from __future__ import (absolute_import, division, print_function,

unicode_literals)

import datetime # For datetime objects

import os.path # To manage paths

import sys # To find out the script name (in argv[0])

import pandas as pd

#import statsmodel as sm

# Import the backtrader platform

import backtrader as bt

# Create a Stratey

class TestStrategy(bt.Strategy):

params = (

# Standard MACD Parameters

('period', 252),

('prepend_constant', True),

)

def log(self, txt, dt=None):

''' Logging function for this strategy'''

dt = dt or self.datas[0].datetime.date(0)

print('%s, %s' % (dt.isoformat(), txt))

def __init__(self):

self.dataclose_x = self.datas[0].close

self.dataclose_y = self.datas[1].close

self.ma1 = bt.indicators.SMA(self.datas[0],

period=self.p.period

)

self.ma2 = bt.indicators.SMA(self.datas[1],

period=self.p.period

)

self.order = None

self.buyprice = None

self.buycomm = None

def notify_cashvalue(self, cash, value):

self.log('Cash %s Value %s' % (cash, value))

def notify_order(self, order):

print(type(order), 'Is Buy ', order.isbuy())

if order.status in [order.Submitted, order.Accepted]:

# Buy/Sell order submitted/accepted to/by broker - Nothing to do

return

# Check if an order has been completed

# Attention: broker could reject order if not enough cash

if order.status in [order.Completed]:

if order.isbuy():

self.log(

'BUY EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

self.buyprice = order.executed.price

self.buycomm = order.executed.comm

else: # Sell

self.log('SELL EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

self.bar_executed = len(self)

elif order.status in [order.Canceled, order.Margin, order.Rejected]:

self.log('Order Canceled/Margin/Rejected')

self.order = None

def notify_trade(self, trade):

if not trade.isclosed:

return

self.log('OPERATION PROFIT, GROSS %.2f, NET %.2f' %

(trade.pnl, trade.pnlcomm))

def next(self):

# Simply log the closing price of the series from the reference

self.log('Close, %.2f' % self.dataclose_x[0])

self.log('Close, %.2f' % self.dataclose_y[0])

# Check if we are in the market

if not self.getposition(self.datas[1]):

# Not yet ... we MIGHT BUY if ...

if (self.ma1[0]-self.ma1[-1])/self.ma1[-1]>(self.ma2[0]-self.ma2[-1])/self.ma2[-1]:

#if sma[0]<top[-5]:

# BUY, BUY, BUY!!! (with default parameters)

self.log('BUY CREATE,{},{}'.format(self.dataclose_y[0],self.dataclose_x[0]) )

# Keep track of the created order to avoid a 2nd order

self.order=self.buy(self.datas[0])

self.order = self.sell(self.datas[1])

else:

# Already in the market ... we might sell

if (self.ma1[0]-self.ma1[-1])/self.ma1[-1]<=(self.ma2[0]-self.ma2[-1])/self.ma2[-1]:

# SELL, SELL, SELL!!! (with all possible default parameters)

self.log('BUY CREATE,{},{}'.format(self.dataclose_y[0],self.dataclose_x[0]) )

# Keep track of the created order to avoid a 2nd order

self.log('Pos size %s' % self.position.size)

self.order = self.close(self.datas[1])

self.order = self.close(self.datas[0])

if __name__ == '__main__':

# Create a cerebro entity

cerebro = bt.Cerebro()

cerebro.addstrategy(TestStrategy)

# Datas are in a subfolder of the samples. Need to find where the script is

# because it could have been called from anywhere

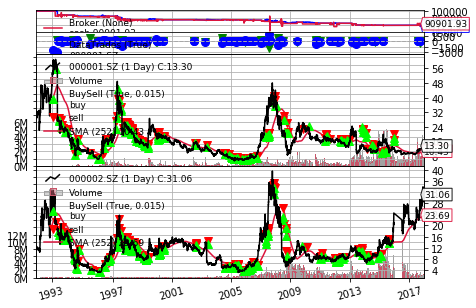

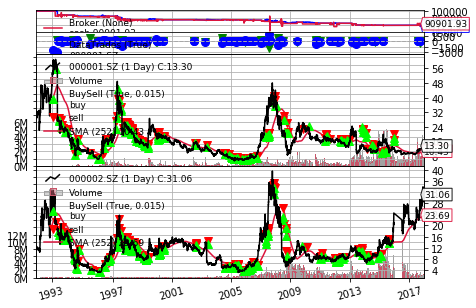

datapath_1='C:/Users/Administrator/Documents/000001.SZ.csv'

datapath_2='C:/Users/Administrator/Documents/000002.SZ.csv'

# Create a Data Feed

data_1 = bt.feeds.GenericCSVData(

dataname=datapath_1,

# Do not pass values before this date

fromdate=datetime.datetime(1991, 12, 23),

# Do not pass values after this date

todate=datetime.datetime(2017, 12, 31),

dtformat=('%Y-%m-%d'),

tmformat=('%H.%M.%S'),

date=0,

open=1,

close=2,

high=3,

low=4,

volume=5,

openinterest=6,

code=-1,

reverse=False)

data_2 = bt.feeds.GenericCSVData(

dataname=datapath_2,

# Do not pass values before this date

fromdate=datetime.datetime(1991, 12, 23),

# Do not pass values after this date

todate=datetime.datetime(2017, 12, 31),

dtformat=('%Y-%m-%d'),

tmformat=('%H.%M.%S'),

date=0,

open=1,

close=2,

high=3,

low=4,

volume=5,

openinterest=6,

reverse=False)

# Add the Data Feed to Cerebro

cerebro.adddata(data_1)

cerebro.adddata(data_2)

# Set our desired cash start

cerebro.broker.setcash(100000.0)

cerebro.broker.setcommission(commission=0.001)

cerebro.addsizer(bt.sizers.FixedSize, stake=100)

# Print out the starting conditions

print('Starting Portfolio Value: %.2f' % cerebro.broker.getvalue())

# Run over everything

cerebro.run()

# Print out the final result

print('Final Portfolio Value: %.2f' % cerebro.broker.getvalue())

cerebro.plot()

![]()

214

214

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?