前面写了一个强大的可转债自定义系统,我们可以利用这个快速对接到大qmt,我提供实时数据支持 量化研究---强大的可转债分析系统上线,提供api,实时数据支持

打开网页 http://120.78.132.143:8023/

强大可转债选择系统 http://120.78.132.143:8023/convertible_bond_custom_system_app

点击运行就要禄得一模一样的选股结果

可以点击下载数据看看结果

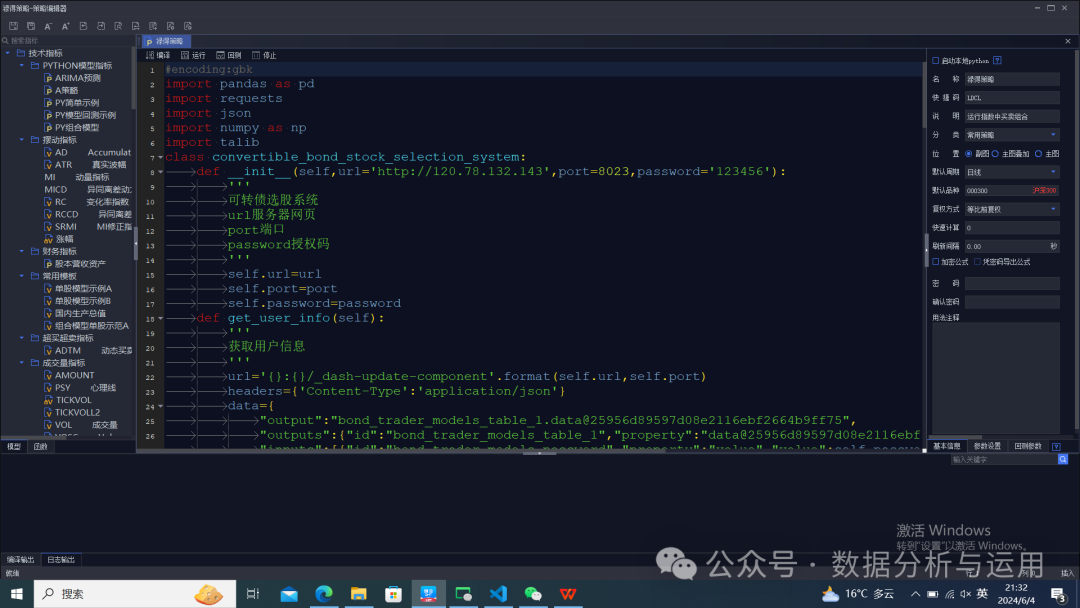

大qmt怎么样使用只需要建立一个策略把代码放入就可以,比如我建立的禄得策略

点击编辑

我们只需要点击运行就会掉我服务器自动分析,得到选股结果,直接加入轮动就可以

我们只需要修改text的内容就可以和禄得一模一样的

后面大家就可以参考写实盘,我后面继续完善这几天事情多,不懂的可以问我

加我备注入群,可以进入策略研究群,源代码

#encoding:gbkimport pandas as pdimport requestsimport jsonimport numpy as npimport talibclass convertible_bond_stock_selection_system:def __init__(self,url='http://120.78.132.143',port=8023,password='123456'):'''可转债选股系统url服务器网页port端口password授权码'''self.url=urlself.port=portself.password=passworddef get_user_info(self):'''获取用户信息'''url='{}:{}/_dash-update-component'.format(self.url,self.port)headers={'Content-Type':'application/json'}data={"output":"bond_trader_models_table_1.data@25956d89597d08e2116ebf2664b9ff75","outputs":{"id":"bond_trader_models_table_1","property":"data@25956d89597d08e2116ebf2664b9ff75"},"inputs":[{"id":"bond_trader_models_password","property":"value","value":self.password},{"id":"bond_trader_models_data_type","property":"value","value":"代码"},{"id":"bond_trader_models_text","property":"value","value":""},{"id":"bond_trader_models_run","property":"value","value":"运行"},{"id":"bond_trader_models_down_data","property":"value","value":"不下载数据"}],"changedPropIds":["bond_trader_models_run.value"]}res=requests.post(url=url,data=json.dumps(data),headers=headers)text=res.json()df=pd.DataFrame(text['response']['bond_trader_models_table_1']['data'])return dfdef get_convertible_bond_stock_selection_system(self,text=''):'''获取选股的结果'''user=self.get_user_info()print(user)print('开始分析*************************************')url='{}:{}/_dash-update-component'.format(self.url,self.port)headers={'Content-Type':'application/json'}data={"output":"bond_trader_models_table.data@25956d89597d08e2116ebf2664b9ff75","outputs":{"id":"bond_trader_models_table","property":"data@25956d89597d08e2116ebf2664b9ff75"},"inputs":[{"id":"bond_trader_models_password","property":"value","value":"123456"},{"id":"bond_trader_models_data_type","property":"value","value":"代码"},{"id":"bond_trader_models_text","property":"value","value":"{}".format(text)},{"id":"bond_trader_models_run","property":"value","value":"运行"},{"id":"bond_trader_models_down_data","property":"value","value":"不下载数据"}],"changedPropIds":["bond_trader_models_run.value"]}res=requests.post(url=url,data=json.dumps(data),headers=headers)text=res.json()df=pd.DataFrame(text['response']['bond_trader_models_table']['data'])return df#if __name__=='__main__':'''获取数据'''text={"可转债溢价率设置":"可转债溢价率设置","数据源模式说明":"服务器/自定义 自定义自己直接导入禄得选股的结果,放在自定义数据,支持盘中,盘后选股交易","数据源":"服务器","更新数据模式说明":"手动/自动","更新数据模式":"自动","服务器":"http://120.78.132.143","端口":"8023","授权码":"123456","是否测试":"否","是否数据没有更新的情况下更新":"是","强制赎回设置":"************************","是否剔除强制赎回":"是","距离强制赎回天数":0,"排除上市天数":3,"是否排除ST":"是","市场说明":["沪市主板","深市主板","创业板","科创板"],"排除市场":[],"行业说明":"查询行业表**********,混合排除不区分一二三级行业","排除行业":[],"企业类型说明":["民营企业","地方国有企业","中央国有企业","外资企业","中外合资经营企业","集体企业"],"排除企业类型":[],"排除地域说明":["陕西", "山西", "山东", "河南", "新疆", "安徽", "西藏", "海南", "湖北", "河北","福建", "广西", "内蒙古", "浙江", "江西", "江苏", "上海", "贵州", "黑龙江", "湖南", "甘肃","宁夏", "云南", "天津", "广东", "四川", "北京", "辽宁", "重庆"],"排除地域":[],"排除外部评级说明":["AAA", "AA+", "AA", "AA-", "A+", "A", "A-","BBB+", "BBB", "BBB-", "BB+", "BB", "BB-", "B+", "B", "B-", "CCC", "CC"],"排除外部评级":["B","B-","CCC","CC"],"排除三方评级说明":["1", "2", "3", "4+", "4", "4-", "5+", "5", "5-", "6+", "6","6-", "7+", "7", "7-", "8+", "8", "8-", "9", "10"],"排除三方评级":["10","9","8"],"添加排除因子":"排除因子设置************************","全部的排除因子打分因子,必须选择可以计算的":["开盘价", "最高价", "最低价", "最新价", "涨跌幅", "5日涨跌幅","正股最高价", "正股最低价", "正股最新价", "正股涨跌幅", "正股5日涨跌幅", "成交量(手)","成交额(万)", "年化波动率", "正股年化波动率", "股息率", "转股价值", "转股溢价率", "理论转股溢价率","修正转股溢价率", "纯债价值", "纯债溢价率", "期权价值", "理论价值", "理论偏离度", "双低","剩余规模(亿)", "剩余市值(亿)", "换手率", "市净率", "市盈率_ttm", "市销率_ttm", "正股流通市值(亿)","正股总市值(亿)", "资产负债率", "转债市占比", "上市天数", "转股截止日", "剩余年限","到期收益率(税前)", "强赎触发比例", "外部评级", "三方评级", "企业类型", "地域", "一级行业", "二级行业", "三级行业"],"因子计算符号说明":"大于,小于,大于排名%,小于排名%,空值,排除是相反的,大于是小于","排除因子":["最新价","最新价","转股溢价率","剩余规模(亿)"],"因子计算符号":["大于","小于","大于","大于"],"因子值":[130,100,0.3,8],"打分因子设置":"*************************************************","打分因子说明":"正相关:因子值越大得分越高;负相关:因子值越大得分越低,","打分因子":["转股溢价率","最新价","剩余规模(亿)"],"因子相关性":["负相关","负相关","负相关"],"因子权重":[1,1,1],"持有限制":10,"持股限制":10,"策略轮动设置":"策略轮动设置************************,轮动都按排名来","轮动方式说明":"每天/每周/每月/特别时间","轮动方式":"每天","说明":"每天按自定义函数运行","每周轮动是说明":"每周比如0是星期一,4是星期五**********","每周轮动时间":0,"每月轮动是说明":"必须是交易日,需要自己每个月自动输入**********","每月轮动时间":["2024-02-29","2024-02-29","2024-02-29","2024-02-29","2024-02-29","2024-02-29","2024-02-29"],"特定时间说明":"特别的应该交易日","特定时间":["2024-02-23","2024-02-24","2024-02-25","2024-02-26","2024-02-27"],"轮动规则设置":"轮动规则设置88888888**********排名","买入排名前N":10,"持有排名前N":10,"跌出排名卖出N":10,"买入前N":10,"自定义因子模块":"自定义因子模块设置***********************","是否开启自定义因子":"否","自定义因子":{"5日收益":"return_5()","均线金叉":"ma_gold_fork()","macd金叉":"macd_gold_fork()"}}def init(ContextInfo):print('*********************8')ContextInfo.accID = '55011917'ContextInfo.accType='STOCk'ContextInfo.buy = TrueContextInfo.sell = FalseContextInfo.models=convertible_bond_stock_selection_system()ContextInfo.df=ContextInfo.models.get_convertible_bond_stock_selection_system(text=text)print(ContextInfo.df)#利用定时函数运行#ContextInf.run_time()def handlebar(ContextInfo):pass

综合交易模型54

综合交易模型 · 目录

上一篇综合交易模型--雪球跟单参数说明支持qmt,同花顺

2123

2123

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?