1. import package and download data

from atrader import *

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import math

import statsmodels.api as sm

import datetime as dt

import scipy.stats as stats

import seaborn as sns

# 获取因子数据

# 单日多标的多因子

# 4个月的动量类因子

names = ['REVS60','REVS120','BIAS60','CCI20','PVT','MA10Close','DEA','RC20','RSTR63','DDI']

factors1 = get_factor_by_day(factor_list= names, target_list=list(get_code_list('hs300',date='2019-02-01').code), date='2019-02-28')

factors2 = get_factor_by_day(factor_list= names, target_list=list(get_code_list('hs300',date='2019-02-01').code), date='2019-03-29')

factors3 = get_factor_by_day(factor_list= names, target_list=list(get_code_list('hs300',date='2019-02-01').code), date='2019-04-30')

factors4 = get_factor_by_day(factor_list= names, target_list=list(get_code_list('hs300',date='2019-02-01').code), date='2019-05-31')

2. factors preprocess

# MAD:中位数去极值

def extreme_MAD(dt,n = 5.2):

median = dt.quantile(0.5) # 找出中位数

new_median = (abs((dt - median)).quantile(0.5)) # 偏差值的中位数

dt_up = median + n*new_median # 上限

dt_down = median - n*new_median # 下限

return dt.clip(dt_down, dt_up, axis=1) # 超出上下限的值,赋值为上下限

# Z值标准化

def standardize_z(dt):

mean = dt.mean() # 截面数据均值

std = dt.std() # 截面数据标准差

return (dt - mean)/std

# 行业中性化

shenwan_industry = {

'SWNLMY1':'sse.801010',

'SWCJ1':'sse.801020',

'SWHG1':'sse.801030',

'SWGT1':'sse.801040',

'SWYSJS1':'sse.801050',

'SWDZ1':'sse.801080',

'SWJYDQ1':'sse.801110',

'SWSPCL1':'sse.801120',

'SWFZFZ1':'sse.801130',

'SWQGZZ1':'sse.801140',

'SWYYSW1':'sse.801150',

'SWGYSY1':'sse.801160',

'SWJTYS1':'sse.801170',

'SWFDC1':'sse.801180',

'SWSYMY1':'sse.801200',

'SWXXFW1':'sse.801210',

'SWZH1':'sse.801230',

'SWJZCL1':'sse.801710',

'SWJZZS1':'sse.801720',

'SWDQSB1':'sse.801730',

'SWGFJG1':'sse.801740',

'SWJSJ1':'sse.801750',

'SWCM1':'sse.801760',

'SWTX1':'sse.801770',

'SWYH1':'sse.801780',

'SWFYJR1':'sse.801790',

'SWQC1':'sse.801880',

'SWJXSB1':'sse.801890'

}

# 构造行业哑变量矩阵

def industry_exposure(target_idx):

# 构建DataFrame,存储行业哑变量

df = pd.DataFrame(index = [x.lower() for x in target_idx],columns = shenwan_industry.keys())

for m in df.columns: # 遍历每个行业

# 行标签集合和某个行业成分股集合的交集

temp = list(set(df.index).intersection(set(get_code_list(m).code.tolist())))

df.loc[temp, m] = 1 # 将交集的股票在这个行业中赋值为1

return df.fillna(0) # 将 NaN 赋值为0

# 需要传入单个因子值和总市值

def neutralization(factor,MktValue,industry = True):

Y = factor.fillna(0)

df = pd.DataFrame(index = Y.index, columns = Y.columns) # 构建输出矩阵

for i in range(Y.shape[1]): # 遍历每一天的截面数据

if type(MktValue) == pd.DataFrame:

lnMktValue = MktValue.iloc[:,i].apply(lambda x:math.log(x)) # 市值对数化

lnMktValue = lnMktValue.fillna(0)

if industry: # 行业、市值

dummy_industry = industry_exposure(Y.index.tolist())

X = pd.concat([lnMktValue,dummy_industry],axis = 1,sort = False) # 市值与行业合并

else: # 仅市值

X = lnMktValue

elif industry: # 仅行业

dummy_industry = industry_exposure(factor.index.tolist())

X = dummy_industry

# X = sm.add_constant(X)

result = sm.OLS(Y.iloc[:,i].astype(float),X.astype(float)).fit() # 线性回归

df.iloc[:,i] = result.resid # 每日的截面数据存储到df中

return df

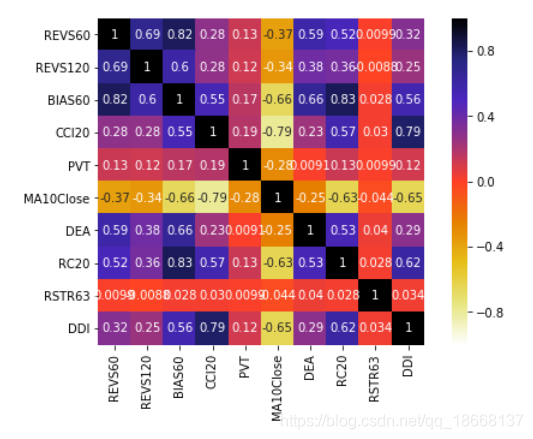

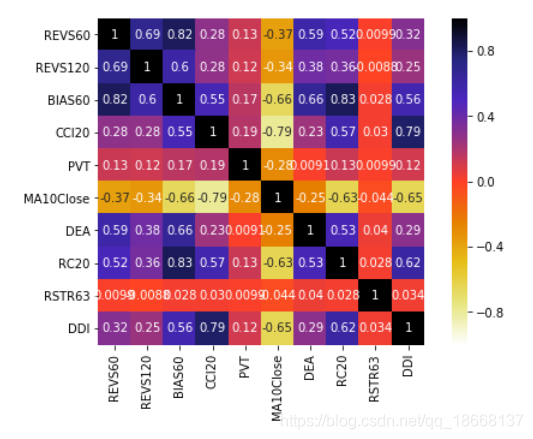

3. corr(mean) test

# 计算因子的相关系数矩阵函数

def factor_corr(factors):

factors = factors.set_index('code')

factors_process = standardize_z(extreme_MAD(factors.fillna(0)))

result = factors_process.fillna(0).corr()

return result

# 获取相关系数矩阵

factors_corr1 = factor_corr(factors1)

factors_corr2 = factor_corr(factors2)

factors_corr3 = factor_corr(factors3)

factors_corr4 = factor_corr(factors4)

factors_corr = (factors_corr1+factors_corr2+factors_corr3+factors_corr4).div(4) # 矩阵均值检验

# 相关系数检验

abs(factors_corr).mean()

abs(factors_corr).median()

4. corr hot map plot

# 画图二

fig = plt.figure()

plt.subplots(figsize=(8, 6.4)) # 设置画面大小

sns.heatmap(factors_corr, annot=True, vmax=1, vmin=-1, square=True, cmap="CMRmap_r",)

plt.show()

5. factors equal combine

# 因子合成

# 等权法

corrnames = ['REVS60','REVS120','BIAS60','CCI20','MA10Close','DEA','RC20','DDI']

collinear_factors = factors4.loc[:,corrnames] # 共线的因子矩阵

composite_factor = collinear_factors.mul(1/len(corrnames)).sum(axis=1)

print(composite_factor)

779

779

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?