.

Hypothesi s 4: Firms entering markets characterized by low investment risk tend to use wholly owned modes of entry while firms entering markets where investment risk is high tend to use joint venture modes.

Hypothesi s 5: Firms entering high growth markets tend to use wholly owned modes of entry while firms entering less rapidly growing markets tend to use joint venture modes.

MODE CHOICE AND PERFORMANCE

- Hypothesi s 6: Entry modes that can be predicted by transaction cost, institutional, and cultural context considerations, tend to perform better than entry modes that cannot be predicted by these variables.

METHODOLOGY

Data

To test the hypotheses outlined above, a sample of European Union (EU) firms was selected. With the assistance of a CD-ROM database (AMADEUS), a selection of the 1000 largest EU companies was made.

A total of two hundred thirteen questionnaires were returned (21%), providing a total of one hundred seventy-eight entries into foreign markets (the remaining thirty-five responding firms declined to participate in the study).

One hundred twenty one of these entries were for manufacturing firms fifty-seven entries were for service firms. One hundred nine (61%) of the entries were wholly owned, forty-seven (26%) of the entries were through joint ventures, ten (6%) of the entries were by license agreement and twelve (7%) of the firms utilized export modes. Respondents made investments in 27 different countries (mostly developing and transitional economies) with only two countries receiving more than 10% of the investments.

Dependent variables

First, in testing the extended transaction cost mode l of mode cho ice, our dependent variable, entry mode, consisted of two mode type s (1) wholly owned subsidiaries, and (2) joint ventures.

Wholly owned modes (95% or more ownership), joint ventures (5%–94% ownership), independent modes (such as license agreements ), or exporting.

The second dependent variable, mode performance, was captured using subjective measures.

Subjective financial measures of performance: But financial measures may be of limited importance to firms because (1) the subsidiary may not have been formed to generate financial gains (i.e., R&D subsidiaries ), or (2) because of timing differences (i.e., financial performance lags start-up)

Subjective non-financial measures of performance: For our sample of firms, these subjective non-financial measures of performance should provide valuable information on the progress of the new subsidiary toward meeting parent firms’goals and objectives.

three financial measures of mode performance – sale s level, profitability, and sales growth – and four non-financia l measures – market share, marketing, reputation, and market access.

Respondents evaluate d each mode performance measure on a scale of 1 “does not meet expectations at all” to 10 “meets expectations completely.” Factor analysis con firmed that two mode performance dimensions we re present: financial ( a = 0.82) and non-financial ( a = 0.87) .

Independent variables

Transaction costs were measured with two different variables .

First, general transaction costs included a set of two Likert-type questions which examined the cos ts of searching for and negotiating with a potential partner and the costs of making and enforcing contract s in the target market, compared with the home market (Cronbach a = 0.73). Second , asset specificity was measured as the percentage of sales spent on R&D .

institutional context variable that differentiates international entry mode choice from domestic choice is the level of legal restrictions on foreign ownership.

Two cultural context variables we re included : market potential and investment risk.

Market potential was measured using a single Likert-type question that asked about the market potential of the target market (Taylor et al., 1998) .

Investment risk was measured with a set of four Likert-type questions that examined both t he need for location-specific knowledge and the need to minimize resource commitment

These question s examined (1) t he risk of converting and repatriating profits , (2) nationalization risks, (3) cultural similarity, and (4) the stability of the political, social and economic conditions in the target market ( a = 0.72)

Three control variables

- firm size,

- international experience

- industrial sector.

Firm size was measured as thenumber of employees worldwide (Erramilli & Rao,1993; Gatignon & Anderson, 1988). International experience was measured as the number of years experience doing business outside the home country (Brouthers et al., 1999).

FINDINGS

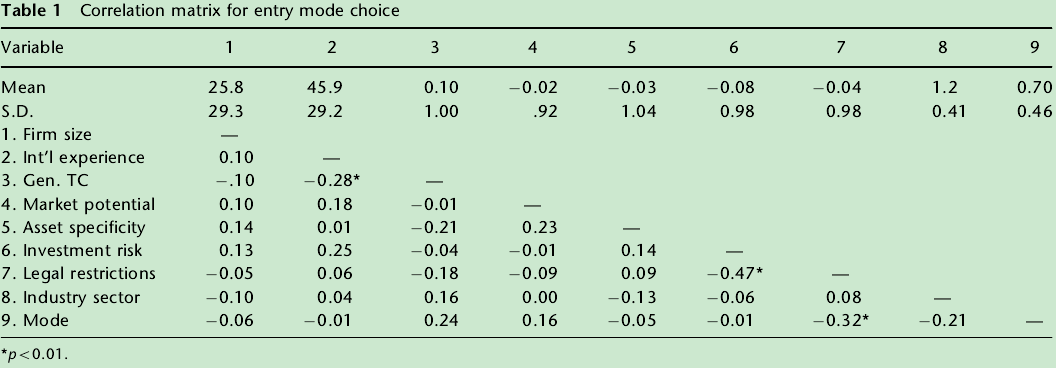

a correlation test of multicollinearity

there were several stati-stically significant relationships. However, none ofthe relationships appeared to be large enough towarrant concern for multicollinearity (Hair et al.,1995).

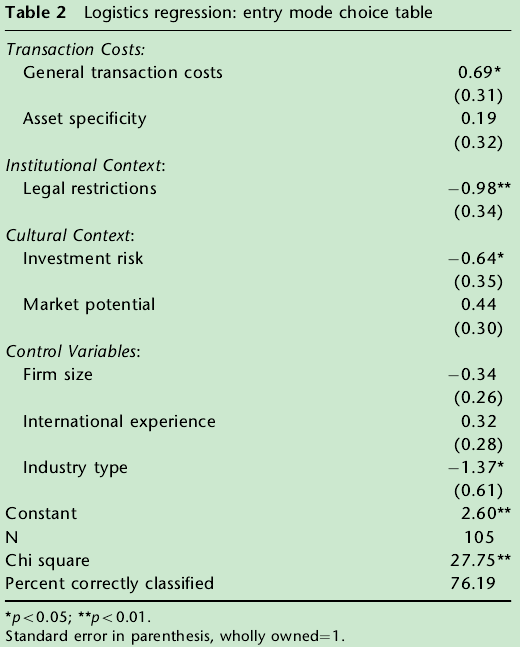

logistics regression–H1:H5

Hypothesis 1: Firms perceiving high transaction costs (high finding, negotiation and monitoring costs) in a market tend to use wholly owned modes while firms perceiving low transaction costs tend to use joint venture modes.

Hypot hesis 2: Firms making high asset specific investments tend to use wholly owned modes of entry while firms making low asset specific investments tend to use joint venture modes.

Hypothesi s 3: Firms entering countries with few legal restrictions on mode of entry tend to use wholly owned modes while firms entering countries with many legal restrictions on mode of entry tend to use joint venture modes.

Hypothesi s 4: Firms entering markets characterized by low investment risk tend to use wholly owned modes of entry while firms entering markets where investment risk is high tend to use joint venture modes.

Hypothesi s 5: Firms entering high growth markets tend to use wholly owned modes of entry while firms entering less rapidly growing markets tend to use joint venture modes.

First, the basic trans-action cost hypothesis (H1) was supported, firms that perceived higher levels of transaction costs tended to use wholly owned modes of entry.Second, the institutional context hypothesis was supported (H3) , firms entering markets characterized by high legal restrictions tended to use joint venture modes of entry. Finally, one of the cultural context hypotheses was also supported (H4) , firms that perceived high levels of investment risk tended to use joint venture modes of entry. Consistent with past transaction cost studies (e.g., Delios &Beamish, 1999; Taylor et al., 1998; Cleeve, 1997;Hennart, 1991) we found no support for the asset specificity measure (H2), nor was support found for the market potential measure (H5), although both variables were correctly signed.

mode performance hypothesis (H6)

entry mode fit

In stage one of this process logistics regression is used to separate firms into two groups. Group one contained those firms whose entry mode choices were predicted by the extended transaction cost model (the fit group).Group two contained those firms whose entry mode choices were not predicted by the model(non-fit group). Based on this analysis a dummy variable (called “entry mode fit”) was developed.

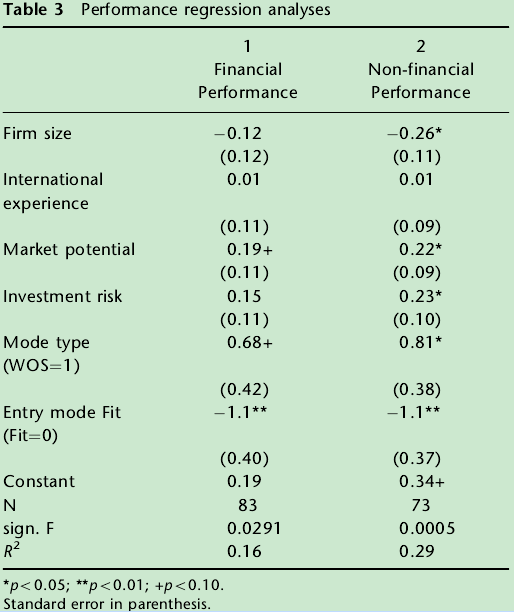

two multiple regressiontests

Regression Model 1 (Table 3)shows that financial mode performance appears to be significantly (po0.0291, r2?0.16) related to entrymode fit (po0.01), market potential (po0.10), and mode type (po0.10). Specially, we found that firms reported higher mode performance when they utilized the entry mode predicted by the extended transaction cost model, when they entered markets with higher market potential, and when they used wholly owned modes.

Model 2 (Table 3)examined the impact of entry mode fit and thefive control variables on non-financial mode per-formance. Model 2 was significant (po0.0005) andhad a higher r2(0.29) than did the financial modeperformance regression analysis.

Firms reported significantly higher satisfaction with non-financial mode performance when the entry mode used fit the extended transaction cost model (po0.01), when market potential was high(po0.05), for firms using wholly owned modes (po0.05), when investment risk was high (po0.05),and for smaller sized firms (po0.05).

VIF

In each of the regression tests, variance inflationfactors (VIF) were examined to determine the exis-tence of multicollinearity. None of the VIF scores

CONCLUSIONS, LIMITATIONS, IMPLICATIONS

CONCLUSIONS

extended transaction cost model

The few studies that have attempted to investigate firm performance and mode choice have suffered from an endogeneity problem (not included mode selection criteria),and have examined mainly financial performance measures. This study addressed each of these limitations and attempted to extend our under-standing of entry mode choice and performance.

- our results suggest that mode selection appears to be driven by a combination of general transaction cost characteristics, institutional context (legal restrictions), and cultural context (investment risk) variables. Hence, this study provides additional support for those scholars (Brouthers & Brouthers, 2000; Delios & Beamish, 1999; Kogut & Singh, 1988; North, 1990) who suggested that the explanatory power of transaction cost models of mode choice could be improved by including aspects of both the institutional and cultural context.

- we can begin to answer the question about the influence of mode choice on firm performance.

We found firms that used modes predicted by the extended transaction cost model reported significantly better mode performance, in terms of both financial and non-financial mode performance, than did firms whose entry mode choice could not be predicted by the extended transaction cost model. In addition, we found that mode type(wholly owned or joint venture) and market potential were also significantly related to our two measures of performance.

Finally, we found that“smaller” EU 1000 firms and firms entering markets characterized by high investment risk tended to rate non-financial performance higher than did larger firms and firms entering less risky markets,although there were no significant differences for the financial performance measure. These differences between the financial performance and non-financial performance models may be caused by timing differences, since financial mode performance may be more difficult to measure for relatively newer international investments.

LIMITATIONS

- First, since this study involved only very large EU firms the findings may not be applicable to small and medium sized firms or to firms outside the EU.

- the results we are getting may be biased due to target countries being entered and may not represent mode performance implications in the developed, larger markets of the world.Future studies may want to gather information on developed market entries and mode performance for comparative purposes.

- Another methodological limitation includes the timing of data gathering. While the most recent entry mode was studied to minimize the time between establishment and completion of the survey instrument, in many cases the time spread was a year or more. Because of this, our study may suffer from recall and memory biases ,future studies couldgo a long way by examining entry mode decisions as they are made, thus reducing time based biases.

- Future studies may extend our understanding of entry mode selection and performance by building on these theories and combining them with the model presented in this paper.

- Future research may wish to explore, both theoretically and empirically, how successful and unsuccessful experiences with various mode types(wholly owned, joint venture etc.) may impact entry mode choice decisions.

- Future entry mode research may want to address this important issue by developing and testing a model of transaction cost mode choice adjusted for differing managerial risk preferences.

IMPLICATIONS

although further research is needed, it is beginning to appear that extending the transaction cost model of international entry mode selection to include both institutional and cultural context variables may help increase the usefulness of the model in the international arena.

The second important managerial implication of our study regards normative aspects of entry mode selection. In addition, non-financial performance also appears to be enhanced by considering both the efficiency (transaction costs) and value enhancement (institutional and cultural context) potential of alternative mode choices.

NOTES

Scott (1995) conceptualizes institutional forces into three distinct groups, regulative, normative and cognitive. Regulative forces include laws and rules.Normative forces include values and norms. Cognitive forces are the frames or conception of reality by which meaning is made. Regulative forces have their root in economics, while normative and cognitive forces are rooted in sociology ( Peng & Heath, 1996). In this study we concentrate on the economic forces of institutional theory (regulative forces) since these forces are most commonly found in entry mode research .

855

855

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?