Basic Financial Arithmetic

Simple and Compound Interest

- Simple Interest : TotalProceed=Principal×(1+interestrate∗daysyear)

- Compound Interest : TotalProceed=Principal×(1+interestrate∗daysyear)N

- Interest Rate:

- The period for which the investment/loan will last

- The absolute period to which the quoted interest rate applies

- The frequency with which interest is paid

Nominal and Effective Rates

1+effectrate=(1+nominalraten)n

-

effectiverate=(1+nominalraten)n−1

-

nominalrate=[(1+effectrate)1n−1]×n

Daily Compounding

-

Dailyequivalent=[(1+effectrate)1365−1]×365

Continuous Compounding

-

1+effectiverate=limx→∞(1+rcn)n=erc

⇒

Continuously compounded rate :

r=ln(1+i)

⇒

Nominal rate for a year :

i=er−1

Time Value of Money

| Items | Short-Term Investment | Long-Term Investment |

|---|---|---|

| Future Value |

FV=PV×(1+i×daysyear)

|

FV=PV×(1+i×daysyear)N

|

| Present Value |

PV=FV1+i×daysyear

|

PV=FV(1+i×daysyear)N

|

| yield |

yield=(FVPV−1)×yeardays

|

yield=(FVPV)1N−1

|

| effective yield |

effectiveyield=(1+yield×daysyear)yeardays−1

effectiveyield=(FVPV)365days−1

|

for simple invest :

yield=i

for compound invest :

yield=i×daysyear

-

PV=FV×DiscoutFactor

| Simple | Compound | Continuous Compounding |

|---|---|---|

|

FV=PV×(1+i×daysyear)

|

FV=PV×(1+i×daysyear)N

|

FV=PV×(ei×daysyear)

|

|

DF=11+i×daysyear

|

DF=(11+i×daysyear)N

|

DF=e−i×daysyear

|

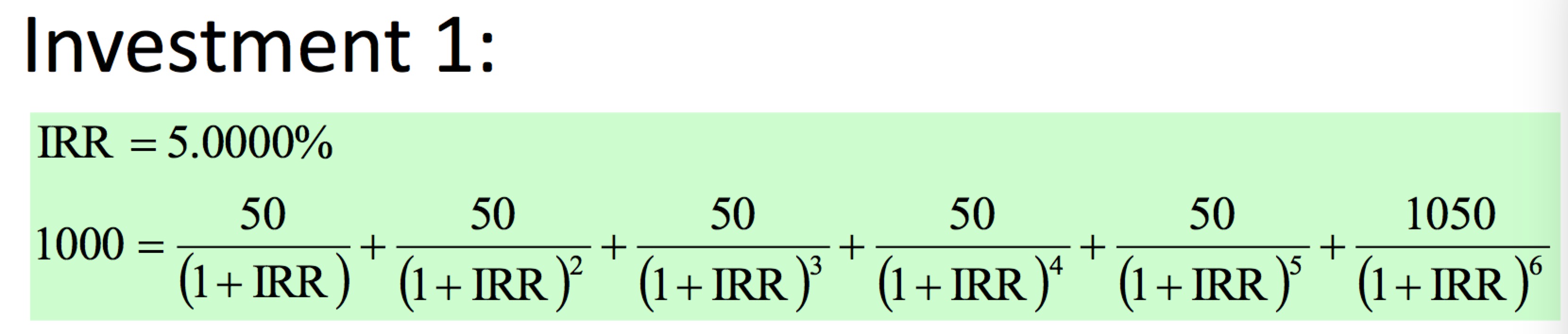

- IRR

⇒

Internal Rate of Return

IRR : The one single interest rate used when discounting a series of future value to achieve a given net present value.

Example:

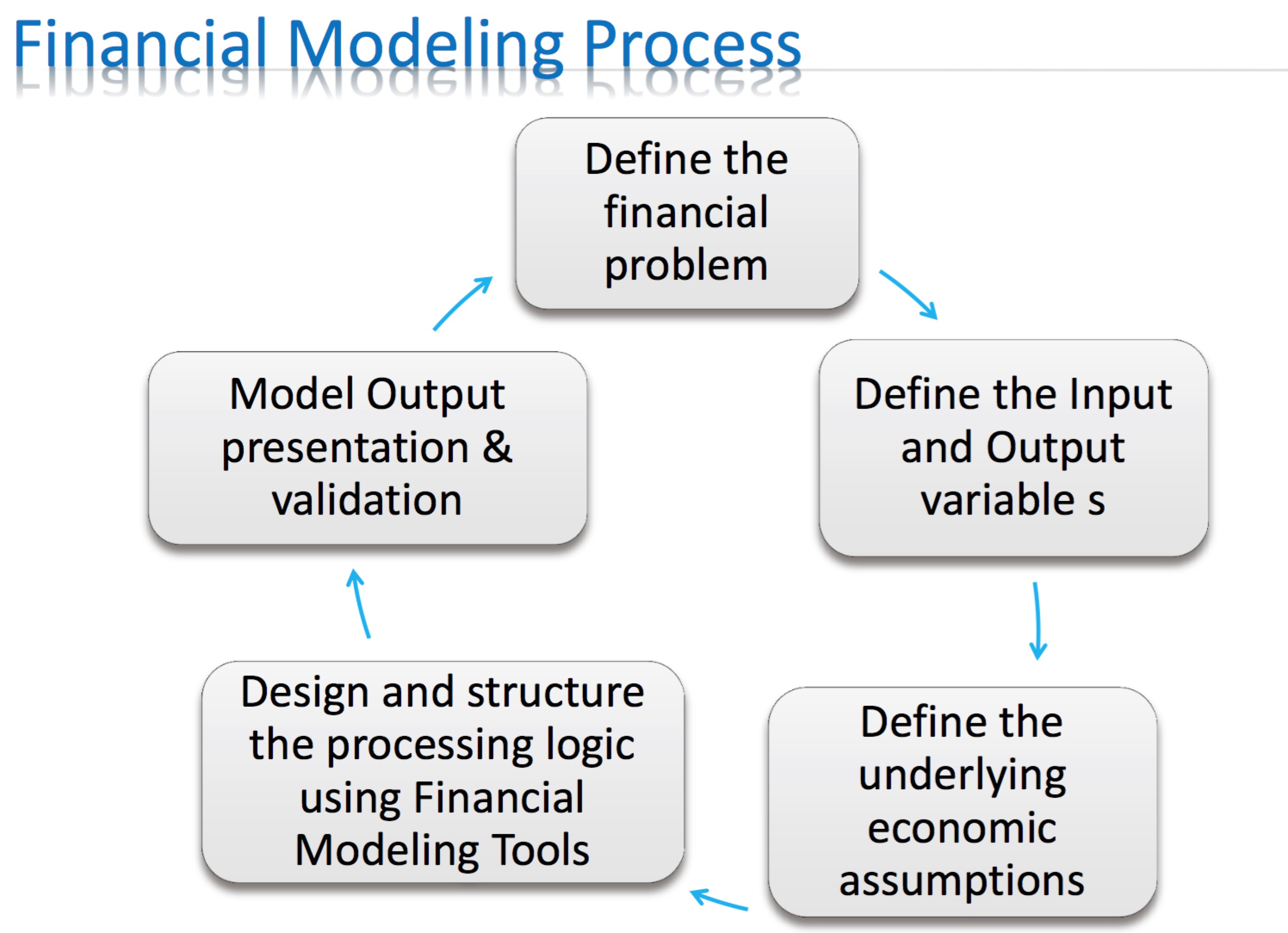

Basic Financial Modeling

Money Market

| Terminology | Explanation |

|---|---|

| Eurodoller | U.S. dollar-denominated deposits at banks outside of the U.S. |

| Coupon | Interest rate stated on an instrument when it is issued |

| Discount Instrument | An instrument which does not carry a coupon is a “discount” instrument. Discount equals the difference between the price paid for a security and security’s par value. |

| Bearer / registered | A “bearer” security is one where the issuer pays the principal (and coupon if there is one) to whoever is holding the security at maturity. |

| Fixed Income Security | Money market instrument whose future cash flows have been contractually defined and can be determined in advance. |

| Yield to Maturity | YTM is the rate of return that you would achieve on a fixed income security, if you bought it at a given price and held it to maturity |

| LIBOR, HIBOR | Interbank offered rate – interest rate at which one bank offers money to another bank. |

| Eurodeposit | Round-the-clock business spanning Singapore and Hong Kong, Bahrain, Frankfurt, Paris, London and New York |

Eurodeposit

- LIBOR

The rate dealers charge for lending money (they offer funds) - LIBID

The rate dealers pay for taking a deposit (they bid for funds) - In London, quote (offered rate – bid rate), Other places, quote (bid rate – offered rate)

- Rule: pay the higher rate for a loan, receive the lower for a deposit

- LIBOR

DAY/YEAR Conventions

- Interestpaid=interestratequoted×daysinperioddaysinyear

- Most money markets use ACT/360

Interest rate on 360-day basis = Interest rate on 360-day basis ×360365 - Exceptions using ACT/365:

Interest rate on 365-day basis = Interest rate on 365-day basis ×365360

- International and domestic:

Sterling, Hong Kong dollar, Singapore dollar, Malaysian ringgit, Taiwan dollar, Thai baht, South African rand. - Domestic (but not international):

Japanese yen, Canadian dollar, Australian dollar, New Zealand dollar

- International and domestic:

Money Market Instruments

| Instrument | Term | Interest | Quotation | Currency | Settlement | Registration | negotiable | Issuers |

|---|---|---|---|---|---|---|---|---|

| Time deposit / loan | 1 day to several years, but usually less than 1 year | usually all paid on maturity | as an interest rate | any domestic or international currency | generally same day for domestic, 2 working days for international | no | no | |

| Certificate of deposit (CD) | generally up to one year | usually pay a coupon | as a yield | any domestic or international currency | generally same day for domestic, 2 working days for international | usually in bearer form | yes | Bank |

| Treasury Bill (T-bill) | generally 13, 26 or 52 weeks | mostly non-coupon bearing, issued at a discount | US and UK a “discount rate” basis; most places on a true yield basis | usually the currency of the country | bearer security | yes | Government | |

| Commercial Paper (CP) | for US, from 1 to 270 days; usually very short-term for ECP, from 2 to 365 days; usually 30 to 180 days | non-interest bearing; issued at a discount | for US, on a “discount rate” basis for ECP, as a yield | for US, domestic US dollar;for ECP, any Eurocurrency but largely US dollar | for US, same day;for ECP, 2 working days | in bearer form | yes | Corporation |

| Bill of exchange / Banker’s acceptance | From 1 week to 1 year but usually < 6 months | non-interest bearing; issued at a discount | for US and UK, quoted on a “discount rate” basis elsewhere on a yield basis | mostly domestic | available for discount immediately on being drawn | none | yes | |

| Repurchase agreement (repo) | usually for very short-term | difference between purchase and repurchase prices | as a yield | any currency | Generally cash against delivery of the security | n/a | no | Government / Bank |

- CD - Pricing

Price=presentvalue

maturityproceeds=facevalue×(1+couponrate×couponperiod(days)year

Price=facevalue×(1+couponrate×couponperiod(days)year)1+interestrate×dayspurchasetomaturityyear - CD - Return

yield=(FVPV−1)×yeardays

yield=(salepricepurchaseprice−1)×yeardaysheld

yield=((1+interestratepurchase×dayspurchasetomaturityyear)(1+interestratesale×dayssaletomaturityyear)−1)×yeardaysheld - Discount rate quote

Price=FaceValue×(1−DiscountRate×daystomaturityyear)

Price=FaceValue1+yield×daystomaturitysyear

yield=discountrate1−discoutrate×daystomaturityyear

discountrate=yield1+yield×daystomaturitysyear

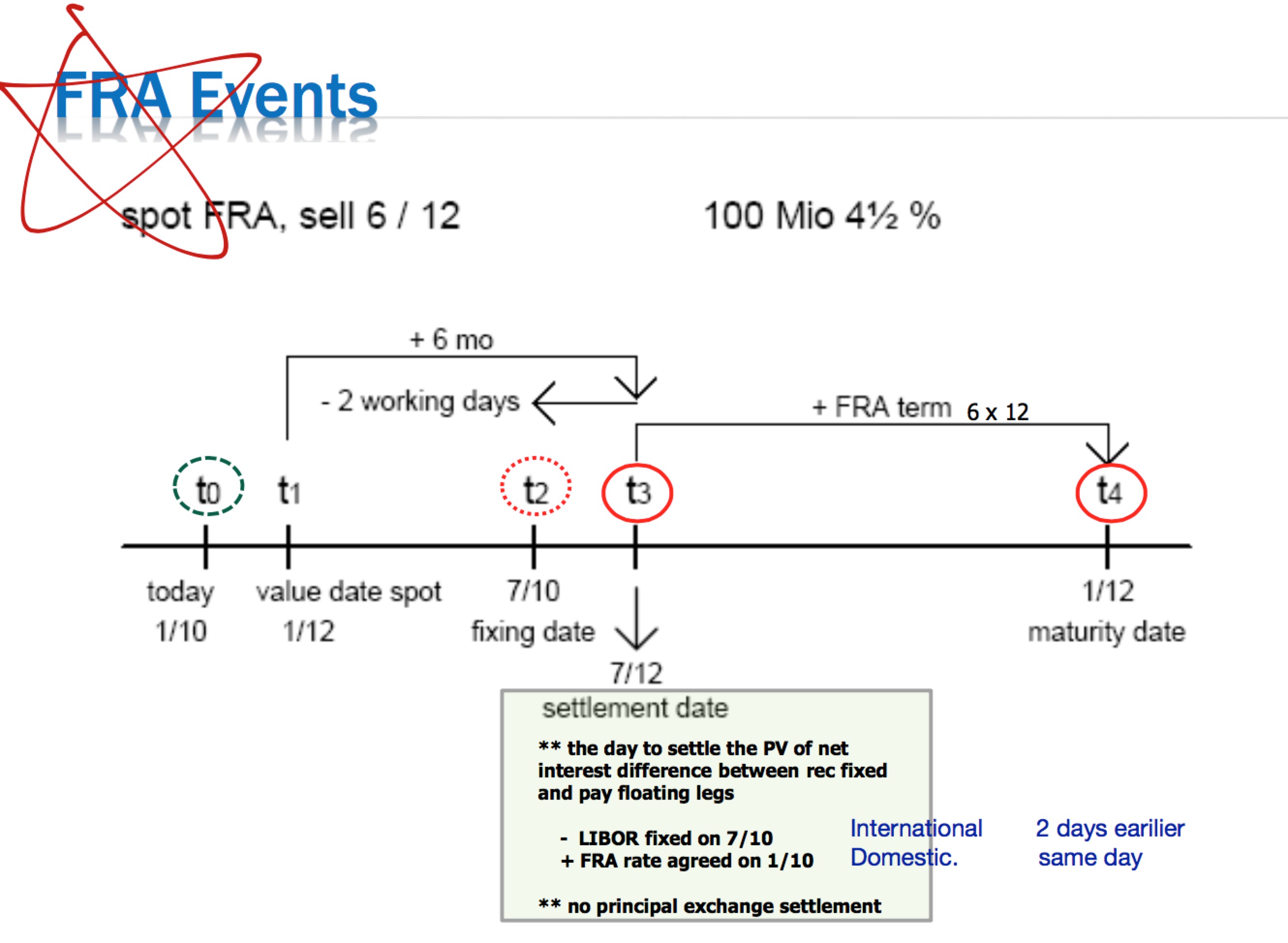

Forward Rate Agreements (FRAs)

Forward-forward

- A cash borrowing or deposit which starts on one forward date and ends on another forward.

- The term, amount and interest rate are all fixed in advance.

forward−forwardrate=[(1+iL×dLyear)(1+iS×dSyear)−1]×yeardL−dS

L and S stand for longer and shorter period respectively

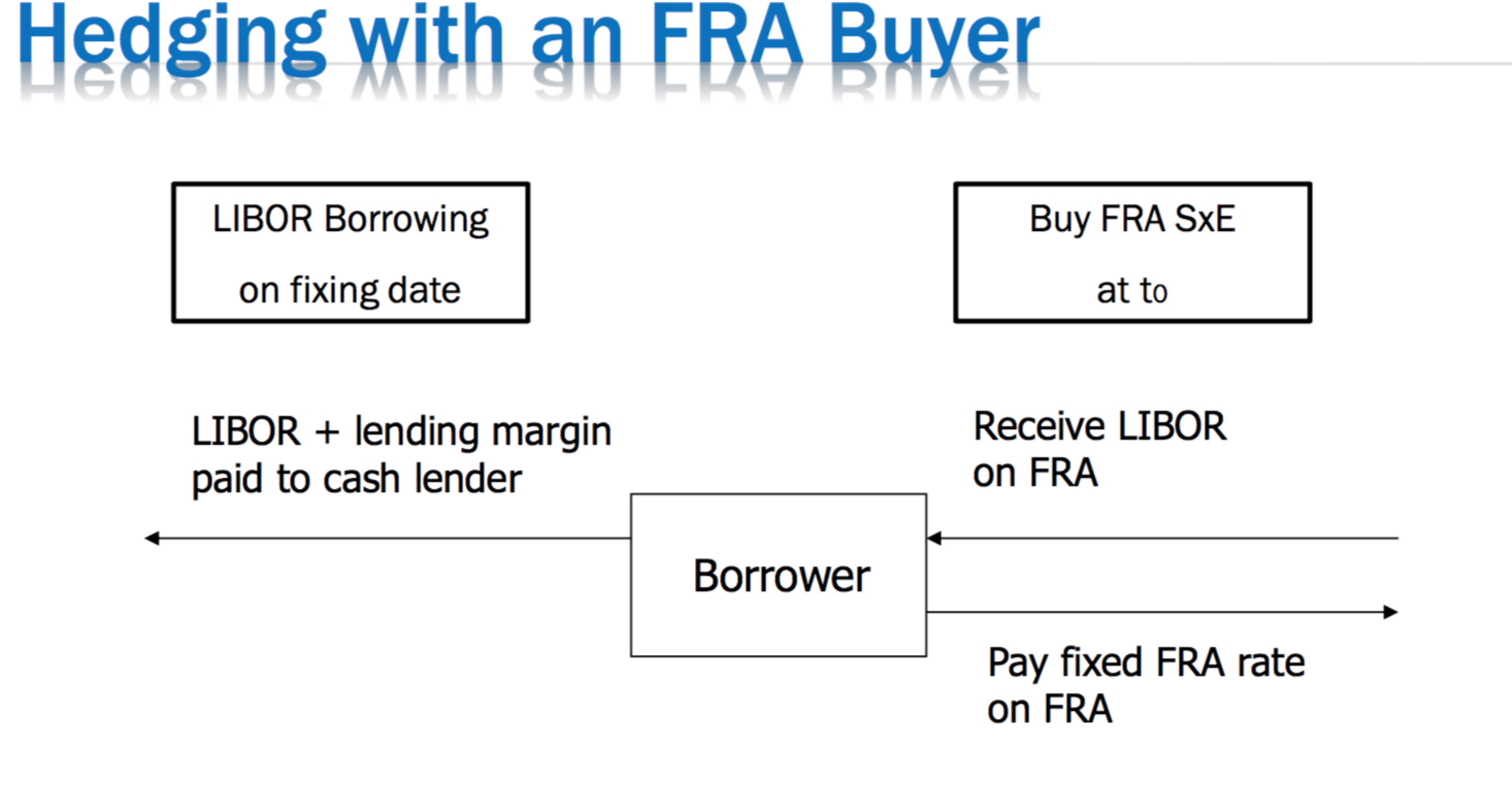

Forward Rate Agreements

- off-balance sheet instrument

- fix a future interest rate

- on the agreed date (fixing date), receives or pays the difference between the reference rate and the FRA rate on the agreed notional principal amount

- Principal is not exchanged

- Settles at the beginning of the period

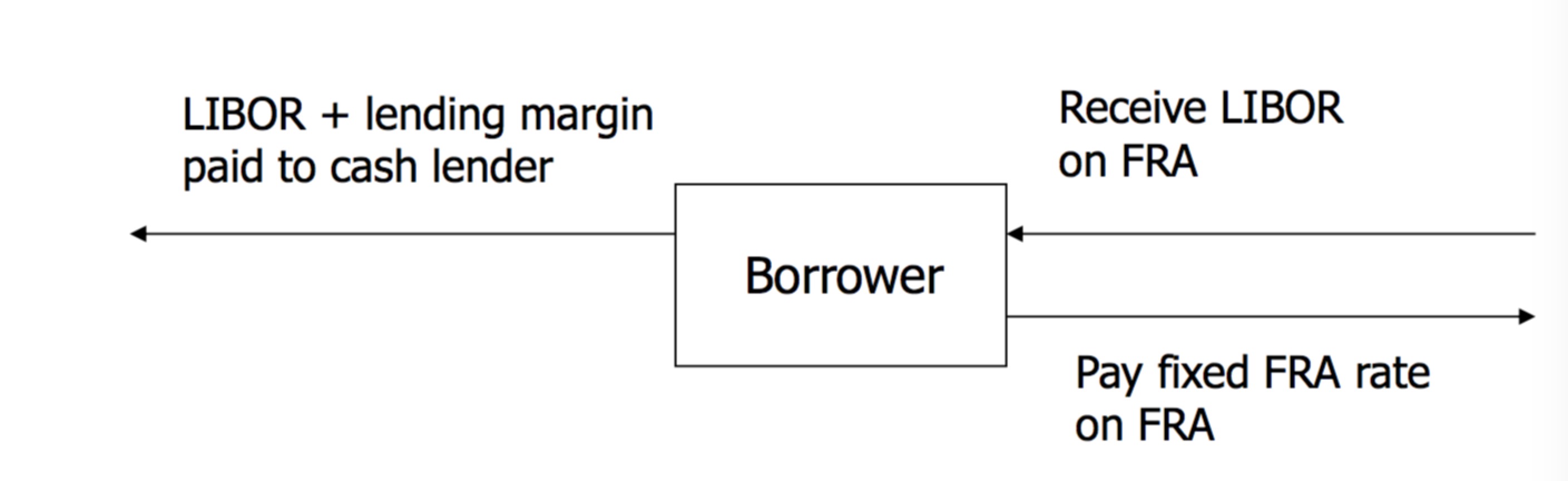

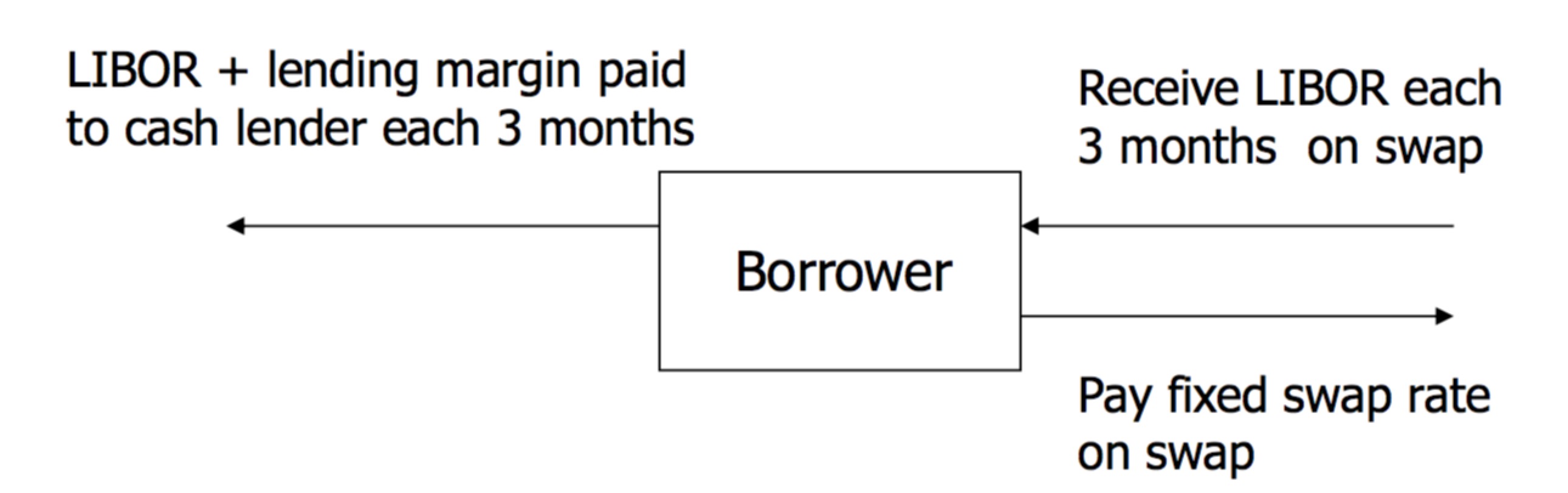

His flow will therefore be : - LIBOR

+ LIBOR

- FRA rate

————–

net cost : - FRA rate

Usually two days before the settlement date, the FRA rate is compared to the agreed reference rate (LIBOR).

Settlement Paid

- Period < 1year

Buyerpaid=notional×(FRARate−LIBOR)×daysyear1+LIBOR×daysyear

- Period > 1year

FRAsettlement=Principal×[(f−L)×d1year1+×d1year+(f−L)×d2year(1+×d1year)×(1+×d2year)]

如果参照利率(e.g., LIBOR)比协议利率为高(>), 卖方需支付给买方合约差额;

反之,如果参照利率比协议利率为低(<), 买方需支付给卖方合约差额。

Constructing a strip

The interest rate for a longer period up to one year =

Futures Contract

Futures

- A contract in which the commodity being bought or sold is considered as being delivered (may not physically occur) at some future date

- Exchange traded (vs OTC in “forward”)

- Contract standardized by exchange

- Pricing depends on underlying commodity

Quotation

Futuresprice=100−(impliedforwardinterestrate×100)

Futures & FRAs are in opposite directions :

Dealing

- Open outcry

buyer and seller deal face to face in public in the exchange’s “trading pit” - Screen trading

designed to simulate the transparency of open outcry

Clearing

Following the confirmation of a transaction, the clearing house substitutes itself as a counterparty to each user and becomes

- the seller to every buyer and

- the buyer to every seller

Margin Requirements

- Initial Margin

- Collateral for each deal transacted

- Protect clearing house for the short period until position can be revalued

- Variation (Maintenance) Margin

- Marking to market

- Paid daily based on adverse price movements

Profit and Loss

Profit/los s on long position in a 3-month contract :

Profit/loss=numberofcontract×contractamount×pricemovement100×14

Hedging FRA with Futures

- Settlement for FRA = Profit or loss on sold futures

- Hedge required is the combination of the hedges for each leg

e.g.,

• Sell 3x6 FRA + Sell 6x9 FRA, hence hedged by

• Sell 10 June futures + Sell 10 Sept futuresImperfect FRA Hedging with Futures

- Future contracts are for standardized amount

- Futures P&L are based on 90-day period rather than 91 or 92 days as in FRA

- FRA settlements are discounted but futures settlements are not.

- Future price when the Sept contract is closed out in June may not exactly match the theoretical forward- forward rate at that time

- Slight discrepancy in dates.

Open Interest : number of purchases of contract not yet been reversed or “close out”

Volume : total number of contracts traded during the day

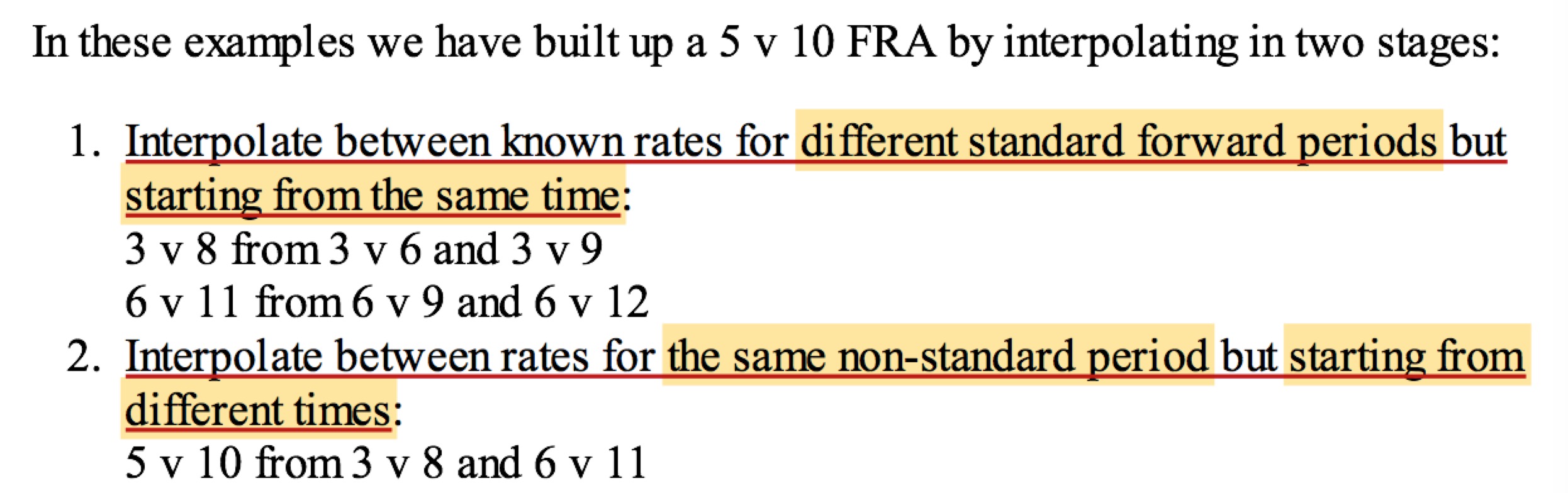

3v8 FRA:

3v6+(3v9−3v6)×daysin3v8−daysin3v6daysin3v9−daysin3v6

5v10 FRA:

3v8+(6v11−3v8)×daysinfixing5v10−daysinfixing3v8daysinfixing6v11−daysinfixing3v8

Arbitrage

Any must win strategy?

buy-buy / sell-sell

Interest Rate Swaps (IRS)

Definitions

- A swap is a derivative in which two counterparties agree to exchange one stream of cash flows against another stream.

- These streams are called the legs of the swap.

- An interest rate swap is a derivative in which one party exchanges a stream of interest payments for another party’s stream of cash flows.

Hedging with FRA

Hedging with IRS

Characteristics of IRS

- Similar to FRA

- No exchange of principal

- Only interest flows are exchanged and netted

- Different from FRA

- Settlement amount paid at the end of relevant period

Motivation: win-win

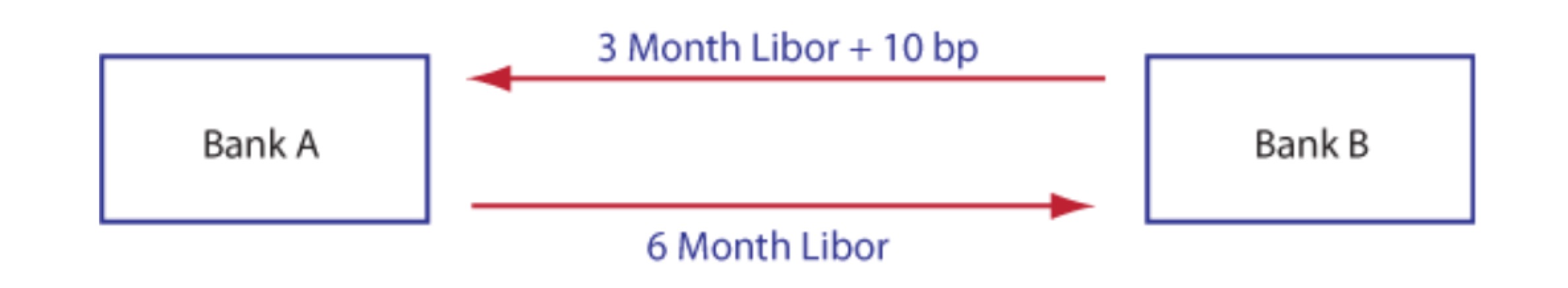

Type of Swap

- Coupon Swap

Party A pay fixed interest rate and receive floating interest rate from party B - Basis Swap

Floating vs floating but on different rate basis

e.g.,

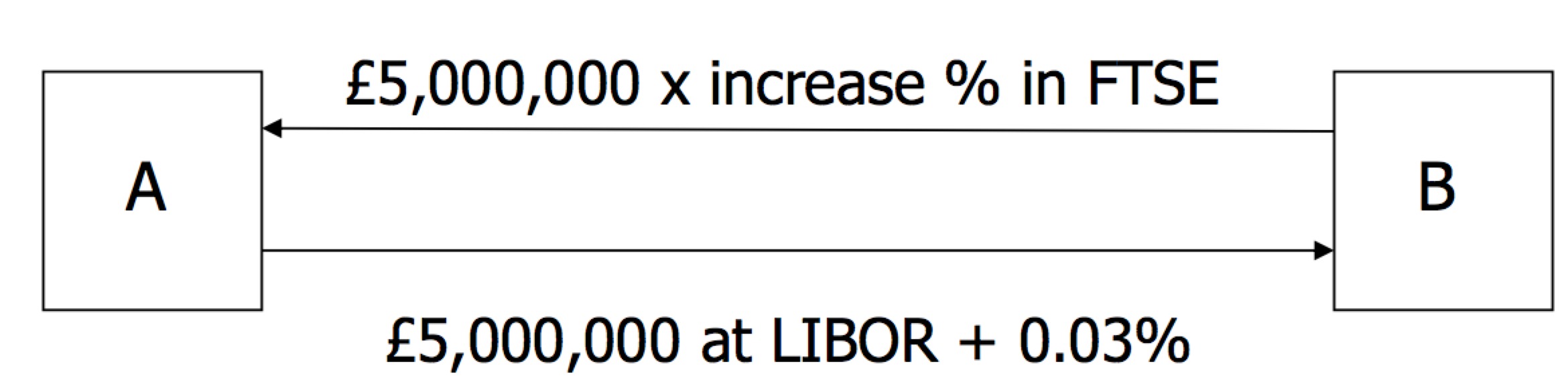

- Index Swap

The flow in one / other direction are based on index

e.g.,

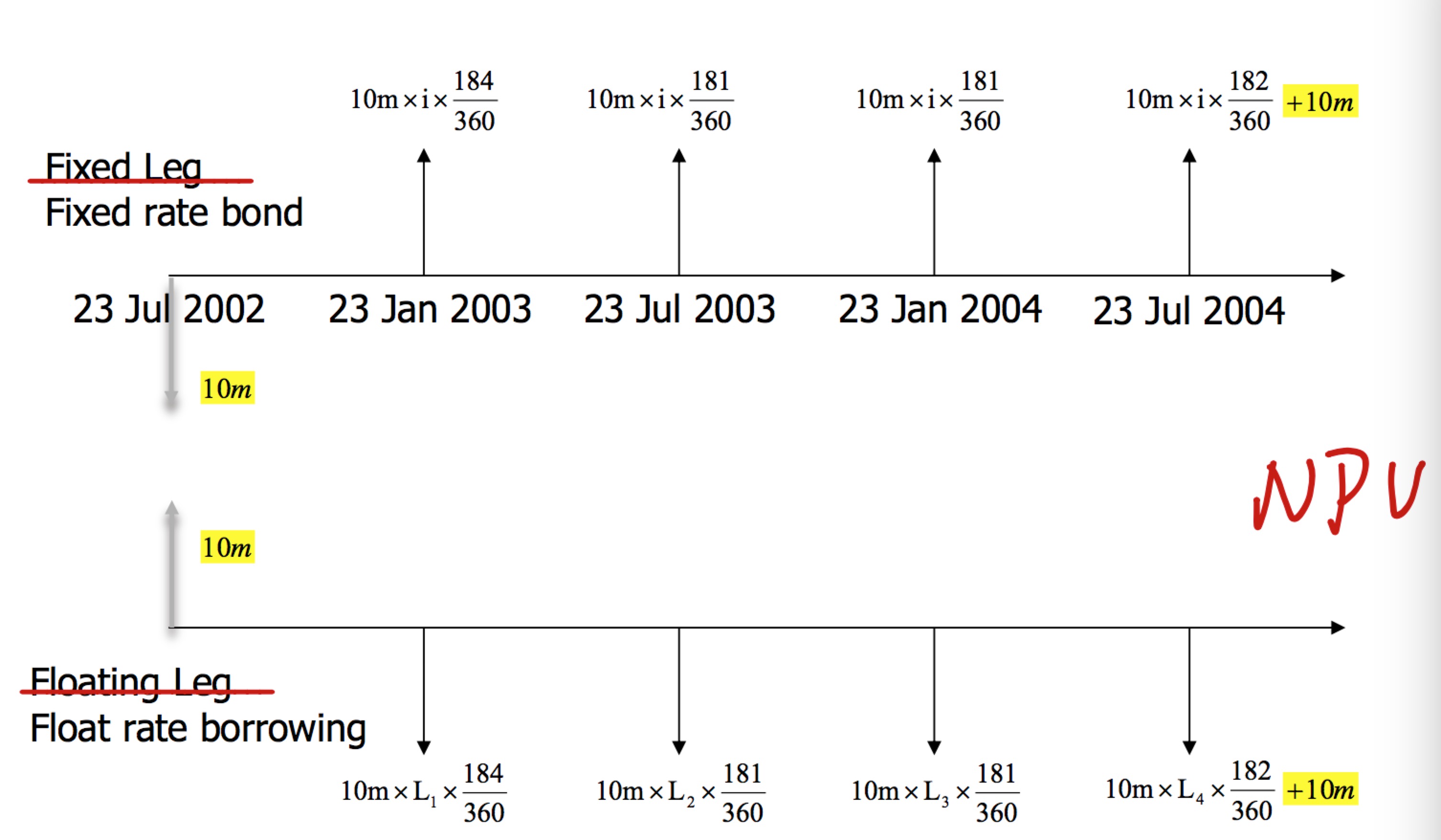

Valuation of Swap

- Long Swap = + Long a Fixed rate bond - Floating rate borrowing

- Swap Value = + PV of Fixed leg cashflow - PV of floating leg cashflow

- Swap = NPV of Fixed leg cashflow

- At inception, NPV = 0

NPV=−P+∑ni=1CiDi+PDn

NPV=0

Dn=(1−r∑n−1i=1tiDi)1+rtn

;

r=1−Dn∑ni=1tiDi

where:

P = hypothetical principal notional

ti

= day count fraction of each interest payment period i

Ci

= cashflow at time period

i=P×r×ti

Di

= discount factor at time i

Dn

= discount factor at time n. (e.g., at maturity)

r = swap par rate (fixed leg)

Construction of Yield Curve

Definitions

- The relationship of interest rate for different maturity

- Market rate of interest for:

- theoretical zero coupon instrument

- matures at any future date

- Derived from

- prices of real financial instrument

- trade in a liquid market

Type

- Curve Shape

- positive

- negative

- flat

- Curve Categories

- Par Yied Curves

- Zero Coupon Yield Curve

- Forward Rate Yield Curve

Example

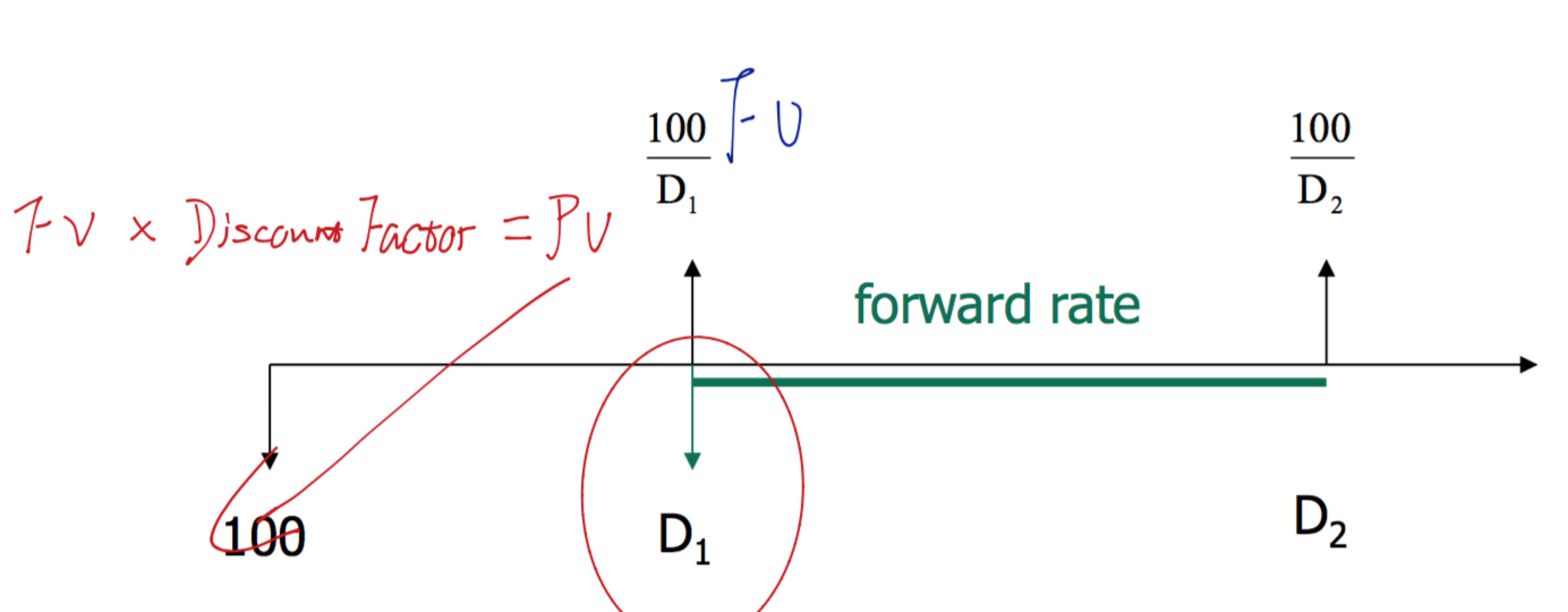

forward rate =

(100D2100D1−1)×yearperiod=(D1D2−1)×yearperiod

Therefore,

D2=D11+forwardrate×periodyear

Base on that and construct further, and this formula use again & again to construct the yield curve.

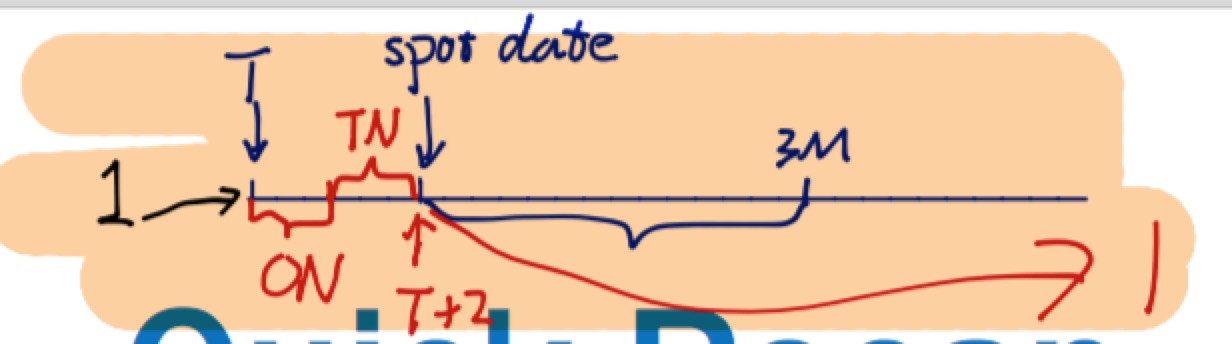

Quick Recap

Over night

DON=11+RON(1365)

DTN=DON1+DTN(1365)

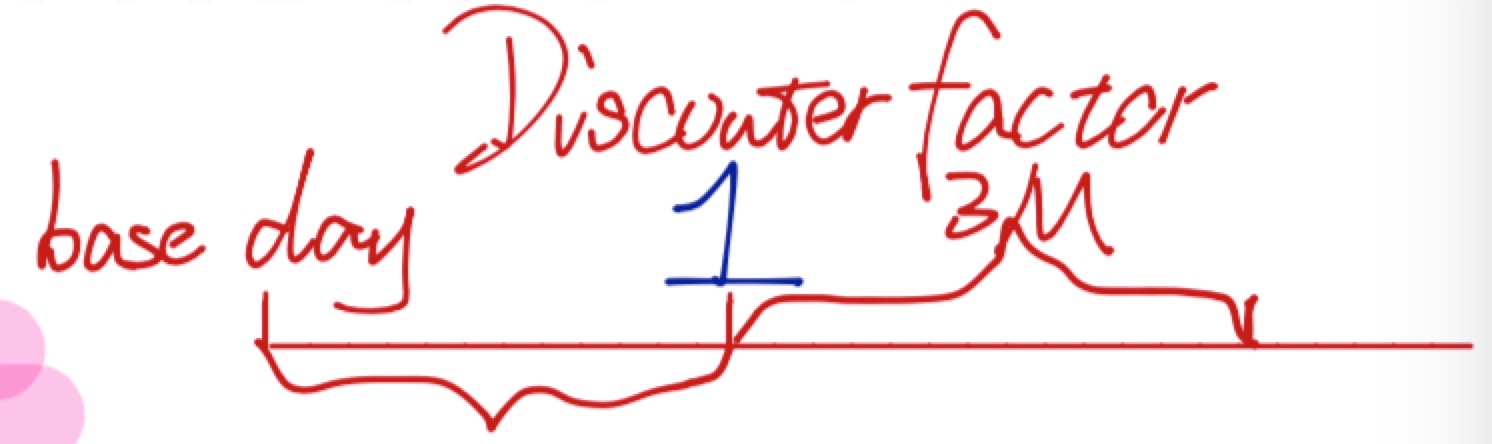

Money Market

D=11+r×t

r=[1D−1]×1t

e.g., DF3M=11+r3M×t3M

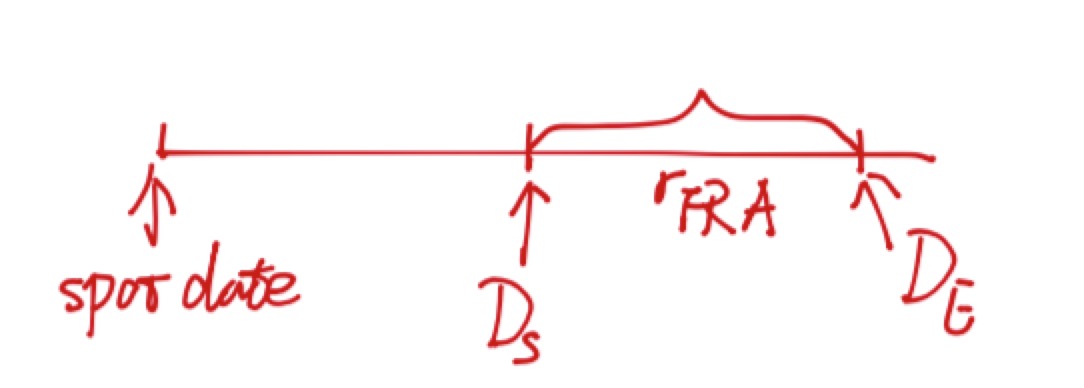

FRA

r=DS−DEDE×t

DE=DS1+rt

where,

DS

: Discount factor on forward start date

DE

: Discount factor on forward maturity date

t : period of FRA

r : FRA forward rate

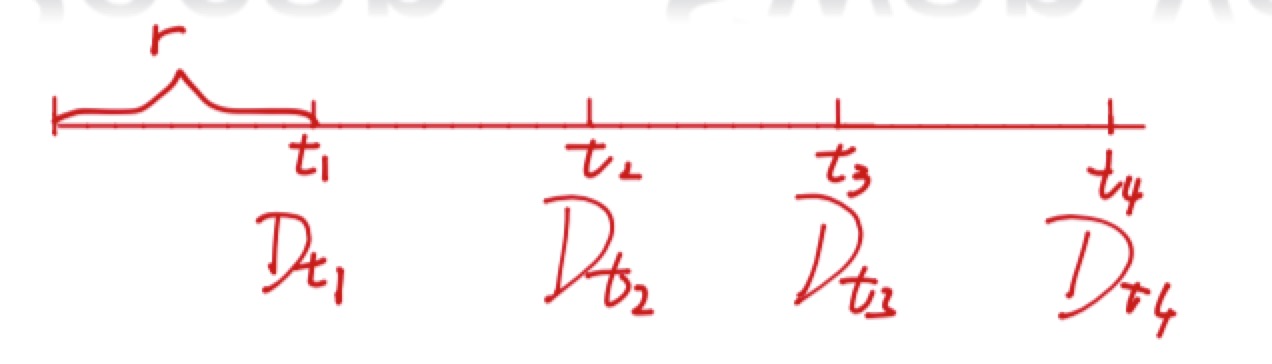

SWAP Valuation

NPV=−P+∑ni=1CiDi+PDn

NPV=0

Dn=(1−r∑n−1i=1tiDi)1+rtn

;

r=1−Dn∑ni=1tiDi

(点与点之间可以通过一次函数求解)

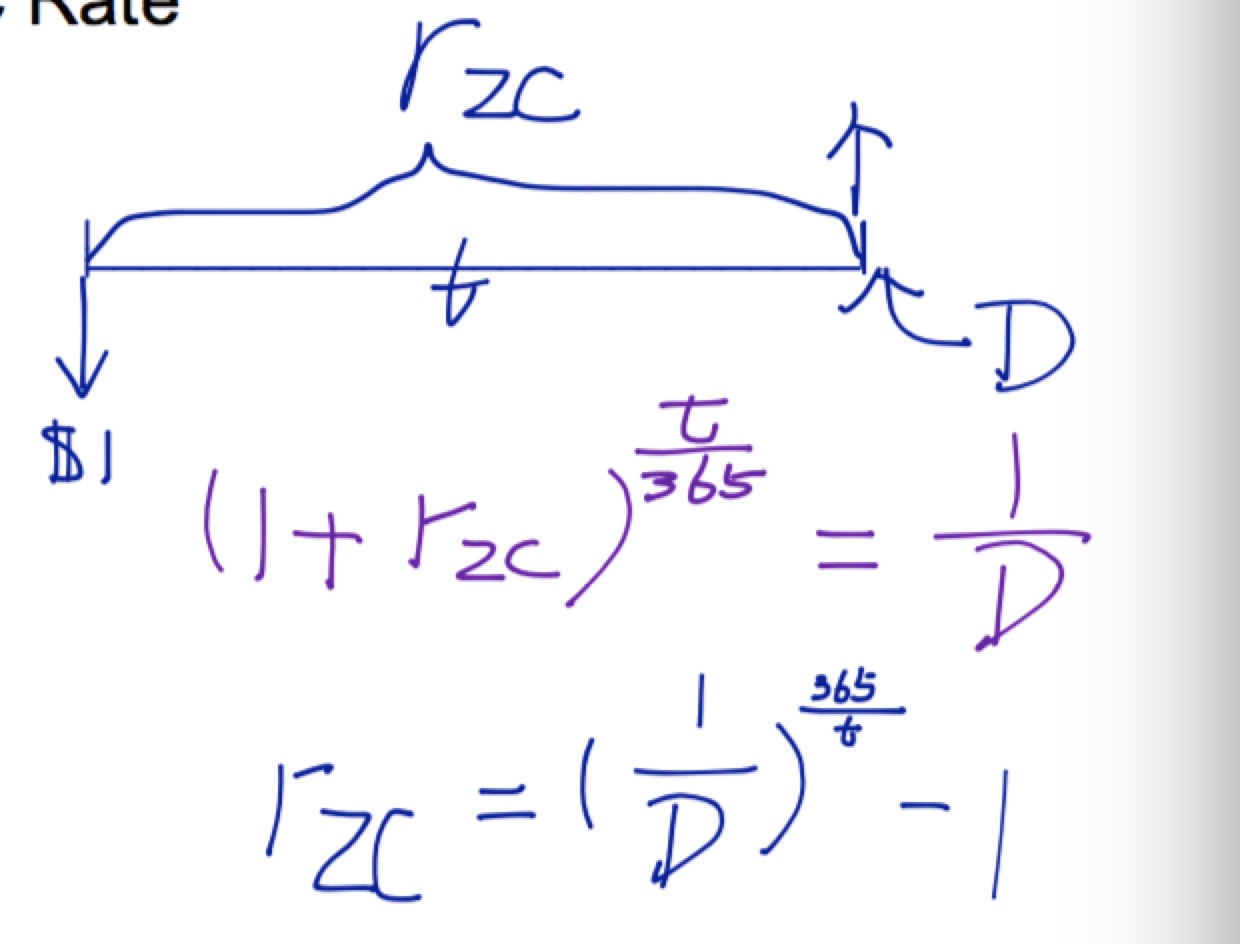

Zero Coupon Rate

Dt=1(1+ZCt)days/year

ZCt=(1Dt)1days/year−1

9993

9993

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?