昨天花了12个小时完成了可转债趋势策略的回测,当然这个全市场的和实盘还是有一点不同,实盘有溢价率限制,可以参考我给的回测模块加入溢价率,价格限制就可以

回测模板

from xgtrader_backtrader.backtrader import backtraderfrom xgtrader_backtrader.user_def_data.user_def_data import user_def_datafrom xgtrader_backtrader.trader_tool import tdx_indicatorimport pandas as pdfrom xgtrader_backtrader.trader_tool import jsl_datadf=jsl_data.get_all_cov_bond_data()print(df)df.to_excel(r'数据.xlsx')stock_list=df['证券代码'].tolist()class my_backtrader:'''多标的均线策略外面可用采用提前计算买卖点的方式也可用实时计算'''def __init__(self,start_date='20160101',end_date='20500101',data_type='D',starting_cash=100000,cash=100000,commission=0.001):self.start_date=start_dateself.end_date=end_dateself.data_type=data_typeself.starting_cash=starting_cashself.commission=commission'''证券代码 名称513100 纳斯达克ETF513500 标普500ETF513290 纳斯达克生物科技ETF159509 纳斯达克科技ETf159655 标普ETF513850 美国50ETF159518 标普油气ETF164824 印度ETF513880 日本225ETF513030 德国ETF513730 东南亚科技ETF159985 豆粕ETF'''self.stock_list=stock_list'''['513100','513500','513290','159509','159655','513850','159518','164824','513880','513030','513730','159985']'''self.amount=1000self.hold_limit=2000#采用目标数量交易self.buy_target_volume=10000self.sell_target_volume=0self.buy_target_value=5000self.sell_target_value=0#上涨突破5日线买self.buy_mean_line=5#下跌10日线卖self.sell_mean_line=10#买的最低分self.buy_min_score=50#持有最低分self.hold_min_score=50self.trader=backtrader(start_date=self.start_date,end_date=self.end_date,data_type=self.data_type,starting_cash=self.starting_cash,commission=self.commission,cash=cash)self.data=user_def_data(start_date=self.start_date,end_date=self.end_date,data_type=self.data_type)def add_all_data(self):'''多线程加载数据'''self.data.get_thread_add_data(stock_list=self.stock_list)self.hist=self.data.histreturn self.histdef get_cacal_all_indicators(self):'''计算全部的指标'''hist=self.add_all_data()trader_info=pd.DataFrame()#拆分数据for stock in self.stock_list:df=hist[hist['stock']==stock]df['mean_5']=df['close'].rolling(5).mean()df['mean_10']=df['close'].rolling(10).mean()df['mean_20']=df['close'].rolling(20).mean()df['mean_30']=df['close'].rolling(30).mean()df['mean_60']=df['close'].rolling(60).mean()df['mean_5_mean_10']=df['mean_5']>=df['mean_10']df['mean_10_mean_20']=df['mean_10']>=df['mean_20']df['mean_20_mean_30']=df['mean_20']>=df['mean_30']df['mean_30_mean_60']=df['mean_30']>=df['mean_60']for i in ['mean_5_mean_10','mean_10_mean_20','mean_20_mean_30','mean_30_mean_60']:df[i]=df[i].apply(lambda x: 25 if x==True else 0)df1=df[['mean_5_mean_10','mean_10_mean_20','mean_20_mean_30','mean_30_mean_60']]df['score']=df1.sum(axis=1).tolist()df['buy']=df['close']>df['mean_5']df['sell']=df['close']<df['mean_5']trader_info=pd.concat([trader_info,df],ignore_index=True)return trader_infodef run_backtrader(self):'''运行回测'''trader_list=self.trader.get_trader_date_list()trader_info=self.get_cacal_all_indicators()for date in trader_list:df=trader_info[trader_info['date']==date]stock_list=df['stock'].tolist()for stock in stock_list:df1=df[df['stock']==stock]price=df1['close'].tolist()[-1]price=float(price)buy=df1['buy'].tolist()[-1]sell=df1['sell'].tolist()[-1]score=df1['score'].tolist()[-1]'''if buy==True:if self.trader.check_stock_is_av_buy(date=date,stock=stock,price=price,amount=self.amount,hold_limit=self.hold_limit):self.trader.buy(date=date,stock=stock,price=price,amount=self.amount)else:self.trader.settle(date=date,stock=stock,price=price)elif sell==True:if self.trader.check_stock_is_av_sell(date=date,stock=stock,price=price,amount=self.amount):self.trader.sell(date=date,stock=stock,price=price,amount=self.amount)else:self.trader.settle(date=date,stock=stock,price=price)else:self.trader.settle(date=date,stock=stock,price=price)'''#目标数量回测例子if buy==True and score>=self.buy_min_score:result=self.trader.order_target_volume(date=date,stock=stock,amount=self.buy_target_volume,price=price)if result==True:passelse:self.trader.settle(date=date,stock=stock,price=price)elif sell==True or score<=self.hold_min_score:result=self.trader.order_target_volume(date=date,stock=stock,amount=self.sell_target_volume,price=price)if result==True:passelse:self.trader.settle(date=date,stock=stock,price=price)else:self.trader.settle(date=date,stock=stock,price=price)'''#目标价值交易if buy==True:result=self.trader.order_target_value(date=date,stock=stock,value=self.buy_target_value,price=price)if result==True:passelse:self.trader.settle(date=date,stock=stock,price=price)elif sell==True:result=self.trader.order_target_value(date=date,stock=stock,value=self.sell_target_value,price=price)if result==True:passelse:self.trader.settle(date=date,stock=stock,price=price)else:self.trader.settle(date=date,stock=stock,price=price)'''if __name__=='__main__':trader=my_backtrader(data_type='D')trader.run_backtrader()#获取全部的交易报告trader.trader.get_poition_all_trader_report_html()#获取策略报告trader.trader.get_portfolio_trader_report_html()#显示个股的交易图trader.trader.get_plot_all_trader_data_figure(limit=1000)#显示策略数据df=trader.trader.get_portfolio_trader_data_figure(limit=100000)

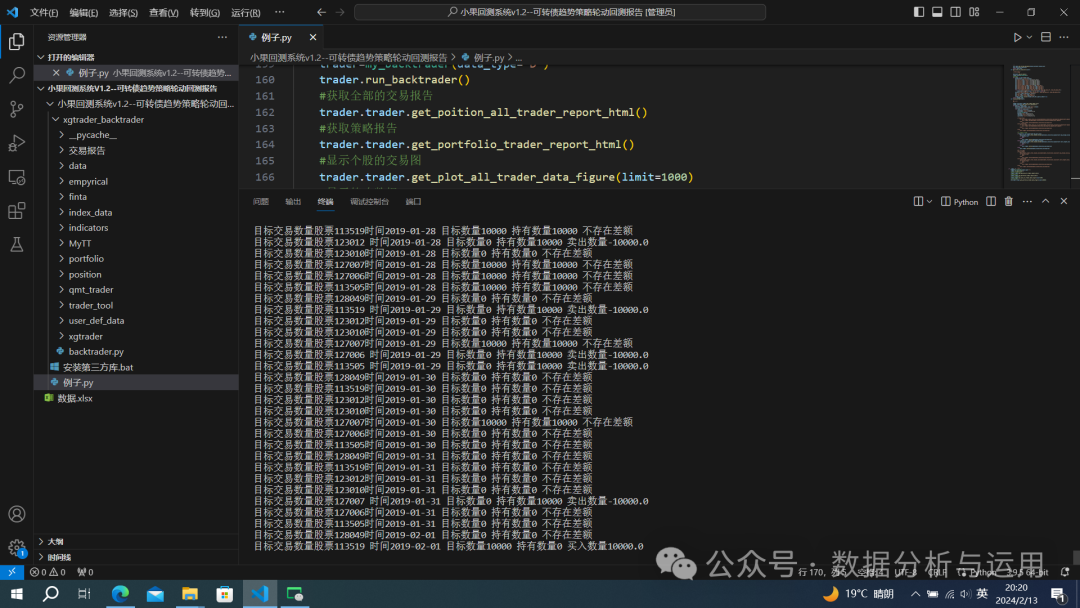

点击运行

多线程加载数据回测

设置回测参数

class my_backtrader:'''多标的均线策略外面可用采用提前计算买卖点的方式也可用实时计算'''def __init__(self,start_date='20160101',end_date='20500101',data_type='D',starting_cash=100000,cash=100000,commission=0.001):self.start_date=start_dateself.end_date=end_dateself.data_type=data_typeself.starting_cash=starting_cashself.commission=commission'''证券代码 名称513100 纳斯达克ETF513500 标普500ETF513290 纳斯达克生物科技ETF159509 纳斯达克科技ETf159655 标普ETF513850 美国50ETF159518 标普油气ETF164824 印度ETF513880 日本225ETF513030 德国ETF513730 东南亚科技ETF159985 豆粕ETF'''self.stock_list=stock_list'''['513100','513500','513290','159509','159655','513850','159518','164824','513880','513030','513730','159985']'''self.amount=1000self.hold_limit=2000#采用目标数量交易self.buy_target_volume=10000self.sell_target_volume=0self.buy_target_value=5000self.sell_target_value=0#上涨突破5日线买self.buy_mean_line=5#下跌10日线卖self.sell_mean_line=10#买的最低分self.buy_min_score=50#持有最低分self.hold_min_score=50self.trader=backtrader(start_date=self.start_date,end_date=self.end_date,data_type=self.data_type,starting_cash=self.starting_cash,commission=self.commission,cash=cash)self.data=user_def_data(start_date=self.start_date,end_date=self.end_date,data_type=self.data_type)

交易算法

def get_cacal_all_indicators(self):'''计算全部的指标'''hist=self.add_all_data()trader_info=pd.DataFrame()#拆分数据for stock in self.stock_list:df=hist[hist['stock']==stock]df['mean_5']=df['close'].rolling(5).mean()df['mean_10']=df['close'].rolling(10).mean()df['mean_20']=df['close'].rolling(20).mean()df['mean_30']=df['close'].rolling(30).mean()df['mean_60']=df['close'].rolling(60).mean()df['mean_5_mean_10']=df['mean_5']>=df['mean_10']df['mean_10_mean_20']=df['mean_10']>=df['mean_20']df['mean_20_mean_30']=df['mean_20']>=df['mean_30']df['mean_30_mean_60']=df['mean_30']>=df['mean_60']for i in ['mean_5_mean_10','mean_10_mean_20','mean_20_mean_30','mean_30_mean_60']:df[i]=df[i].apply(lambda x: 25 if x==True else 0)df1=df[['mean_5_mean_10','mean_10_mean_20','mean_20_mean_30','mean_30_mean_60']]df['score']=df1.sum(axis=1).tolist()df['buy']=df['close']>df['mean_5']df['sell']=df['close']<df['mean_5']trader_info=pd.concat([trader_info,df],ignore_index=True)return trader_infodef run_backtrader(self):'''运行回测'''trader_list=self.trader.get_trader_date_list()trader_info=self.get_cacal_all_indicators()for date in trader_list:df=trader_info[trader_info['date']==date]stock_list=df['stock'].tolist()for stock in stock_list:df1=df[df['stock']==stock]price=df1['close'].tolist()[-1]price=float(price)buy=df1['buy'].tolist()[-1]sell=df1['sell'].tolist()[-1]score=df1['score'].tolist()[-1]'''if buy==True:if self.trader.check_stock_is_av_buy(date=date,stock=stock,price=price,amount=self.amount,hold_limit=self.hold_limit):self.trader.buy(date=date,stock=stock,price=price,amount=self.amount)else:self.trader.settle(date=date,stock=stock,price=price)elif sell==True:if self.trader.check_stock_is_av_sell(date=date,stock=stock,price=price,amount=self.amount):self.trader.sell(date=date,stock=stock,price=price,amount=self.amount)else:self.trader.settle(date=date,stock=stock,price=price)else:self.trader.settle(date=date,stock=stock,price=price)'''#目标数量回测例子if buy==True and score>=self.buy_min_score:result=self.trader.order_target_volume(date=date,stock=stock,amount=self.buy_target_volume,price=price)if result==True:passelse:self.trader.settle(date=date,stock=stock,price=price)elif sell==True or score<=self.hold_min_score:result=self.trader.order_target_volume(date=date,stock=stock,amount=self.sell_target_volume,price=price)if result==True:passelse:self.trader.settle(date=date,stock=stock,price=price)else:self.trader.settle(date=date,stock=stock,price=price)'''#目标价值交易if buy==True:result=self.trader.order_target_value(date=date,stock=stock,value=self.buy_target_value,price=price)if result==True:passelse:self.trader.settle(date=date,stock=stock,price=price)elif sell==True:result=self.trader.order_target_value(date=date,stock=stock,value=self.sell_target_value,price=price)if result==True:passelse:self.trader.settle(date=date,stock=stock,price=price)else:self.trader.settle(date=date,stock=stock,price=price)'''

数据加载开始回测

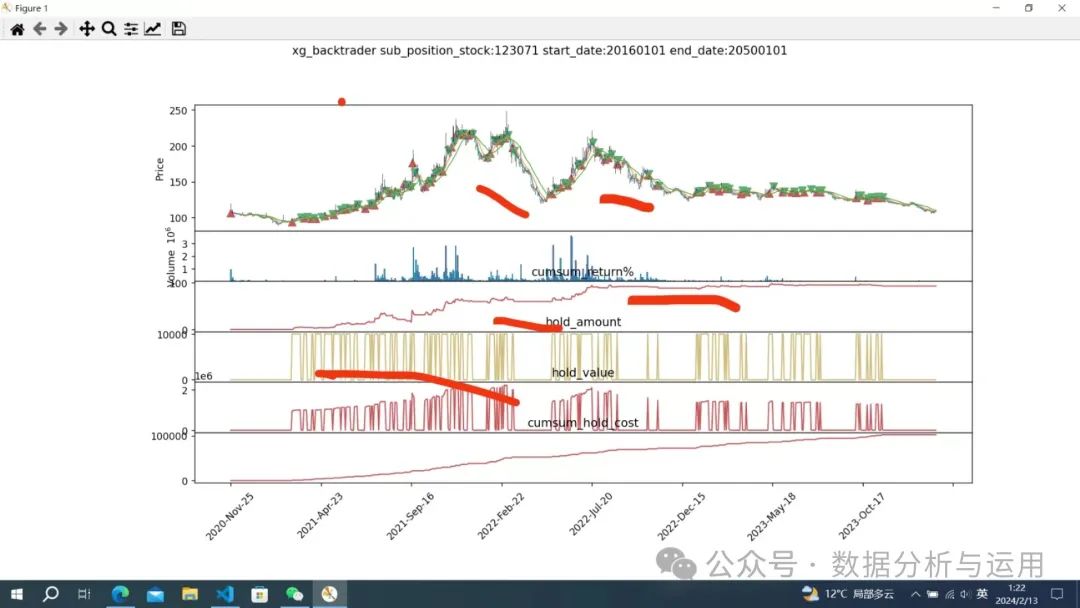

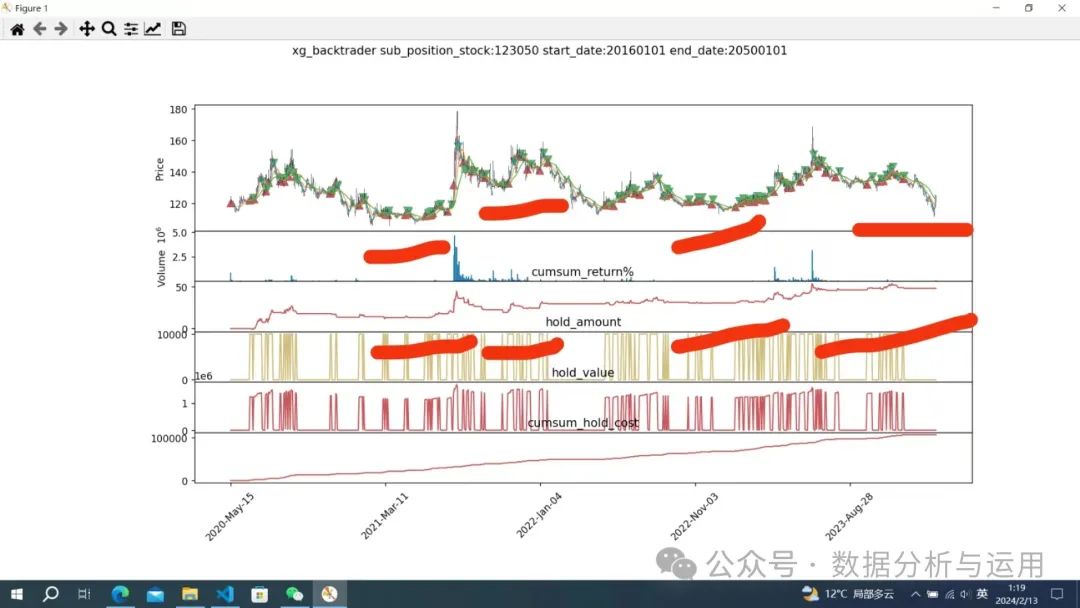

我们直接看回测结果非常多,每一个标的

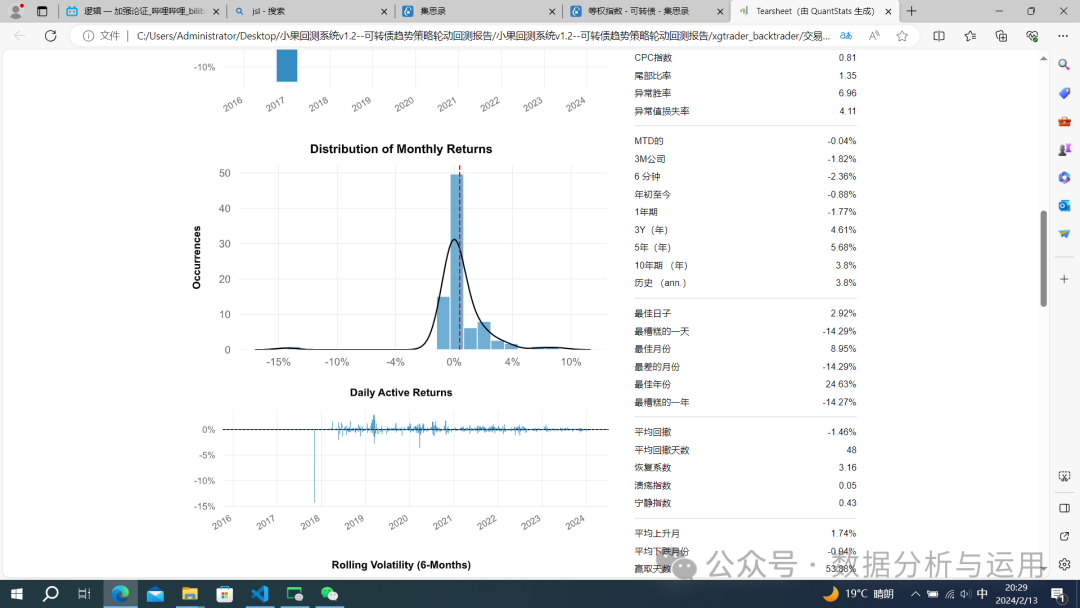

交易报告

全市场回测的可以继续优化

实盘的有比较多的条件限制

我们看个股的买卖点分析

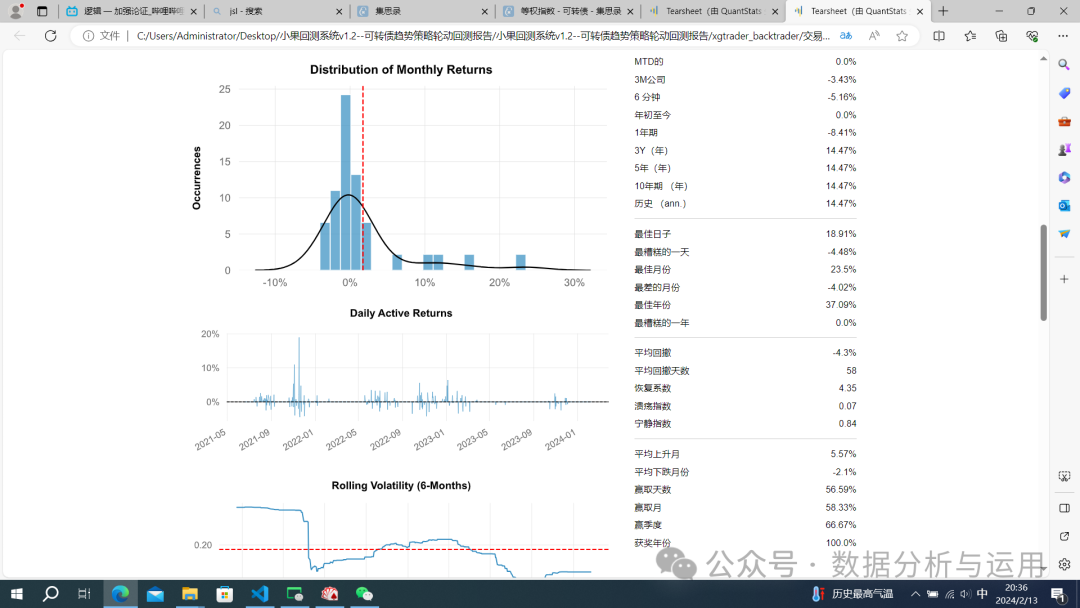

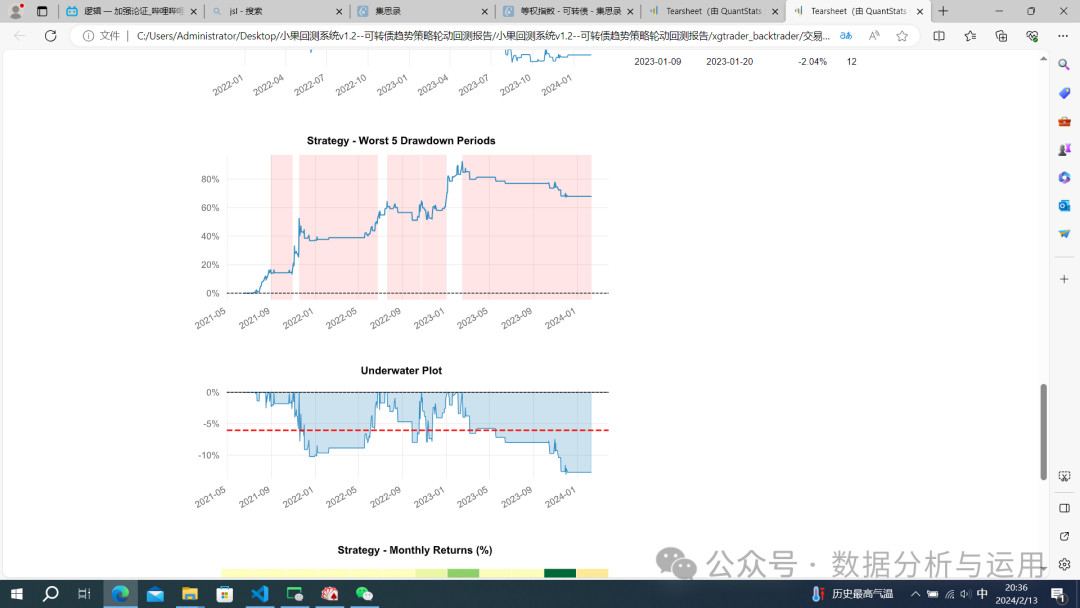

我们看策略的报告,17不知道发生了什么,我还在读高中,高一,得加入溢价率指标,价格来优化策略,实盘有这个参数限制

我们随便选择一个个股看看个股的交易报告

111000

看看程序的交易效果

需要全部的交易报告直接回复20240213就可以

数据分析与运用

很高兴和志同道合的你们一起学习,本公众号分享金融知识,大家一起相互学习,信息分享如有侵权,或者没有作者的同意,我们将撤回,同时也感谢大家积极的分享,大家的支持。让我们一起加油

271篇原创内容

公众号

回测框架,实盘策略全部上传了知识星球可以直接下载,最后2张优惠券

2953

2953

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?