import pandas as pd

import pywt

import matplotlib.pyplot as plt

import numpy as np

from scipy.special import factorial # Import factorial function

# Function for noise estimation

def estimate_noise_std(coefficients, scales):

low_activity_scales = scales[:5]

noise_region = coefficients[:5, :]

noise_std = np.std(noise_region)

return noise_std, noise_region

# Function for Morse wavelet

def morse_wavelet(t, beta, gamma):

return (2**(beta/gamma)) * (gamma**(beta)) * t**(beta - 1) * \

np.exp(-gamma * t) * np.exp(-0.5 * t**2) / factorial(beta - 1)

# Function for maxima detection

def find_maxima(coefficients, scales, noise_std=None, percentile_threshold=None):

maxima_points = []

if noise_std:

threshold = noise_std * 3

maxima_points = np.where(np.abs(coefficients) > threshold)

elif percentile_threshold:

threshold = np.percentile(np.abs(coefficients), percentile_threshold)

maxima_points = np.where(np.abs(coefficients) > threshold)

else:

print("Error: Specify either a noise_std or percentile_threshold")

return maxima_points

# Step 1: Read Excel data into a DataFrame

file_path = 'sp_500.xlsx' # Replace with your file path

df = pd.read_excel(file_path)

# Step 2: Specify the wavelet function

wavelet = 'morl' # Use the Morlet wavelet

# Step 3: Extract data for the entire dataset

pe_ratio_values = df['value'].tolist()

years = pd.to_datetime(df['Date']).dt.year.tolist()

# Perform wavelet analysis

coeffs, freqs = pywt.cwt(pe_ratio_values, scales=np.arange(1, 128), wavelet=wavelet)

# Noise estimation

noise_std, noise_region = estimate_noise_std(coeffs, freqs)

# Maxima detection

maxima_points = find_maxima(coeffs, freqs, noise_std=noise_std)

# Create common x-values for plotting

x_values = np.arange(len(pe_ratio_values))

# Plot the wavelet analysis results

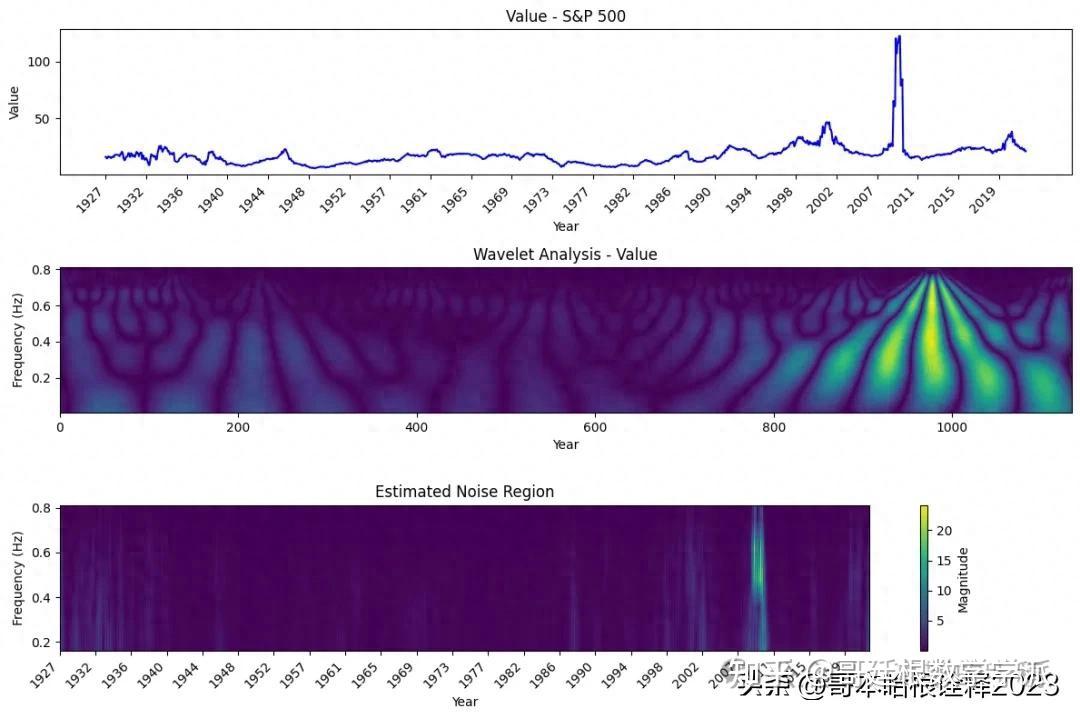

plt.figure(figsize=(12, 8))

# Plot the original PE ratio with years on the x-axis

plt.subplot(3, 1, 1)

plt.plot(x_values, pe_ratio_values, color='blue')

plt.title('Value - S&P 500')

plt.xlabel('Year')

plt.ylabel('Value')

plt.xticks(x_values[::50], years[::50], rotation=45, ha='right') # Show every 50th year for better visibility

# Plot the wavelet coefficients

plt.subplot(3, 1, 2)

plt.imshow(np.abs(coeffs), aspect='auto', extent=[0, len(pe_ratio_values), freqs[-1], freqs[0]], cmap='viridis', interpolation='bilinear')

plt.title('Wavelet Analysis - Value')

plt.xlabel('Year')

plt.ylabel('Frequency (Hz)')

# Plot the estimated noise region

plt.subplot(3, 1, 3)

plt.imshow(np.abs(noise_region), aspect='auto', extent=[0, len(pe_ratio_values), freqs[4], freqs[0]], cmap='viridis', interpolation='bilinear')

plt.title('Estimated Noise Region')

plt.xlabel('Year')

plt.ylabel('Frequency (Hz)')

plt.colorbar(label='Magnitude')

plt.xticks(x_values[::50], years[::50], rotation=45, ha='right') # Show every 50th year for better visibility

plt.tight_layout()

plt.show()

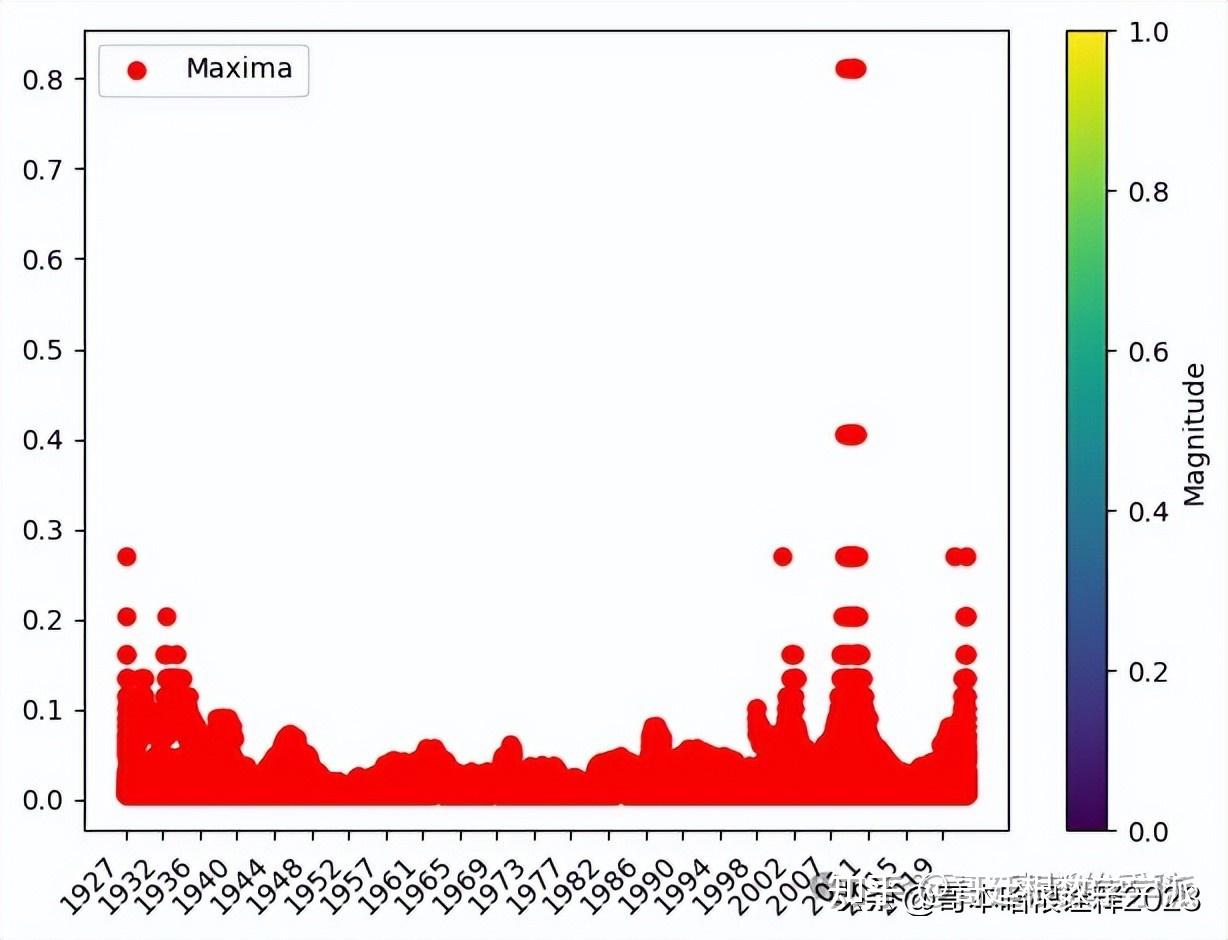

# Mark maxima points on the plot if any are found

if maxima_points:

plt.scatter(maxima_points[1], freqs[maxima_points[0]], color='red', marker='o', label='Maxima')

# Adjust x-axis ticks and labels

plt.xticks(x_values[::50], years[::50], rotation=45, ha='right')

plt.colorbar(label='Magnitude')

plt.legend()

plt.tight_layout()

plt.show()

import pandas as pd

import pywt

import matplotlib.pyplot as plt

import numpy as np

# Step 1: Read Excel data into a DataFrame

file_path = 'sp_500.xlsx' # Replace with your file path

df = pd.read_excel(file_path)

# Step 2: Specify the wavelet function

wavelet = 'morl' # Use the Morlet wavelet

# Step 3: Extract data for the entire dataset

pe_ratio_values = df['value'].tolist()

years = pd.to_datetime(df['date']).dt.year.tolist()

# Perform wavelet analysis

coeffs, freqs = pywt.cwt(pe_ratio_values, scales=np.arange(1, 128), wavelet=wavelet)

# Create common x-values for plotting

x_values = np.arange(len(pe_ratio_values))

# Plot the wavelet analysis results

plt.figure(figsize=(12, 8))

# Plot the original PE ratio with years on the x-axis

plt.subplot(2, 1, 1)

plt.plot(x_values, pe_ratio_values, color='blue')

plt.title('Value - S&P 500')

plt.xlabel('Year')

plt.ylabel('Value')

plt.xticks(x_values[::50], years[::50], rotation=45, ha='right') # Show every 50th year for better visibility

# Plot the wavelet coefficients

plt.subplot(2, 1, 2)

plt.imshow(np.abs(coeffs), aspect='auto', extent=[0, len(pe_ratio_values), freqs[-1], freqs[0]], cmap='viridis', interpolation='bilinear')

plt.title('Wavelet Analysis - Value')

plt.xlabel('Year')

plt.ylabel('Frequency (Hz)')

# Adjust x-axis ticks and labels

plt.xticks(x_values[::50], years[::50], rotation=45, ha='right')

plt.colorbar(label='Magnitude')

plt.tight_layout()

plt.show()

import pandas as pd

import pywt

import matplotlib.pyplot as plt

import numpy as np

# Step 1: Read Excel data into a DataFrame

file_path = 'nifty50.xlsx'

df = pd.read_excel(file_path, sheet_name=0) # Assuming data is in the first sheet

# Step 2: Specify the wavelet function

wavelet = 'morl' # Use the Morlet wavelet

# Step 3: Extract data for the entire dataset

last_price_values = df['LastPrice'].tolist()

years = pd.to_datetime(df['Date']).dt.year.tolist()

# Determine the length of the dataset

data_length = len(last_price_values)

# Determine the range of scales based on the length of the dataset

max_scale = min(128, data_length) # Limit the maximum scale to avoid exceeding the length of the dataset

scales = np.arange(1, max_scale)

# Perform wavelet analysis

coeffs, freqs = pywt.cwt(last_price_values, scales=scales, wavelet=wavelet)

# Create common x-values for plotting

x_values = np.arange(data_length)

# Plot the wavelet analysis results

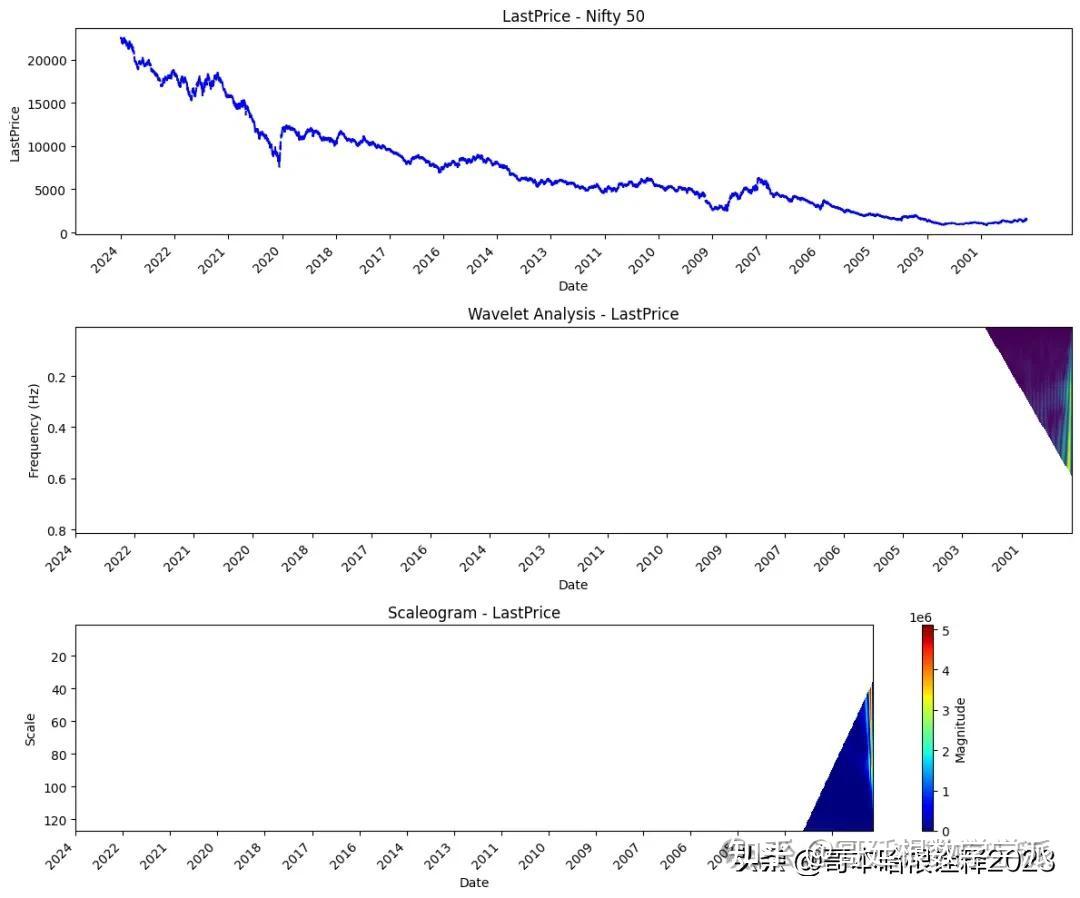

plt.figure(figsize=(12, 10))

# Plot the original LastPrice with years on the x-axis

plt.subplot(3, 1, 1)

plt.plot(x_values, last_price_values, color='blue')

plt.title('LastPrice - Nifty 50')

plt.xlabel('Date')

plt.ylabel('LastPrice')

plt.xticks(np.arange(0, len(x_values), 500), [years[idx] for idx in range(0, len(x_values), 500)], rotation=45, ha='right') # Show every 500th year for better visibility

# Plot the wavelet coefficients

plt.subplot(3, 1, 2)

plt.imshow(np.abs(coeffs), aspect='auto', extent=[0, data_length, freqs[0], freqs[-1]], cmap='viridis', interpolation='bilinear')

plt.title('Wavelet Analysis - LastPrice')

plt.xlabel('Date')

plt.ylabel('Frequency (Hz)')

plt.xticks(np.arange(0, len(x_values), 500), [years[idx] for idx in range(0, len(x_values), 500)], rotation=45, ha='right') # Show every 500th year for better visibility

# Plot the scaleogram

plt.subplot(3, 1, 3)

plt.imshow(abs(coeffs)**2, aspect='auto', origin='lower',

extent=[0, data_length, scales[-1], scales[0]], cmap='jet')

plt.title('Scaleogram - LastPrice')

plt.xlabel('Date')

plt.ylabel('Scale')

plt.xticks(np.arange(0, len(x_values), 500), [years[idx] for idx in range(0, len(x_values), 500)], rotation=45, ha='right')

plt.colorbar(label='Magnitude')

plt.tight_layout()

plt.show()

# Perform wavelet analysis

coeffs, freqs = pywt.cwt(last_price_values, scales=scales, wavelet=wavelet)

print("Shape of coeffs:", coeffs.shape) # Debugging

print("Shape of freqs:", freqs.shape) # Debugging

学术咨询:

基于小波分析的时间序列降噪(Python,ipynb文件)

信号降噪与时频分析(Python,ipynb文件)

基于连续小波变换的信号滤波方法(Python,ipynb文件)

信号的时域、频域和时频域特征提取(Python)

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?